Fortescue Metals Group unveils $800m green energy spending

Fortescue Metals Group has outlined plans to pump up to $800m into its global green energy plans this financial year.

Fortescue Metals Group has outlined the scale of its near-term spending on its ambitious push to grow into a global green energy giant, saying it will pump up to $800m into its plans this financial year, but the company faces growing questions about when the green push will translate into value for shareholders.

Fortescue now has more than 350 staff dedicated to its green energy dreams, according to chief executive Elizabeth Gaines, and the company outlined its planned spending on Fortescue Future Industries (FFI) projects in its June quarter production report on Thursday, saying it will spend $US400m to $US600m ($540m to $810m) over the coming year.

Spending priorities include projects to convert Fortescue’s fleet of mining equipment to green fuels, broader plans to decarbonise its mining operations, as well as “studies and asset identification across Australia, Asia, Africa, Latin America, Europe and North America”.

Fortescue has previously said it plans to spend about 10 per cent of net profits on FFI projects in the future.

Fortescue chairman Andrew Forrest outlined his ambitious plan to turn the iron ore major into a global clean energy giant at the company’s annual shareholder meeting in 2020, surprising the market by announcing plans for Fortescue to eventually produce 235 gigawatts of renewable energy a year, or five times the current capacity of Australia’s National Energy Market.

Since then the mining magnate has been travelling the globe, signing early stage evaluation deals in far flung locations including Papua New Guinea, the Democratic Republic of Congo, India, Indonesia, Brazil and beyond.

The company announced a new “framework agreement” with India’s JSW Energy on Thursday, to “collaborate and conduct scoping work on potential projects relating to the production of green hydrogen and explore opportunities to utilise it for green steel making, hydrogen mobility, green ammonia and other mutually agreed industrial applications in India”.

But aside from plans to make a final investment decision on hydro-powered ammonia plant in Tasmania by the end of 2020, and plans to investigate a pilot “green steel” plant in WA, Fortescue has provided little detail about cost and progress on individual programs, or when the spending will deliver returns for Fortescue shareholders.

On Thursday Ms Gaines told analysts the company believed that green energy was an emerging business opportunity for Fortescue, potentially worth billions in the future.

“FFI’s vision is to make renewable green hydrogen the most globally traded seaborne energy commodity in the world,” she said.

“And as a key enabler of Fortescue decarbonisation strategy FFI has made significant progress on its 30 June stretch targets during the quarter, and that included the successful combustion of ammonia in a locomotive, the testing of battery cells for use on Fortescue haul trucks, as well as design and construction of a hydrogen powered haul truck.”

Despite outlining a raft of other FFI achievements for the year, in which it spent about $US120m on its various projects, the company faces growing pressure from analysts and shareholders to outline the business case for its mounting investment in green energy developments.

On Thursday’s analyst call Ms Gaines was repeatedly challenged to provide more detail on how the company’s spending was adding value for shareholders.

Pendal Group fund manager Brenton Saunders put it bluntly, telling the Fortescue boss the mining giant “owed it to shareholders” to articulate a business case for its spending on FFI projects.

“I think decarbonisation is a process, not an investment case or a business case. And I honestly think you owe it to shareholders to properly articulate what those projects are and what the business case is around them, because otherwise the market is going to continue to assume it’s an expense,” he said.

“You owe it to shareholders to properly articulate the business cases around these, and not as second and third derivative explanations to develop global markets in hydrogen – because for every expert I speak to that tells me hydrogen is going to work, I speak to one that tells me it’s not. So I think it’s still up in the air, it’s not a dead cert.”

Ms Gaines said early stage project deals signed by FFI should be seen in the same light as Fortescue’s minerals exploration spending, which totalled $US183m last financial year.

She said Fortescue’s green fleet program, to which the company has devoted about 150 staff, would deliver returns to shareholders by reducing operating costs as well as helping the company reach its goal of becoming operationally carbon neutral by 2030.

“And we’re actually mitigating what might be another way of increasing costs through a carbon charge or the removal of a diesel fuel rebate in the future. So this is about lowering our cost as well,” she said.

“We don’t dispute that those projects will be significant investments in their own right, but when you look at a development of a $12 trillion green energy market over the next decade, then you want to participate in that market. It’s the right thing to do.”

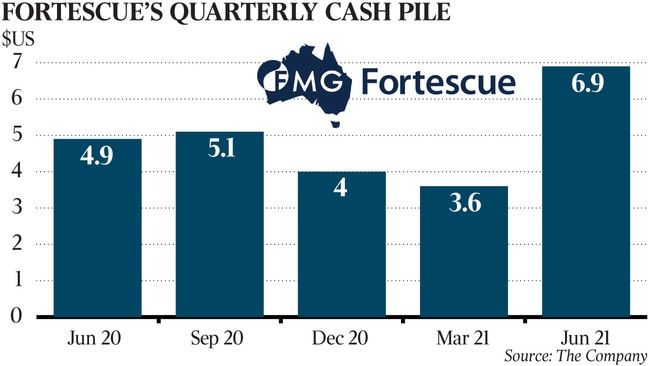

And, with cash flooding in from high iron ore prices and record production last financial year, Ms Gaines pointed to Fortescue’s track record on keeping costs tight and returning cash to shareholders.

“The flip side is you get the ESG focused investors who actually say ‘well you’re not doing enough to reduce emissions so you’re not tackling carbon reduction’. There will be different shareholders with different views,” she said.

“We’re staying very true to our focus and I don’t think there’s an ASX-listed company that has a more rigorous approach to delivering returns to shareholders and capital allocation than Fortescue. And we’ve proven that over the last 18 years.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout