Home owners fear mortgage abyss in 2023

Homeowners in Sydney and Melbourne will bear the brunt of repayment pain as the bulk of fixed loans secured at record low rates approach the ‘mortgage cliff’.

Homeowners in the suburbs of Sydney and Melbourne will bear the brunt of repayment pain as the bulk of fixed loans secured at record low rates approach the “mortgage cliff” this year.

Australians raced to secure fixed loans through the pandemic when interest rates were at an all-time-low, with the percentage of households that locked in mortgage costs hitting a record 45 per cent of the market.

The Reserve Bank of Australia – whose governor, Philip Lowe, assured borrowers rates would likely be on hold until 2024 – now estimates two in five of that group will face an increase in their commitments of at least 40 per cent as most loans switch to variable in the next 18 months.

This so-called “cliff” will be felt most in the suburban mortgage belts of Sydney and Melbourne and cost the average household $13,000 extra each year, new analysis from Lendi Home Loans has revealed exclusively for The Weekend Australian.

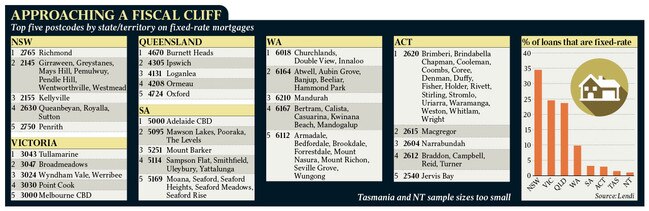

More than a third of all current fixed loans were in NSW. These loans were most prevalent in Greater Western Sydney, namely in The Hills and northwest suburbs of Richmond, Greystanes, Kellyville and Penrith.

It was similar in Victoria, with fixed rates loaded primarily in the outer Melbourne suburbs of Tullamarine, Broadmeadows, Wyndham and Point Cook. The periphery of Brisbane – such as Ipswich, Loganlea, Ormeau and Oxenford – held the highest portion of Queensland’s fixed loans.

PropTrack director of economic research Cameron Kusher said these areas are open to greater risk due to their popularity with first-time borrowers and upgraders through the recent boom.

“It’s really first homebuyers, people that borrowed with limited deposit and those areas where prices haven’t actually grown that much over the last few years that are going to be the most challenged,” Mr Kusher said.

“A lot of first homebuyers probably have bought into that mortgage-belt market and fixed, thinking ‘my mortgage rolls off in 2023, 2024, interest rates will still be 0.1 per cent and then they’ll go up gradually from there’. That’s … a challenge for those buyers.”

Australia’s big four banks have a total of $267bn in fixed loans set to expire through 2023, nearly half of those currently on the books. A further $174bn in loans will work through the system in 2024.

Households were sitting on an average fixed mortgage of $519,000 with a term of two years, said Lendi home loans director Sam Hyman. They now carry the potential of an extra $1019 a month in repayments in 2023 as they roll off their existing term.

“Given the averaged fixed mortgage interest rate this time two years ago was sitting at around 2.20 per cent, we know it is these Aussie households who are heading for the biggest revert rate shock when their fixed rates roll off – facing into average standard variable rates now sitting at around 6 per cent with the major lenders,” Mr Hyman said.

“If no action is taken by such borrowers, this equates to a yearly difference of $13,000 and a total life-of-loan difference of $327,000 over a 25-year loan term.”

Eight consecutive interest rate rises in 2022 eroded the 2.5 per cent and 3 per cent serviceability buffers enforced by banking regulator APRA to ensure borrowers can afford higher repayments.

Mr Kusher said the market is entering unknown territory. “In most instances, people will be able to find a way to ride this out,” he said. “People will find ways to cut back on their spending elsewhere … (and) prioritise paying their mortgage over other things.”

The Carbone family, from Gregory Hills in Sydney, have been putting off thinking about their household budget. Joseph, 28, and Angela, 27, purchased two properties in 2019; the family home in Gregory Hills has always been on a variable rate, while an investment property in nearby Lurnea has been fixed for the lifetime of the loan.

While they have felt each rate increase on their primary mortgage, they are bracing for the investment mortgage to move to variable in April – a jump of around 4 per cent – knowing even if they raise the rent, they will be unable to cover repayment costs.

“It’s a conversation we have to have … we are just worried about the answer,” Mr Carbone said.

“We knew anything could happen, but we weren’t expecting rates to rise so fast … especially when the RBA said they wouldn’t go up for a few years. If it comes to it, we might have to sell our second property but that is the last resort.”

Many, like the Carbones, are now looking to refinance loans in search of a better interest rate. A total of $13.4bn in owner-occupier loans switched between lenders in November, a rise of 9.1 per cent on October, according to the Australian Bureau of Statistics.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout