Fortescue’s first green hydrogen projects to cost $US750m

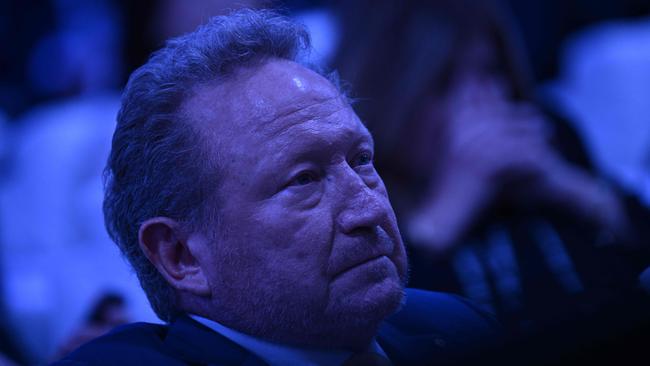

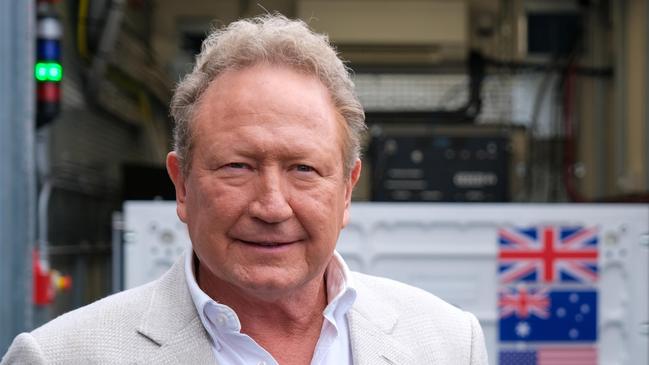

Shareholders have returned an historic strike against Andrew Forrest’s mining giant, as it earmarked $1bn for its first green hydrogen projects in Arizona and Queensland.

Fortescue has received a first strike against its remuneration report at the company’s annual shareholder meeting — with more than 52 per cent of shares voted against the motion — amid a backlash against the company’s decision to give additional payouts to the company’s former chief executive and chief financial officer.

The shareholder backlash is believed to be the first time in Fortescue’s history it has received more than a 25 per cent vote against its pay report.

Key proxy advisers recommended a vote against the company’s pay report on the basis of the payments to Elizabeth Gaines and Ian Wells as a result of their retirement from executive roles with the company.

CGI Glass Lewis also noted the extraordinary turnover in the senior executive ranks of the company, with most recently saw metals boss Fiona Hick leave Fortescue only six months after starting her job, quickly followed by incoming CFO Christine Morris.

The vote came after Fortescue revealed its first two green energy projects will cost $US700m ($1.06bn) and produce a total of only 19,000 tonnes of hydrogen a year, with the company ticking off plans for plants in Phoenix in the US and at Gladstone in Queensland ahead of the company’s annual shareholder meeting in Perth.

The announcement comes three years after Fortescue founder Andrew Forrest first outlined his ambitious plans to turn Fortescue into a green energy giant capable of producing 15 million tonnes of green hydrogen a year by 2030.

The additional “special recognition” payments included almost $2m awarded to Ms Gaines, who stepped down as chief executive in August 2022 to become a non-executive director of the company, only to be reinstated to a role as an executive director only a few months later.

Mr Well was awarded a payment of an additional $1m, according to the company’s annual report.

In addition Ms Gaines was granted a one-off payment of $794,836 to reflect additional work she conducted as a non-executive director and the company’s “global ambassador”, and is now receiving annual payments of $1.3m as an executive director.

Proxy advisors also criticised the $1.3m in annual payments to deputy Fortescue chairman Mark Barnaba.

Speaking to journalists after the shareholder meeting, Fortescue executive chairman Andrew Forrest dismissed the latter payments as necessary to keep Ms Gaines and Mr Barnaba working for the company.

“It’s fractional to what I’d have to pay them if they weren’t already very loyal to Fortescue, and to ambition,” he said.

“But it appears as a one off payment, such is life, it did cross their rulebook. We’ve spoken to them about that and said look, we didn’t have a choice about this. We really need this talent, we need them even more now.”

Non-executive director Penny Bingham-Hall told the meeting the company had taken note of the backlash, and would further engage with shareholders over the issue.

The company will also spend $US50m on a commercial green iron plant at its Christmas Creek iron ore mine in WA, the company said.

Fortescue has promised to make five final investment decisions on green energy projects by the end of 2023, and said on Tuesday its board has “fast tracked” three other projects in Kenya, Brazil and Norway.

But the first cab off the rank will be a 11,000 tonne a year green hydrogen project in Phoenix, Arizona, which will come with a $US550m capital cost and is due to start commercial operations in mid-2026.

Fortescue said it will “initially” fund 100 per cent of the project, as it looks for debt and equity funding for the facility.

In addition, Fortescue will spend $US150m on a hydrogen plant in Gladstone, which will use electrolysers made in Fortescue’s nearby manufacturing plant to make up to 8000 tonnes of green hydrogen a year.

Other than estimated capital costs, Fortescue did not give any details of the expected returns from the projects.

The company’s proposed Gibson Island plant, a joint venture with Incitec Pivot, appears to have been pushed to the back burner, however, with the company saying it was still working on front end engineering and design studies but requires further work “as Australia struggles to shed its petrostate status and still suffers structurally high green electricity costs”.

Dr Forrest told reporters the decision did not mean that the Gibson Island project was dead.

“We’ve really got the technology down pat, and it’s a function of electricity prices. We’re still working with the Queensland Government closely. We’re still working with the technology sector to drag those costs down and drag that capex down,” he said.

“But we’ve set ourselves high hurdles as a public company, and we’re very disciplined on capital allocation.”

High power costs were a major factor in Incitec’s decision to mothball the Gibson Island ammonia plant in 2022.

The projects approved by Fortescue are relatively minor in the scope of Fortescue’s stated ambition of being capable of producing 15 million tonnes of green hydrogen by the end of the decade.

Fortescue increased its capital spending guidance for its Fortescue Energy division by $US100m on Tuesday, saying it now plans to spend $US500m this financial year as it presses on with its first hydrogen projects.

The company said it plans to install 80MW of electrolysers at its Phoenix plant, aiming to supply hydrogen into the US domestic market. Fortescue said it expects the facility to be eligible to collect a $US3 a kilogram subsidy available through the US Inflation Reduction Act, as well as indirectly benefit from subsidies on offer through California’s push to phase out the use of diesel as a fuel by 2036.

Construction is expected to begin in the US by 2024, with commercial production by mid-2026, the company said.

Fortescue says its Gladstone facility will produce about 8000 tonnes of hydrogen a year, using renewable power bought on the spot market on the NEM — suggesting the plant will only run intermittently, when power prices fall overnight and outside peak demand periods.

Initially it will only be able to run at 30MW capacity due to water constraints.

Fortescue shares closed up 17c to $25.47 on Tuesday.

.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout