Health, IT stocks set to shine: Mercer

Technology, healthcare and consumer discretionary stocks may continue to shine as COVID-19 accelerates long-term trends.

Technology, healthcare and consumer discretionary stocks may continue to shine as COVID-19 accelerates long-term trends.

Stocks finished higher after a dovish speech from RBA boss Philip Lowe and jobs figures were better than expected.

Veteran investor Charles Goode says after an initial sprint, Australia’s economic recovery is likely to be a slow grind blighted by higher unemployment.

There is a risk of higher capital gains and corporate tax rates if Democrats win control of the Senate.

Consumer confidence hit a 3-month high, but the ASX finished firmly lower, snapping a 7-day winning streak.

The waste company avoided a ‘first strike’ at its AGM despite controversy over its chief executive.

A government controlled by one party is seen as more likely to expand the federal budget deficit, which could lift bond yields.

The ASX closed up 1pc, clocking its best seven-day winning streak since 2009.

Australia’s sharemarket has continued to surge, with banks doing much of the heavy lifting.

NSW inquiry told of ‘failure of culture’ at Crown, while ASX closes up 0.5pc at 7-week high.

The personal feud between baby boomer fund manager Geoff Wilson and millennial entrepreneur Nicholas Bolton is shaping up as a doozy.

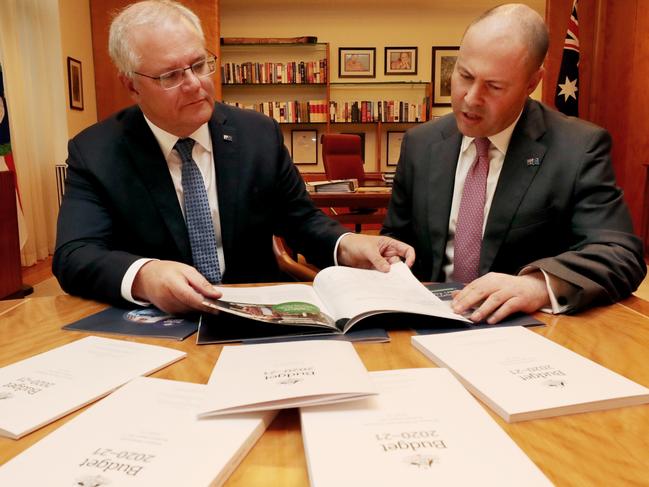

The federal budget has been unusually positive for the sharemarket as the coronavirus finally gave the government the pretext to abandon its surplus obsession.

The ASX finished flat of Friday but the index still managed to clock its best weekly gain in more than six months.

Japanese investors are helping underwrite governments’ massive borrowing spree, buying almost $35bn of government bonds over the year to August.

A surge in bank stocks has been a key driver of the best week in Australian shares in the past six months.

James Packer’s influence over Crown’s board examined, as ASX posts best close in 5 weeks.

Investors welcomed a highly stimulatory federal budget with the local sharemarket surging to its highest level in almost five weeks.

James Packer opened up at the Crown inquiry, while the ASX surged to a five-week high following the business-friendly budget.

Shares in Douugh surged on Tuesday after debuting on the stock exchange. The next-gen neobank and AI-driven ‘financial wellness app’ more than doubled to 6.8c.

The Reserve Bank has bolstered market expectations of interest rate cuts and the start of quantitative easing at its November board meeting.

Original URL: https://www.theaustralian.com.au/business/markets/page/196