Trading DayTrading DayUS jobs data due. ASX has worst day, lowest close in over a week after record highs. Goodman Group, APA Group sell-downs completed. Iluka’s WA refinery costs weigh as government steps up support. Domino’s downgraded. Aristocrat down as gaming CEO joins rival. WiseTech director pockets nearly $200m via share sale.

MarketsMarketsBitcoin has surpassed $US100,000 and Australia’s crypto industry says the digital currency is no longer fringe technology but offers strong investment prospects.

CryptoMarketsThe world’s largest digital currency has staged an extraordinary rally since the US election, surging more than 40 per cent in just four weeks and setting one record after another.

Alexander Osipovich

Trading DayTrading DayBitcoin hits much-awaited milestone. Rio Tinto’s buyback, dual-listing pressures mount. HMC rises on $950m energy buyout. Kmart finds new boss. Aristocrat gaming arm names new CEO. Woolworths strike action ‘concerning’: Wesfarmers boss.

ExchangeMarketsDisappointing economic data could see the RBA adopt a more dovish tone at next week’s board meeting, potentially setting up a February rate cut.

Trading DayTrading DayEconomy grew 0.3 per cent in the September quarter, below expectations of 0.5 per cent and mostly due to government spending. AUD weaker after GDP data. Pro Medicus up after founders’ $500m selldown, broker upgrade. Goodman dives on Citi repricing. UBS wins NZ$1.3bn of Auckland Airport stake sale.

ExchangeMarketsStocks are soaring before the year’s end but Macquarie has raised concerns of a pullback amid stretched valuations, sliding US economic resilience and a fear of Donald Trump’s policies.

Trading DayTrading DayWiseTech’s ex-CEO Richard White says stepping down after a personal scandal’s his decision. Shares in KFC operator Collins Foods down after profit fall. Woolworths counting cost of strike actions.

EconomicsMarketsEconomists have cautiously backed the Reserve Bank’s high-for-longer approach on interest rates while warning of significant challenges for the global economy.

Trading DayTrading DayFlurry of new partners at Barrenjoey. Northern Star down on $5bn buyout bid. Singapore Post locks in $1bn sale to Pacific Equity Partners. Metcash climbs as investors look past underlying profit drop. Retail sales, building approvals rise.

MARKETSMarketsInvestors will gain a clearer picture of the state of the economy this week with the release of September quarter gross domestic product figures expected to show only a slight pick-up.

WealthWealthMounting debts are not the issue for global sharemarkets, rather the question is whether the relevant economies have the capacity to finance their obligations.

Trading DayTrading DayInterim nod for the aviation partners to operate 28 weekly return flights between Doha and Aus cities. Meta warns on incoming social media ban. Cbus chair Wayne Swan says no ‘reserve’ being built for fine payments. ANZ forecasts May rate cut.

ExclusiveCompaniesHaemaLogiX, which counts former minister Greg Hunt as a director, is readying to float in 2025, as it seeks inroads into the $36bn global market for treating blood cancer multiple myeloma.

EXCHANGEEconomicsThe Reserve Bank boss continues to argue monetary policy must stay restrictive because underlying inflation won’t sustainably fall — until the end of 2026.

Trading DayTrading DayStar investors vote against CEO pay amid liquidity, viability concerns. ACCC sues Webjet. IAG snaps up most of RACQ underwriting for $855m. AVJennings shares rocket on takeover. Activist group ordered to pay Santos $9m.

geopoliticsFinancial ServicesThe election of Donald Trump and geopolitical volatility globally make it a scary time for people trying to manage their wealth and prepare for their retirement, says Janus Henderson’s Ali Dibadj.

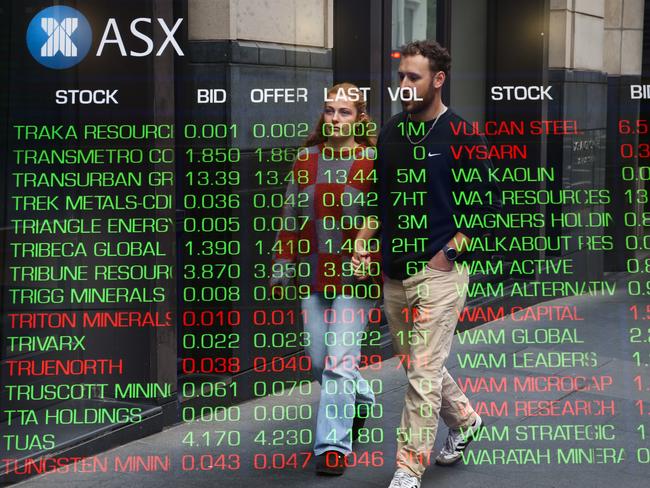

ExclusiveMarketsA group of investment banks have joined forces to press the ASX and corporate regulator for wholesale and radical changes to the sharemarket listing process.

EXCHANGEMarketsFidante’s survey of financial advisers shows global equities and domestic small caps are expected to offer the best opportunities for local investors over the next six months.

investmentPropertyOne time investment banker turned fund manager Al Rabil believes buying conditions in international property markets present the best opportunities he has seen in years.