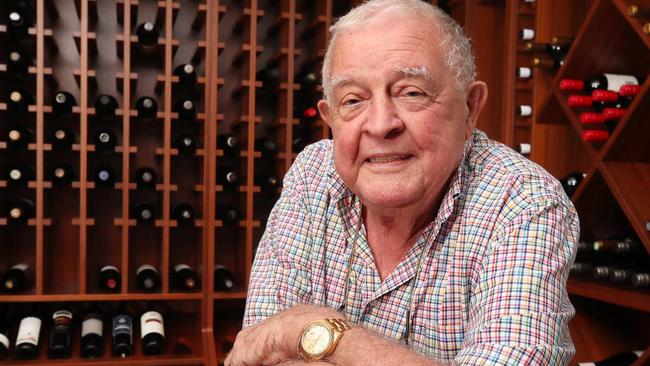

Billionaire publican Bruce Mathieson may have been working with Bally’s Corporation to top up its offer for Star Entertainment as late as Monday night, in a quest to ensure it is successful in gaining control of the embattled casino operator.

But there’s talk in the market that at the weekend, there was an alternative proposal being worked up in the market with a focus on the Sydney asset, but it is unclear what parties are involved.

Sources say that a number of firms had been working on alternative proposals.

DataRoom revealed on March 19 Mr Mathieson, who owns about 10 per cent of Star’s shares, was throwing his support behind a takeover bid from the Rhode Island-based group which owns casino operations globally.

Under the original terms of the Bally’s transaction this year, it offered a deal where it would provide Star $250m of capital through convertible notes, creating a 50.1 per cent ownership position and underwriting the raising.

But, with time running out for Star, the market view is the funds under the original terms will not be enough to keep the lights on at Star’s Gold Coast, Brisbane and Sydney casino operations and entertainment complexes, let alone pay the Austrac fines that market brokers are betting will cost about $350m, or the class actions.

Many have considered voluntary administration looks increasingly inevitable for the group hit that was found to have acted as a haven for money laundering and has wracked up losses with new regulations around cashless gaming.

If that’s the case, some say that with the delay of putting the business into voluntary administration, it leaves the casino operator with less cash than if it had folded earlier.

Mathieson’s affairs

DataRoom understands Mr Mathieson was adverse to an earlier offer by Salter Brothers where it offered $750m of debt in a $940m overall ‘in kind’ offer, as concerns had grown around the market the group would not have the capital needed to stand behind the offer when it came down to handing over the funds.

It is estimated Mr Mathieson stands to lose about $150m should Star collapse, with voluntary administration leaving the value of the equity in the business held by shareholders at zero.

Mr Mathieson is known to be a keen buyer of the Gold Coast casino complex.

Earlier, Mr Mathieson said publicly he would put $50m into Star to support the Bally’s Corp bid, but now the understanding is his financial support may increase.

Yet some question where he finds the money, with the 82-year-old wealthy investor, who has had some recent health challenges, also believed to be carrying debt against some investments.

Mr Mathieson also owns a 15 per cent stake in Endeavour Group after his private pub operations he jointly owned with Woolworths (an 85 per cent holder), ALH, were spun out of Woolworths and listed as a new business, Endeavour Drinks.

The Endeavour share price is now about $3.82 with its market value at $7.2bn, half the price it was at when it was listed in 2021 and below its $8 peak.

That leaves him about $1bn less off, based on the price, and comes after he has previously agitated for boardroom change to improve performance.

Endeavour is also expected to face the consequences of more heavy regulation on gambling given most of the pubs in the hotel and liquor business generate profits from poker machines.

Bally’s offer has been subject to due diligence and any deal would come after the Queen’s Wharf asset in Brisbane is sold to Star’s partners, Chow Tai Fook and Far East Consortium.

The transaction is set to finalise later this month and will see Star escape major debt repayments it is on the hook for later this year.

Bally’s is proposing to operate the Brisbane casino for the new owners.

While about $35m of cash has been released from the Queen’s Wharf transaction to Star, it is unknown when Star will be able to access the $60m from the sale of its Sydney event centre.

It creates a tense situation for Star’s Steve McCann-led management and the board has cash to keep trading for just days, as it remains in safe harbour protection, with directors unable to sign off accounts saying the company remained a going concern.

The Australian reported at the weekend billions have been wiped from Bally’s share price on the market tariff meltdown in recent days, down 15 per cent in the past week, with its market value at less than $US550m further calling into question how it could complete a Star Entertainment acquisition.

There’s still uncertainty in the market as to whether Star’s senior lenders, owed $100m out of $430m, will agree to terms for a proposed $250m bridging loan from King Street Capital which expires April 29.

Bally’s has $US5.9bn assets and $5.9bn in liabilities, with $3.3bn of long-term net debt, according to its annual report, calling into question whether it has the balance sheet to support Star.

One prediction is ultimately Star just becomes the Gold Coast casino asset and it gets owned by one of Australia’s billionaires like Bruce Mathieson, Clive Palmer or Gina Rinehart.

This may imply Blackstone would take over the licence of Star Entertainment in Sydney to gain permission to use its machines, and shuts Star Sydney down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout