Sealed over sushi: How Star Entertainment’s survival plan was hatched

Casino boss Soo Kim is prepared to bet on himself and drive the change needed to succeed where others have failed. But can Star’s saviour really do it?

The Star first came on the radar of New York-based Soo Kim last year as investment bank UBS was quietly testing the market to raise more cash for the struggling casino and keep options alive for new chief executive Steve McCann.

Kim, a Wall Street hedge fund manager turned casino mogul, saw plenty of potential in Star, operator of casinos in Sydney, Gold Coast and a brand-new home in Brisbane. However, as far as he was concerned, he didn’t want to be a passenger in someone else’s ride. And this was a business that had a well-documented history of making wrong turns.

The Bally’s chairman wanted something bigger. “Everything needed to change,” Kim tells The Australian.

But in order to drive that change, Kim needed the control to bring his own expertise and management team to Star. “We would have to have more than just a minority stake,” he says.

A firm message came back that Star’s board wasn’t interested in ceding control, and the US casino boss backed off.

From a distance, Kim was watching the situation at Star quickly go from bad to worse. The equity raising never went ahead, and a debt issue could only be partially completed. It was burning through tens of millions of dollars a month and running out of time.

Kim, who describes himself as a builder, had the chance to come to Australia in February. His visit was timely as Star could see its future counted in weeks.

Over the course of a week and unknown to Star and its bankers, Kim kicked the tyres himself. He started out in Sydney, walking the floor of Star’s Pyrmont casino. He went to Brisbane and the Gold Coast.

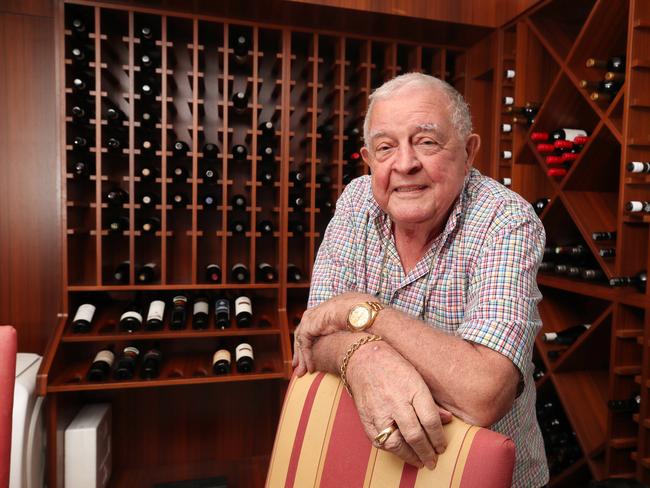

A turning point came when Kim sat down for dinner with Bruce Mathieson Jr who now runs the family’s investment fund on behalf of his father and Star’s biggest shareholder, Bruce Mathieson.

The two caught up over sushi at Star Gold Coast’s upmarket Japanese restaurant, Kiyomi. There they shared their respective insights into what was needed at Star. Here Kim found exactly what he needed, a local partner who knew the gaming business.

Kim’s tour also took in Star’s rivals, making a lightning visit to Melbourne to see what Blackstone was doing with its massive Crown facility there. He also went to Crown’s new Barangaroo casino in Sydney to get a sense of what the competition is like.

He thought Crown’s Barangaroo a “super beautiful” building with heavy investment, but it was located on the edge of the city and difficult to get to. There’s one road in and one road out. Parking there is extremely limited, whereas Star has plenty of parking underground.

His first impressions of Star was one of “pleasant surprise”. It was a casino with high quality assets. What interested Kim was the reasons behind the sharp decline in performance. He felt it was easy to blame competition from Crown or even the regulatory environment.

“When we looked at the Star and Crown, we realised that nothing really has changed,” he says.

Born in Korea, Kim grew up in Queens, New York. He went to a public school in Manhattan. There he’d often see “sharply dressed folks in suits and ties, going to Wall Street. And I remember thinking, ‘hey, I don’t know what’s going on there, but I want to be doing that’’.

He became involved in asset management and ultimately started his own hedge fund. And it was through that he got involved in gaming via a controlling stake in Bally’s, which now owns 19 casinos across the US.

“As much as a wonderful business it is, (casino) companies get in trouble all the time. Mostly, it’s for capital allocation: they borrow too much or buy too much.”

While Kim was touring Star in February, the Australian casino was nearing its endgame. Its lenders had run out of patience, and directors again were unable to sign off on its accounts. They couldn’t declare the business would remain solvent.

In the background, Star’s McCann was working on his own blockbuster rescue deal, albeit one that required a lot to go right. The first leg was the controversial property swap that delivered the flagship Queen’s Wharf casino to Star’s Hong Kong-based partners. The win here for Star was the removal of crushing $750m debt on the new property and around $45m in cash. In exchange, Star would get full ownership of the upmarket hotels and additional property on the Gold Coast.

Next was a $250m bridging loan and then a $750m five-year loan led by Melbourne property developers Salter Brothers. This was designed to reset Star for good.

Star’s board weren’t interested in Kim’s rival proposal for control. Kim saw Star slipping away and went public with his offer, but Star’s board thought they could go it alone, and this time they sent Kim packing.

It all fell apart three weeks later when the NSW government put a spanner in the works, refusing to cede security on the leasehold property Salter needed.

Suddenly, Star’s board found themselves in a familiar place: running out of options and cash. Kim was the only card they had left before Star would be placed in administration. They swallowed their pride and picked up the phone.

The initial reception from Kim wasn’t as warm. “Maybe you shouldn’t have wasted the two prior weeks by not returning my calls”. Then it was down to business. “We’re here to save your company,” Kim told Star’s board.

Kim was speaking with The Australian as he was making a two-hour drive to upstate New York. He was heading to his farm after spending a week crisscrossing the US and sealing the $300m bailout of Star with Mathieson.

If the deal by the way of an equity injection is approved, the two will emerge with a combined 56 per cent stake in Star, giving them management control. The deal values Star at around $540m. For comparison, four years ago, Star was worth almost $4.5bn.

Mathieson Jr describes Kim as “energetic” and “a good operator who loves the sector”. He’s looking forward to getting the deal done as soon as possible so “we can get on with business”.

The beginning of April saw a furious week of work in securing the Bally’s bailout through a debt injection that converts to equity once approvals are given. The board went through a marathon meeting that lasted into the weekend, the paperwork finally signed late on Sunday night. Kim was working out of Las Vegas where Bally’s is building a new resort hotel on the old Tropicana site.

In parallel, Star’s board had also drawn up options for administration. One of these was to lop off the troubled Sydney casino in order to save the profitable Gold Coast and allow the Brisbane deal to move ahead.

Without Bally’s cash commitment and $100m advance on Wednesday, Star would have been forced to call in administrators. Collapse was “days away” one person with knowledge of the talks says. “If they had not announced on Monday that (Bally’s) transaction, Star would have been in administration by Wednesday.”

Kim says he couldn’t wait until administration because this was a company in the process of “tossing the chairs in the fire” to stay alive: there may not be any company left by the time it hit the wall.

Kim says he’s looking ahead now: “Everything needs to change.”

Clearly, the casino hasn’t responded to the collapse in its earnings as well as it should, he says. He wouldn’t be drawn on his plans for Star’s management or CEO McCann.

Kim says he’s not fazed by the prospect of turning Star around.

“If we didn’t think there would be a challenge or an opportunity, then we’re not challenged,” he says. “We own 19 casinos today. All but one of them we bought someone else’s casino, someone else’s problem. Every single one of those problems was underperforming relative to what it’s doing today. Every single one was forced divestitures, or left for dead restructuring. And we’re very good. Our management team and the ownership group has been doing this for well over a decade together, and we’re just very good at identifying opportunities that require the actual turnaround,”

Kim is understood to have critical support from Star’s lenders for now. His plan at least gives the business a chance whereas previously it had none.

Still, some close to the company wonder if Kim really knows what he’s getting himself into. He’s committed hundreds of millions with only the lightest of due diligence. A conga line of other big names have had a deep look at Star’s books over the past year and baulked.

At the same time, there’s a steep fine expected to be negotiated with Austrac for past money-laundering breaches. Shareholder class actions are afoot and Star faces a near hostile regulatory regime in NSW, with daily gaming caps and cashless gaming meaning it’s losing business to pubs and clubs. Bally’s itself has a stretched balance sheet for operating 19 casinos. It is capitalised at just over $1bn.

“He’s either going to crash through or crash,” one person close to the transaction says.

Kim remains determined.

“This deal allows us to bet on ourselves. It’s a control deal and we get to fund our activity. What else can you ask for in life?”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout