The superannuation push was highlighted by ASIC in public speeches last year, with the aim to be selective in the actions taken, focusing on where the biggest hits to consumers and markets have been.

It has around a dozen investigations under way in the field, covering a range of issues from fees for no service to trustees behaving badly and not providing the correct levels of oversight.

In recent weeks the regulator has highlighted fund-switching as an area of concern, which forms part of the overall target of putting members’ interests first.

The trustee focus will be in areas where member interests are not paramount.

Other areas of focus include insurance, misappropriating money and lack of oversight.

A major thrust of regulatory action will be around the design and distribution obligations, where issuers have a duty to ensure they have the products marketed to the right people.

The DDO requires firms (product manufacturers, issuers, etc) to clearly identify the intended (target) market when designing financial products, and requires distributors (insurance brokers, insurer sales agents) to distribute products in accordance with the insurer’s target market.

In superannuation the new rules will apply in product choice to ensure members are put in the right funds.

The regulatory push will come with co-operation between APRA and ASIC.

It also focuses on ASIC’s principle-based regulatory model, with responsibility placed on industry to do the right thing and ASIC to come down hard against breaches.

ASIC’s targeted approach was shown in its recent action against Squirrel Superannuation for false and misleading product statements on property investments.

Earlier last month it took action against La Trobe Financial, alleging misleading statements over fund redemptions.

The fund advertised money could be withdrawn in 90 days on some accounts and 48 hours in others, when in fact the fine print revealed withdrawals could be delayed for 12 months.

The work program indicates the regulator is getting on with its job without chair James Shipton, who stepped aside last October over an investment into his tapping taxpayer funds to pay for tax advice on his move to Australia.

Treasurer Josh Frydenberg has a report on the matter, prepared by Vivienne Thom, which he is yet to release.

In stark contrast to former Australian Post Christine Holgate, who quit under parliamentary attack from Prime Minister Scott Morrison, Shipton appears to be ready to fight.

Holgate has since been effectively cleared of any wrongdoing but quit due to the obvious difficulty of working in the job after the parliamentary attack.

Some argued Shipton would take a similar approach given the obvious credibility issues he faced both internally and externally at ASIC.

As corporate plod the ASIC boss is meant to ensure business behaves well.

His credibility in doing that would be shot, given question marks over his use of taxpayer funds to pay for his legal advice on his personal finances.

The problem facing Frydenberg is unless there is clear evidence of specific wrongdoing it is very difficult for him to sack Shipton.

Shipton was appointed to the role when Scott Morrison was treasurer and Kelly O’Dwyer financial services minister. Frydenberg is also considering who to appoint to the job of overseeing the financial regulators, a role which was recommended by the Hayne royal commission.

A decision on both is expected in the next couple of weeks.

The role of overseer could play a key role in setting the financial regulatory responses, or play a more back-seat role based around annual reports to parliament with little day-to-day involvement. Just who is appointed will be a guide to how Frydenberg wants to approach the issue.

Obviously if Frydenberg can’t get Shipton to see the blindingly obvious and resign then the overseer role has a key role to play.

While the Treasurer is mulling his moves, along with the imminent appointment to fill Geoff Summerhayes’ seat as an APRA member, the regulators are concentrating on their day jobs.

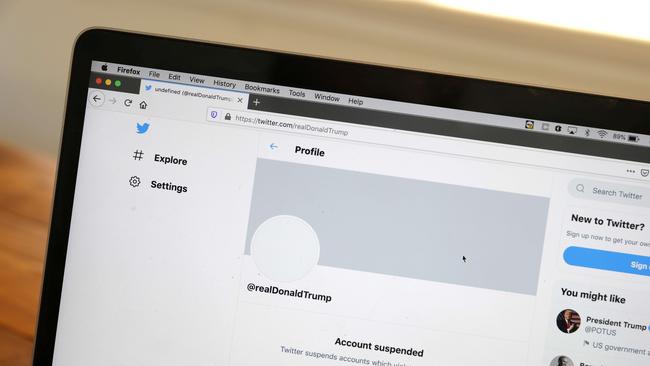

Dangers in Twitter ban

Twitter’s decision to ban President Trump from its platform, while welcome, holds dangers in the glee with which regulators have jumped to extend their powers.

The risk is that in the rush to support the welcome show of accountability from the platform, regulators want to impose rules on just how and when decisions are made.

Controls on the platforms could quickly be applied to mainstream media, despite its long track record in both accountability and responsibility for what is published.

More regulation is not needed just better enforcement of the existing rules.

That is happening, as seen by the string of regulatory litigation against the platforms for abuse of market power, unfair trade and privacy breaches in Australia, the US and Europe.

The overwhelming positive from the Twitter action is a clear demonstration they can and do control what appears to their platform.

This is in sharp contrast to previous platform arguments that they can’t control what appears.

Apple took this a step further by cutting the right-wing Parler app from its platform and Amazon said it would not offer the app past cloud-based support.

The actions are ultimately politically-based commercial decisions.

But having demonstrated this power the platforms may yet regret the legal consequences of these essentially commercially-based decisions.

Regulators have shown their hand in their desire to control the platforms but conventional media may also be in the firing line if the switch has extended application.

Donald Trump also has 88 million followers on Twitter and if they can’t get access to him on the platform they may drop it altogether.

The platforms use media to drive content because this drives its ability to track consumers for its advertising. They want content which drives more eyeballs to their site which then gives them access to personal data.

In the US the platforms have specific powers under section 230 of the Communications Decency Act which at its widest reading says the providers have no responsibility for what appears on their platform.

This doesn’t exist in Australia but the US based platforms tend to act globally based on US law. The US law is in sharp contrast to the rights and obligations of the publishers of this publication.

ACCC chief Rod Sims was quoted on Monday saying there is a legitimate question to ask as to just who makes the decisions about what appears on social media.

This of course is not an issue for the ACCC directly given its mandate is over competition. But if freedom from regulation gives one competitor in a marketplace a free ride then the competition regulator has a valid view.

Regulation of media content is a whole new ball game which must be avoided.

ASIC will target the superannuation sector this year as part of its attempt to get better consumer returns from business behaving better.