Endeavour Group to stare down ESG hit

As it heads to an IPO worth as much as $15bn, Endeavour’s CEO in waiting is backing its booze, pubs and pokies approach against the rising ESG tide.

Steve Donohue has offered a muscular defence of Endeavour Group’s pubs and pokies assets to get ahead of expected heat from the nation’s powerful superannuation funds, which command $1.6 trillion in retirement savings and follow tight environmental, social and governance principles.

He says he is proud of Endeavour’s history of serving customers alcohol from its liquor stores, and drinks along with a play on the pokies at his pubs, and won’t be distracted by some who advocate for an end to a glass of beer or a spin of a pokies machine.

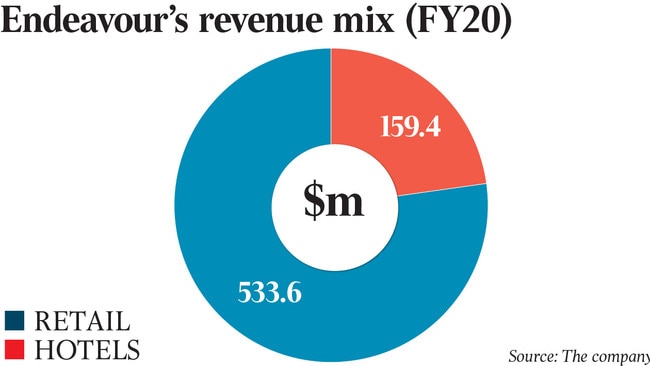

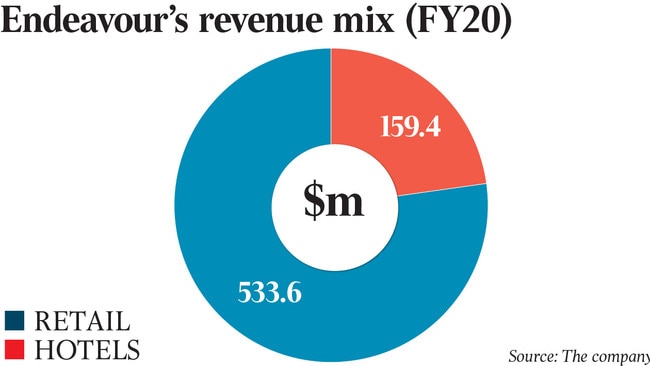

He is also pitching the company as having plenty of growth in the tank that will come with a healthy dividend for those investors also looking for income, while there is a universe of opportunities to harness the power of online and digital platforms to supercharge operations at its retail chains Dan Murphy’s and BWS, as well as its hotels arm.

Mr Donohue, who on Thursday will become the chief executive of the ASX’s new top 50 company when its shares are demerged from Woolworths and list on the market in their own right, said he would adopt a balanced view to operating his highly profitable 330 hotels and 12,400 electronic gaming licences.

The newly minted Endeavour CEO started his drinks career more than 25 years ago at Dan Murphy’s as a 19-year-old store manager of its Alphington store in Melbourne’s north, where at the time the most popular drink was Lindemans Bin 65, selling for $6.90. He would roll out pallets of the stuff at a time when chardonnay was king.

Now he finds himself head of a national drinks and pubs business that could be valued as much as $15bn when it hits the ASX, with a heavy reliance on earnings from its hotels and thousands of gaming machines. He will lead the nation’s biggest owner of pokies and some of Australia’s most well known pubs, including Brisbane’s Breakfast Creek Hotel and the Young & Jackson Hotel in Melbourne’s CBD.

But it looks like Mr Donohue will have work to do winning over superannuation funds and other large investors who could shun Endeavour given its trade in alcohol and pokies

“Our objective is to provide customers with products and services that so many millions of them enjoy using throughout Australia and we intend to keep doing that, noting that it is everybody’s responsibility, us included, to provide them in a responsible way,” Mr Donohue said on the eve of Endeavour’s listing on the ASX.

“We have to take a balanced view and also participate in the mechanisms and controls intended to support people who have got challenges with things like alcohol and gambling, which could be in some contrast perhaps to more extreme views that people don’t see any merit in alcohol and gambling.

“We will take a very balanced view of it and work hard to support people that need support in those areas, including with other stakeholders that share that responsibility with us.”

However, he did not go as far as to declare that those investors who did not like booze, pubs and pokies should not invest in Endeavour, but said the company would proudly campaign on its history of corporate responsibility while eagerly growing its business across liquor retail and hotels.

“I won’t give anyone investment advice, but I am clear about our intention to continue to maintain our track record and expand our track record of responsible service of alcohol and gaming and gambling,” he said.

“I think there are certain investment vehicles out there that exclude certain segments and that’s across a whole variety of industries, so I guess those decisions are left with those fund managers and investors more broadly.

“We will continue to expect to be held to account on our intention to maintain our leadership when it comes to responsible service of alcohol and gambling.”

But just how the nation’s investors, fund managers and superannuation funds that speak for more than $1.6 trillion in ESG-directed savings will take to Endeavour is yet to be tested, with all the heat and protests aimed at Woolworths directors at its AGMs through the years now switching venues to Endeavour and its shareholder forums.

These institutional investors will receive one share in Endeavour for every Woolworths share held, but some could come under pressure to sell down their Endeavour stock to keep to strict ESG principles, adding some selling pressure to Endeavour shares when they begin trading on the stock exchange.

Mr Donohue got a taste of some of that ESG sting when Woolworths and Endeavour were forced into a grovelling apology earlier this month over a long-running attempt to open a Dan Murphy’s in Darwin that ignited a backlash from some sections of the local Indigenous community, with accusations the company had acted unconscionably and not properly engaged with locals.

There will be more when he fronts its AGMs, with the event likely to become a crucible for arguments on the role of alcohol and gaming in the community.

Turning to Endeavour’s investment profile, Mr Donohue said investors should feel confident in its intention to be consistent with Woolworths’ approach in terms of dividend flows, and said it would aspire to enlarge its business operations across liquor stores and the hotels arms.

“I am pitching it (the Endeavour story) as sustainable, consistent growth in line with what we have generated historically,” he said. “There is no big standout or step out that we intend to unveil here, it is a business that has really generated very consistent growth returns over a long period of time.”

Mr Donohue said he would be celebrating the listing with a Krondorf wine from the Barossa Valley. Then the hard work really begins.