It is high time the ASX applied the same standards to Fortescue Metals as it does across the rest of the market.

Fortescue’s disclosure habits around its green energy arm, Fortescue Future Industries, have gone past the point of being a bad joke.

I have no doubt that every single announcement made by FFI is on the right side of the ASX disclosure laws, however close to the line I may think they run.

But their cumulative effect has distorted the market for Fortescue shares and regulators should subject the company to far greater scrutiny.

Early on Monday morning, FFI sent around a release about yet another early-stage deal struck by the company, this time to sell up to “100,000 tonnes of green hydrogen equivalent per year, starting as early as 2024” to German plastics major Covestro.

Like most FFI releases, the announcement is long on the benefits of green hydrogen and desperately short on details of the commercial arrangements included in the memorandum of understanding.

There is no mention of pricing, of where the hydrogen will come from, or how much it will cost to produce.

Viewed cynically, the agreement could be interpreted as little more than a nod in the direction of market sceptics who have criticised Fortescue’s spending on FFI, and have been asking when the grand idea will begin to deliver returns to shareholders.

Even the tentative delivery of the hydrogen in 2024 raises more questions than it answers.

Fortescue has not yet announced any investment decision on a hydrogen project that could deliver commercial-scale volumes by 2024. Nor has it given any indication of how much a plant could cost, how long it would take to build, or how cheaply hydrogen could be produced.

Last year The Australian calculated the capital spending needed to make good on even a small portion of the green hydrogen projects Fortescue was studying. The figure was a hair-raising $US145.5bn.

Fortescue has disclosed none of it to the market.

Outgoing Fortescue chief executive Elizabeth Gaines has repeatedly been challenged on FFI’s business model by analysts, journalists and fund managers.

Her response in an October analyst call was that Fortescue had not yet made any final investment decisions in hydrogen, but would inform the market when it did.

“We haven’t actually announced or approved any projects yet. We’re talking about the opportunity of this industry which we think will be significant,” she said.

There’s also an argument around what is “material” for Fortescue, worth $66bn on the market. Even committing to a $1bn project is arguably not “material” under the current rules.

But FFI’s PR blitz has been worth about $15.6bn to Fortescue’s market valuation, according to Citi analysts.

Regulators need to work out a way to deal with that cumulative effect.

Citi analysts noted last week that Fortescue’s share value had broken its long-term association with the iron ore price.

“In the last three months Fortescue shares are up 46 per cent, with benchmark iron ore up 8 per cent and iron ore peers up about 6 per cent on average. Iron ore prices alone can’t explain the outperformance,” Citi said.

“To bridge the valuation gap to peers, we need to assume an FFI valuation of about $US11.3bn ($15.6bn) … At this early stage and with no visibility, this seems a bridge too far.”

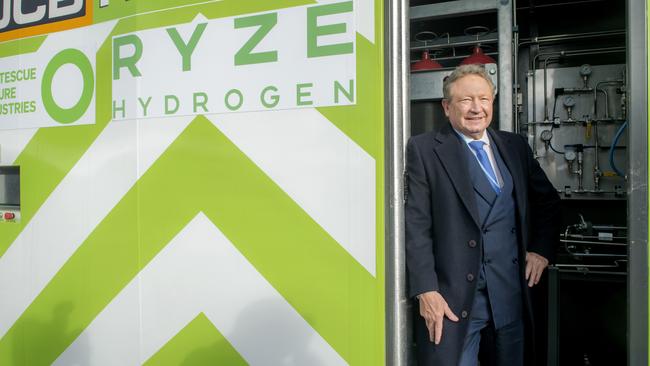

Both Gaines and chairman Andrew Forrest have been open about the role FFI has played in Fortescue’s share surge.

“We’re actually getting a recognition of both the excellent operational performance and the breadth of opportunities that we have in front of us with the success of Fortescue Future Industries,” Gaines said last month, when announcing her resignation as CEO.

Gaines and Forrest also pointed to a doubling of the number of Fortescue shareholders over the past year, to about 70,000, as a sign of market support for FFI.

In reality, that suggests that large institutional shareholders have been selling stock to smaller shareholders, who may lack the resources to assess the risks posed by Fortescue’s green transformation. They certainly won’t find any discussion of those risks in Fortescue disclosures or FFI announcements.

The situation has infuriated institutional investors in Fortescue, who have demanded the company outline its business case for hydrogen, disclose the commercial terms for deals and rough costings for early-stage projects.

Fortescue is yet to do so.

The ASX itself has almost certainly helped create this situation. For the past year the market operator has cracked down on so-called “marketing announcements” by fintechs, biotechs, explorers and other spiv-laden sectors of the market.

The ASX has blocked the release of many announcements, directing speculative plays to instead put details on their websites or in quarterly progress reports rather than in discrete market announcements – which must include concrete terms of any deals if they are to be approved for release.

That may well have helped calm the volume of garbage spewing from blue-sky spruikers, and has probably helped improve the quality of disclosure in announcements that make it through.

But it does not account for high-profile entrepreneurs such as Forrest – and Elon Musk, in the US – who know that their every word will be picked up and published to a vast audience, generally without much scrutiny along the way.

The doubters could be wrong, and FFI could make Forrest Australia’s first trillionaire. Or FFI could just fall over one afternoon in a puff of logic, when the engineers finish their sums.

If Forrest wants to get back to his glory days of selling blue sky to speculators with an appetite for risk, good on him. But if so, he should either take Fortescue private or spin FFI out and get on with it.

As it stands, FFI has added more than $15bn to Fortescue’s market valuation without disclosing a single hard number about how it expects to make money from hydrogen.

That is not how an orderly market should work.

If Fortescue won’t make the appropriate disclosures of its own accord, then the regulators should take action to ensure it does.