Former hydrogen market darling Plug Power looking for $US1bn to stay afloat

Despite all of the hype, hydrogen is turning out to be a tricky business – as Plug Power, a key partner for Andrew Forrest’s Fortescue Energy – is finding out.

Fortescue partner and supplier Plug Power is looking to raise $US1bn in the US capital markets to keep its hydrogen ambitions alive, underlining the risks facing the nascent green hydrogen sector.

Stock in the electrolyser and hydrogen company crashed on the US markets this week after the company said it planned to raise as much as $US1bn in a stock offering, despite the company downplaying its financial troubles in November.

Plug is a key partner for Andrew Forrest’s Fortescue Energy, both as a potential supplier of electrolysers for the company’s own projects, and as a joint venture partner with Fortescue in the US hydrogen market.

Last October Fortescue named Plug Power as the preferred supplier of 550MW in electrolysers for its Gibson Island green ammonia plant in Queensland – although that plan may be stalled as Fortescue battles to find power cheap enough to realise its hydrogen ambitions.

Plug and Fortescue also have a deal for the Australian resources major to take up to a 40 per cent stake in Plug’s Texas hydrogen plant and for Plug to take up to a 25 per cent stake in a plant Fortescue wants to build in Arizona.

Those plans may also need rethinking, though, after the draft detail of hydrogen subsidies on offer from the Biden administration turned out tougher than expected, requiring new sources of clean energy powering the production of hydrogen to qualify for generous $US3 per kilogram subsidies.

In November Plug attached a going concern warning to its quarterly accounts, warning the company was running out of cash after burning through more than $US860m in the first nine months of the year.

At the time a spokesman for Fortescue said the company was not concerned about Plug’s financial position or ability to deliver on its agreements with Fortescue.

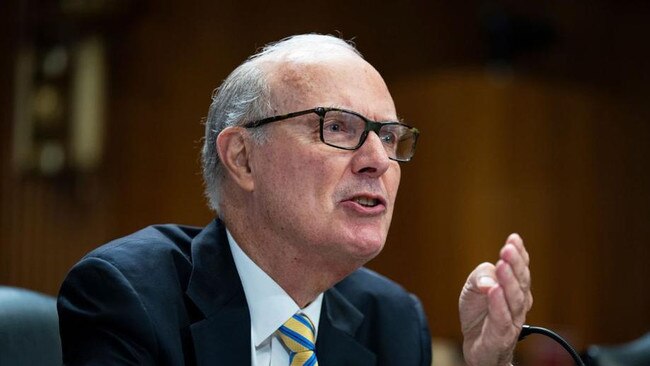

Plug chief financial officer Paul Middleton told analysts the going concern warning was driven by the need to comply with corporate accounting standards, and Plug was confident it could raise debt to cover its obligations.

“I have a $US5bn ($9.43bn) balance sheet that’s unlevered,” he said.

“I mean, I really don’t have any debt. So, we still are extremely confident about the range of parties and solutions that we’re working with.”

But the company instead filed a prospectus to raise up to $US1bn on the US market this week, in a move that could dilute existing shareholders substantially.

The filing sent Plug stock down more than 40 per cent over the last few days, with the company now trading around $US2.40 a share – more than 85 per cent below its price a year ago, and a fraction of its all-time high of $US66.87 in January 2021.

Plug is due to give a business update to analysts and investors early next week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout