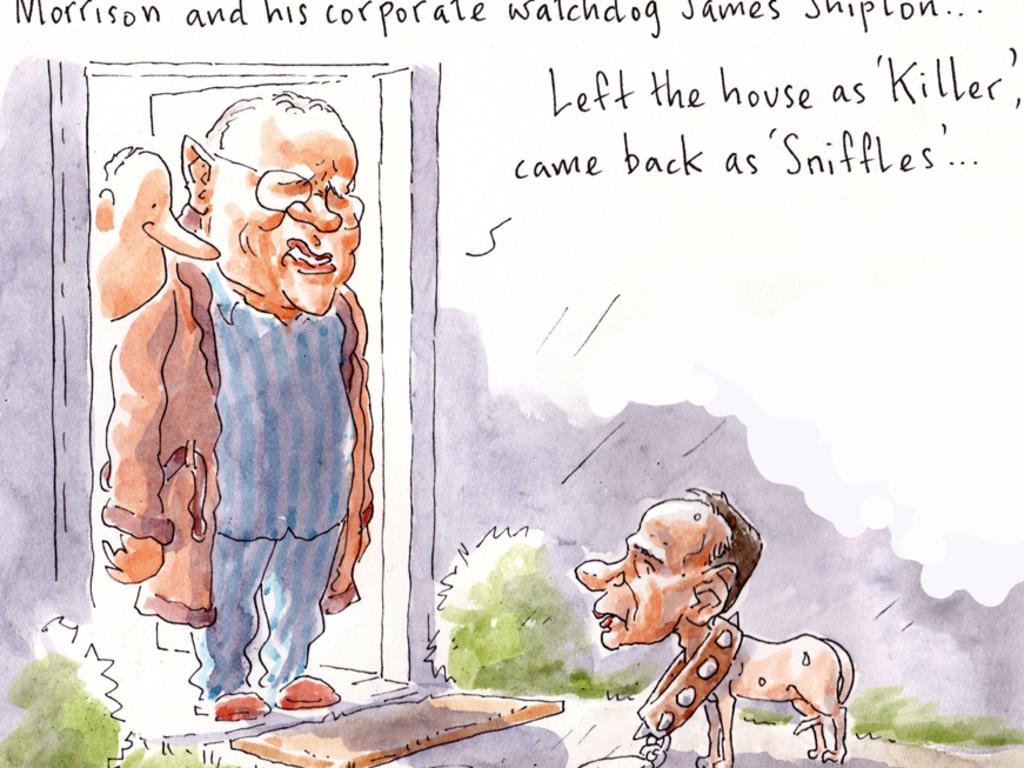

ASIC boss James Shipton burnt by bill for tax and investments advice

ASIC used public funds to pay for advice about chairman’s personal investments, ‘optimisation’ of tax returns and help with his overseas tax bills.

The chairman of the nation’s corporate regulator has stood aside after it used taxpayer funds to pay for advice about his personal investments, the “optimisation” of tax returns and help deal with overseas tax bills.

The Australian Securities & Investments Commission has also admitted it took more than a year to address separate concerns from the government auditor about $70,000 claimed by its deputy chairman, Daniel Crennan QC, after he relocated from Melbourne to Sydney.

ASIC chairman James Shipton on Friday stood aside from his position as Treasury launched an independent review into how the regulator allowed him to rack-up a $118,557 bill for KPMG advice, “in excess of the approved procurement” and potentially in breach of remuneration rules.

ASIC in September 2018 agreed that just $9500 of Mr Shipton’s tax bill would be covered by the agency but reversed the decision a month later and agreed to pay all the expenses.

KPMG invoices scrutinised by Auditor-General Grant Hehir show the provided services were described as “tax advice on personal investments”, “optimisation of the Australian taxation of foreign exchange gain or loss in foreign bank accounts” and “assistance in respect of resolution of Massachusetts state tax notices and penalties due to late filing”.

“The ANAO (Australian National Audit Office) was unable to obtain any documentary evidence that a confirmation of the services provided occurred prior to payment by ASIC,” Mr Hehir wrote to Josh Frydenberg this week.

The ANAO also found Mr Crennan was given a weekly “accommodation payment” of $750 in the last two financial years, “over and above the total remuneration package”.

In his letter to the Treasurer, Mr Hehir noted his agency had told ASIC to seek advice about the payments and whether they were allowed — something which had still not been done by the end of September this year.

Both Mr Shipton and Mr Crennan will repay the money.

Mr Shipton, in a statement to a parliamentary inquiry, said ASIC “acknowledges that action in relation to (Mr Crennan’s) matter … should have taken place more promptly”. “ASIC acknowledges the processes supporting the approval of these relocation expenses were inadequate and, given the high standard ASIC holds itself to, it is disappointed that such situation has occurred,” he said.

Karen Chester, ASIC’s deputy chairwoman, will act as the interim head of the regulator until the conclusion of Treasury’s investigation, which is being undertaken by the former inspector-general of intelligence and security Vivienne Thom. Scott Morrison on Friday flagged the potential for a wider investigation into the remuneration arrangements for all government appointees after controversies at ASIC and Australia Post this week.

“It’ll be important to receive the recommendations of the reports, the inquiries that are being initiated,” the Prime Minister said. “It may well be that that (an audit of government agencies and their senior staff) comes forward. Let’s wait and see. I’m very open to those recommendations.”

Mr Shipton became ASIC chairman in 2018 after working at Hong Kong’s Securities and Future Commission and spending almost a decade at investment bank Goldman Sachs.

The advice from KPMG was part of a payment to assist his relocation from the US.

Before he was appointed chairman, ASIC had told Treasury tax advice costs for a successful applicant would likely amount to a total of $8000 in 2017.

When he joined, Mr Shipton was told by KPMG that its fees for taxation services would be “approximately $60,000-$70,000”. ASIC agreed to cover $9500. But in October 2018, advice provided to Mr Shipton by ASIC was that “the full amount” would be paid by the regulator given it was within the overall relocation cost limits discussed with Treasury.

Mr Shipton, in his statement on Friday, said he believed he “acted properly and appropriately”. “What matters is that I act with integrity and honour,” he said. “That means I need to act in the best interests of ASIC and its vital purpose to build a fair, honest and efficient financial system for all Australians … I only took this position to serve the Australian community and to work to improve the corporate and financial system that should also serve it.

“If I in any way impede that purpose, the right thing for me to do is to step aside until such time that I can.”

Mr Hehir, in his letter to Mr Frydenberg, said he had recommended ASIC review how executive remuneration and benefits are approved, and what internal controls need to be reinforced.

“No evidence was available to support that the approval of services to be provided on behalf of the chair was subject to any additional advice or consideration prior to approval nor supported by a formalised policy on executive officer relocation costs and benefits,” he wrote.

Mr Crennan, the son of former High Court judge Susan Crennan QC, joined ASIC as deputy chairman in July 2018 after working as a senior barrister in Melbourne.