Institutional investors forgive Fortescue’s turmoil, insists its bosses

Fortescue Metals Group’s institutional investors ‘understand’ the reasons for last week’s executive chaos, says Fortescue Energy boss Mark Hutchinson.

Fortescue Metals Group’s institutional investors have told the company’s new leadership they “understand” the reasons for last week’s extraordinary executive chaos, according to Fortescue Energy boss Mark Hutchinson, as the company prepares to sign another hydrogen deal.

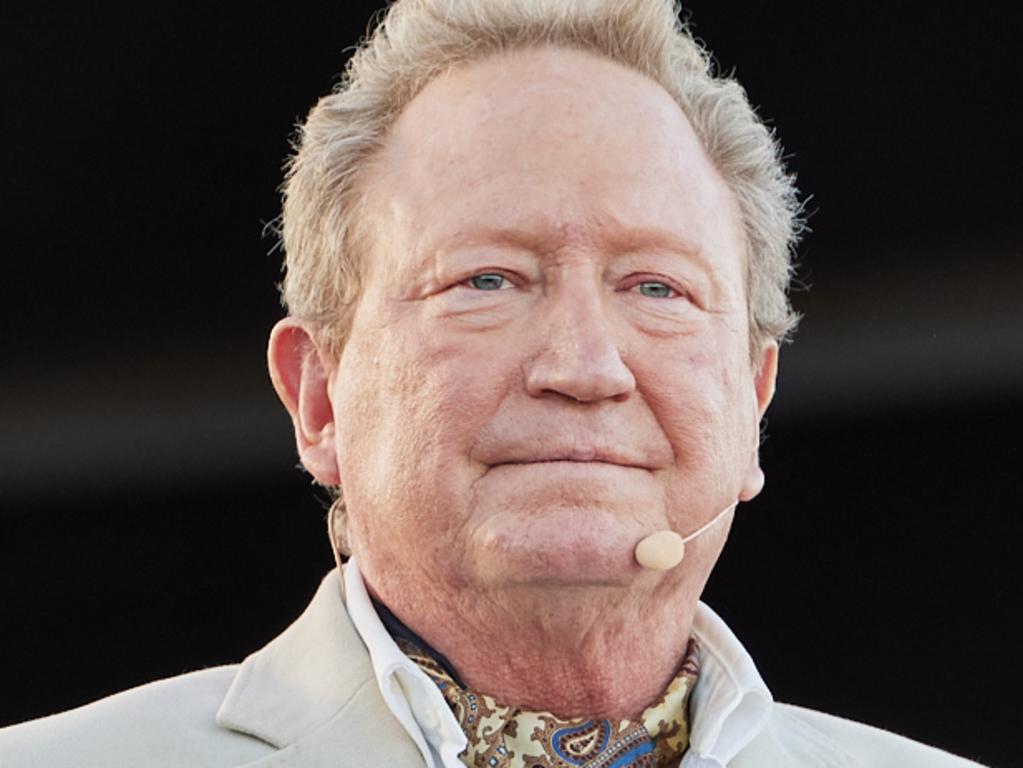

And despite flagging that the first round of Fortescue’s green energy projects would be relatively small, Mr Hutchinson said he was more confident than ever that the company would meet Andrew Forrest’s stated goal of building infrastructure capable of supporting 15 million tonnes of green hydrogen production per year by 2030.

Mr Hutchinson and new metals chief executive Dino Otranto hit the road to speak to institutional investors and analysts in Sydney and Melbourne this week, after the mining major spooked the market by announcing the sudden exits of former metals boss Fiona Hick and chief financial officer Christine Morris in the wake of Fortescue’s annual financial results the previous week. “I think it (the roadshow) was really well received,” Mr Hutchinson told The Australian on Friday.

“The reaction from investors of the changes was ‘we understand that you moved as an organisation very fast and, and took the hard decision’. I was on a bunch of Australian boards before I joined Fortescue, and most organisations wouldn‘t have done that. I think we’re unique this way – to make the hard call and move on, as opposed to let it fester for a year or so.

“I think most investors understood that.”

Fortescue has turned over at least a dozen members of its most senior leadership team in the past two years, and Mr Hutchinson admitted the staff turnover in its energy arm – formerly called Fortescue Future Industries and now known as Fortescue Energy – had been substantial.

“There‘s been a lot of turnover in the energy side, but you’d expect that because we’re a start-up,” he said.

Mr Otranto dismissed concerns that the leadership changes at Fortescue would eventually flow into the performance of its mines, saying Fortescue’s operational leadership team had been “incredibly stable” in recent years, and should not be compared to the turnover in Fortescue Energy.

“We started that side of the business with essentially WA mining folks trying to run a global energy business and create new ventures – and we’ve had to change a lot of folks out,” he said.

“And metals hasn’t missed a beat. When you’re going down through the organisation, right down to frontline supervision, tenure is good and turnover is remarkably low.”

While Fortescue has suffered major blowouts and delays at its Iron Bridge magnetite project in the Pilbara – where the company has exceeded its initial budget by $US1.4bn – Mr Otranto said changes made to the project management team since the blowouts were first revealed by The Australian in 2021 had put the project back on track.

“Since we brought the Fortescue project team back into that project, it hasn’t missed a beat. The first shipment actually was sent out above specifications,” he said.

“To have that run first time above specification – I think it‘s completely unfair to connect any turmoil to any results.”

Mr Hutchinson said investors and analysts attending the roadshow showed more interest in the future of Fortescue’s energy business than its leadership changes – and in particular when the company would deliver hard numbers on the cost and returns on its green ammonia and hydrogen projects.

Fortescue plans to approve five projects this year – all relatively small projects so far.

But he rejected suggestions the big projects touted by Mr Forrest in previous years – such as a 15GW hydrogen project in Argentina, worth about $US8.4bn, that was announced in 2021 on the sidelines of the global COP26 meeting – were on the backburner.

“The focus has been to work on those we can get to market quickly – get product out there and show the world we can do it. It doesn’t mean that we’ve dropped all the other projects.

“We have the first five priming the pump. We then have some very large projects coming behind this – in Brazil, and in Jordan, and in Egypt, in Namibia, in Western Australia,” he said.

And he said he was more confident than ever that Fortescue would be capable of producing 15 million tonnes of green hydrogen a year by 2030.

“The Saudis have come out and said they’re going to do 400 million tonnes, so 15 million tonnes doesn’t look so crazy,” he said. “A year ago, I probably would have agreed with you. But the next wave of projects behind the first five are all in the millions-of-tonnes of ammonia. So where I’m sitting today, it doesn’t look so crazy.”

Fortescue said on Friday it had signed a new agreement with US hydrogen company Plug Power to look at jointly investing in two separate hydrogen production facilities in the US.

If the agreement is consummated, Fortescue will take a 40 per cent stake in a 45 tonne a day (about 16,000 tonnes a year) in Plug’s planned hydrogen plant in Texas, and Plug could take a 25 per cent share of Fortescue’s hydrogen project in Phoenix.

Plug Power will also supply electrolysers to Fortescue’s ammonia-production facility at Gibson Island in Australia, if the plant is given the go-ahead.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout