Endeavour Group stumbles on ASX debut but future holds expansion plans

Liquor and pubs company Endeavour stumbled on its ASX debut but it appears to have a profitable future ahead as it pours capital into expanding its empire.

Liquor and pubs company Endeavour sank on its ASX debut on Thursday but it appears to have a profitable future ahead as it pours capital into expanding its empire around Australia after being spun out of supermarket giant Woolworths.

The company came on at $6.60 and dipped as low as $5.77 per share before recovering to close at $6.02, as investors juggled their holdings in the $10.8bn company.

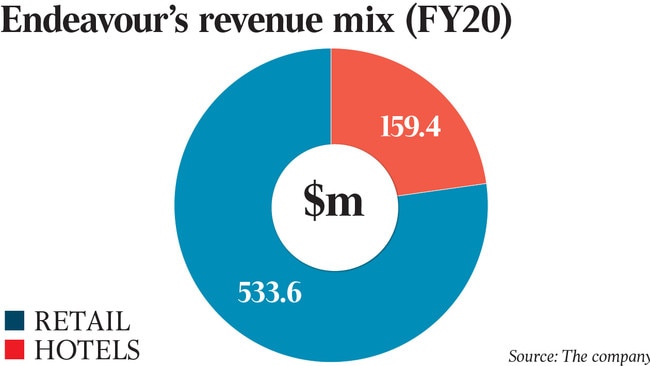

Chief executive Steve Donohue has laid out a growth agenda that includes expansion of retail chains Dan Murphy’s and BWS and its controversial hotels arm.

Endeavour became the ASX’s newest top 50 company when its shares demerged from Woolworths and listed on Thursday, with much of the investor focus on how it will run its lucrative 330 hotels and 12,400 electronic gaming licences.

Woolworths shareholders received one Endeavour share for each share they held in the supermarket business.

Woolworths slipped by 11.2 per cent to close at $37.75, reflecting the value lost from the spin-off.

Endeavour chairman Peter Hearl said that joining the ASX under its own name and as a stand-alone business marked the next chapter in the evolution of the group, which is also backed by billionaire Bruce Mathieson.

Endeavour managing director Steve Donohue pointed to the group’s capacity to expand. “We are excited about the future as we continue to focus on growth and building on the successful platform we have in place through our portfolio of trusted retail brands, including Dan Murphy’s and BWS, as well as Australia’s largest portfolio of hotels, including many Australian icons such as Brisbane’s Breakfast Creek Hotel and the Young & Jackson Hotel in Melbourne,” he said.

Jarden analysts Ben Gilbert and Keegan Booysen said in a note that they remained positive on the outlook for Woolworths without the Endeavour business, believing it can generate higher returns on invested capital, add new shareholders and have a more focused medium-term ecosystem strategy.

They said Endeavour’s outlook was less certain, but it arguably has more earnings potential as an independent entity thanks to more targeted capital expenditure in higher returning areas such as gaming and new venues.

“We envisage Endeavour would be able to extract material synergies via potential mergers and acquisitions, for which they have more than $600m of capacity. The challenge for Endeavour is a lack of disclosure to date over its strategy as a stand-alone entity and if there is a step-change opportunity without Woolworths as its parent,” they said.

Mr Donohue this week told The Australian than investors should feel confident Endeavour would continue Woolworths’ approach in terms of dividend flows, and said it would aspire to enlarge its business operations across liquor stores and the hotels arms.

“I am pitching (the Endeavour story) as sustainable, consistent growth in line with what we have generated historically,” he said. “There is no big standout or step out that we intend to unveil here. It is a business that has really generated very consistent growth returns over a long period of time.”

He also addressed the pressure that Endeavour is expected to face from ESG-focused superannuation investors, given its trade in alcohol and gaming.

“Our objective is to provide customers with products and services that so many millions of them enjoy using throughout Australia and we intend to keep doing that, noting that it is everybody’s responsibility, us included, to provide them in a responsible way,” Mr Donohue said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout