Trading Day: Packer’s influence over Crown examined, as ASX posts best close in 5 weeks

James Packer’s influence over Crown’s board examined, as ASX posts best close in 5 weeks.

- ASX clocks best close in 5 weeks

- Packer quizzed on junket expose

- Another UBS loss to Barrenjoey

- Sezzle unveils 3Q sales boost

The ASX has closed firmly higher in what was its first four-day gain since early July. The gains followed a lift on Wall Street overnight following Trump’s partial reversal of his earlier decision to end talks on a stimulus package. The Dow gained 1.9 per cent, the S&P 500 ended up 1.7 per cent, and the Nasdaq added 1.9 per cent.

8.10pm: Asian markets rise

Asian markets mostly rose Thursday as investors tracked a Wall Street rally, with investors increasingly confident Joe Biden and the Democratic Party will win the presidency and both houses of Congress, paving the way for a huge new stimulus.

Tokyo rose 1 per cent, while Mumbai, Manila and Taipei added more than 1

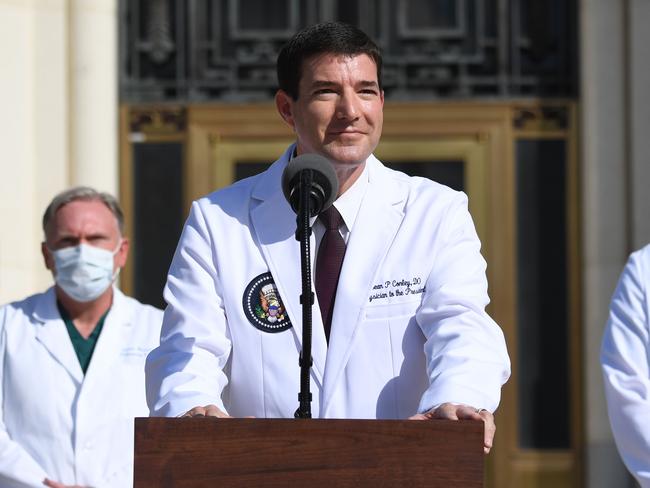

Wellington jumped 1.8 per cent after the New Zealand central bank indicated it could unveil fresh economy-boosting measures. New Zealand’s dollar sank 0.4 per cent against the US dollar on the news.

However, Hong Kong fell 0.2 per cent after four days of gains, while Singapore was flat.

London, Paris and Frankfurt all enjoyed gains in early trade, while US futures were also healthily higher.

“The prospect of the Democrats sweeping all three levels of government continues to support stock markets in the run-up to the election day,” said Axi strategist Stephen Innes.

This “would put the Democrats in a position to all but rubberstamp an energetic fiscal stimulus bill while lavishing the country with significant investment in health care, education, and infrastructure,” he added.

AFP

David Rogers 7pm: Banks in the engine room

Australia’s world-leading fiscal stimulus outlined in the budget has improved the nation’s economic outlook and thereby lessened the risk to banks from the worst recession since WWII.

A surge in bank stocks has been a key driver of the best week in Australian shares in the past six months.

With the US market bouncing back after Donald Trump said he would agree to fiscal stimulus on a piecemeal basis, and investors still reacting to a massive increase in stimulus outlined in the budget, the S&P/ASX 200 index rose as much as 1.4 per cent to a five-week high of 6123.4 points.

Profit-taking trimmed it to 6102.2 by the close amid what may be the start of another wave of COVID-19 in NSW, but after advancing every day this week, the index had its first four-day gain since early July.

The index is on track for its best week in six months with a 5.4 per cent rise so far this week.

It has convincingly regained its 200-day moving average for the first time since February, when the coronavirus pandemic sparked the fastest-ever bear market in global sharemarkets.

Banks have done much of the heavy lifting, with the sector up 7.8 per cent this week.

Indeed, while the banks were a major drag on the local bourse from the start of the pandemic until unprecedented fiscal and monetary policy support was implemented in March, and again from mid-August to late September (when leading commentators highlighted the risks they faced from deteriorating loan quality as mortgage holidays expired), the banks have potentially turned into a major source of support for the Australian market as the economic outlook improves.

Interestingly, while the ASX 200 has broken above its 200-day moving average this week, the bank sector index is still 4 per cent below its own 200-day average.

5.58pm: WiseTech boss White cashes in $10m of shares

WiseTech founder and CEO Richard White sold $9.6m worth of shares in the tech logistic company, according to filings with the ASX. Since October 1 White has been selling down 191,000 of direct holdings and 175,490 of indirect holdings. The average sale price for the direct holdings is $26.18 a share and $26.16 a share. Following the sale White is sitting on 137.8m shares with a paper value of $3.77bn. WiseTech on Thursday closed up 3.1 per cent at $27.39.

Lachlan Moffet Gray 5.20pm: Brazil had ‘no knowledge’ of Packer’s bipolar

Commissioner Patricia Bergin has asked Mr Brazil whether he had any idea of the reasons behind Mr Packer’s resignation from the Crown board in 2015 due to mental health issues.

Mr Packer earlier told the inquiry that he was suffering from bipolar at the time, but Mr Brazil said he had no knowledge that fact.

Counsel assisting Scott Aspinall resumed pressing Mr Brazil on the extent to which he was an independent director in the truest sense of the term, maintaining that his friendship with Mr Packer could appear to be perceived as a factor nullifying his independence when compared to ASX guidelines.

Mr Brazil maintained that he saw no conflict.

Moving back to the 2016 arrests of 19 Crown staff in China, Mr Aspinall asked Mr Brazil when the operations in China first came to his attention.

Mr Brazil said it was through a presentation on the VIP business that he requested in December of 2012, but he was not specifically aware of staff being in China until their arrest almost four years later.

“I requested the briefing because there was ordinary cycle VIP reporting, but I asked that we have a specific briefing on VIP, I think, because it was described as an area where...it was a..risk of not achieving profits,” Mr Brazil said.

Mr Aspinall asked about Mr Brazil’s relationship with former Crown chair Robert Rankin and whether they had spoken recently.

Mr Brazil said they had not spoken since his last board meeting at Crown.

Mr Brazil also claimed, like James Packer did on Wednesday, that he was not aware of the risks posed to staff in China before their arrest.

Counsel assisting Scott Aspinall has asked Mr Brazil about the extent he knew about Crown’s dealing with junkets.

Mr Brazil said he did not know specifically which junkets Crown dealt with, and only knew in a general nature that they may at times be exposed to organised crime.

“I expected that management was taking the necessary steps to ensure...that there would not be infiltration by criminal elements,” Mr Brazil said.

Mr Aspinall showed Mr Brazil emails between some of Crown’s staff in China that demonstrated a knowledge that they were dealing with some “underground” characters.

“This represents a failure of escalation of information within the organisation,” Mr Aspinall said, to which Mr Brazil agreed.

Commissioner Patricia Bergin suggested that the escalation may not have occured because of a top down “push for profits,” but Mr Brazil said he was not aware of such a culture existing.

“I think the board’s expectations about no criminal infiltration was clear enough,” Mr Brazil said.

“I agree that we weren’t asking the CEO for a report in a situation where there were tensions on that question.

Ms Bergin said that there were more than “tensions” on that question and that after ABC’s Four Corners aired a story about Crown’s junkets and organised crime, the board should have dealt with it immediately.

Mr Brazil conceded that more should have been done.

Mr Aspinall then raised the multitude of occasions in which banks expressed concerns over potential money laundering to Crown and contrasted it to the Chinese staff’s earlier failure not to escalate the information, asking why it all occurred.

“You were on the board for a long time,” Mr Aspinall said.

“I’ll agree that they are failures of the risk management process,” Mr Brazil said.

“I believe that, um, it has probably risen through a failure of repetitive corrective action where small failures in escalation have taken place.”

Mr Aspinall also asked about the service agreement between CPH and Crown and whether it was appropriate.

Mr Brazil said it was a beneficial arrangement and did not think it was inappropriate that the agreement also allowed CPH to receive confidential information about Crown.

Mr Aspinall asked how the rates CPH charged for these services were set and whether as a member of the audit and corporate governance committee he reviewed them.

Mr Brazil said he did not, but that it was considered by the nomination and remuneration committee.

Finally, Patricia Bergin asked whether by the time Mr Brazil left the board, he viewed the “post-mortem” as completed.

Mr Brazil said it was “on track” to be completed but “there was more thumping at the table required.”

Mr Brazil also clarified that he did not take up any potential offer for Mariah Carey tickets made by James Packer.

The inquiry was adjourned for the day and is due to return on Friday with current Crown non-executive director Harold Mitchell or Andrew Demetriou in the witness box.

4.30pm: ASX clocks best close in 5 weeks

Australia’s share market rose much more than projected by overnight futures amid a further reaction to the budget and anticipation of more gains on Wall Street.

The S&P/ASX 200 closed up 66 points or 1.1pc at 6102.2 - its best close in 5-weeks - after hitting an intraday high of 6123.4 mid-afternoon.

The modest afternoon pullback came after NSW recorded 12 new COVID cases in 24 hours after none for 10 days, though the news came out late morning.

Having risen every day this week, the index recorded its first four-day rise since early July.

A 5.4 per cent rise so far this week puts in on track for its best week in more than six months.

Internationally-exposed materials and health care names stood out with BHP up 2.2pc, James Hardie up 2.5pc, CSL up 2.4pc and Cochlear up 5.3pc.

Stocks that will benefit from domestic economic recovery also outperformed with the major banks are 0.8-1.5pc, Macquarie is up 2pc, Wesfarmers up 1.5pc, Seven Group is up 3.8pc, Downer is up 3.8pc, Seek is up 3.2pc and Star Entertainment up 3.1pc.

The S&P/ASX 200 now has potentially strong support from its 200-day moving average at 6023. Today marked the first two-day break above this important support/resistance line since February.

There’s also a double bottom pattern - formed by matching lows around 5770 in recent weeks - which should see a retest and potentially a break above the August rebound high at 6196.6.S&P 500 futures were up 0.4pc by the time the local market closed.

Lachlan Moffet Gray 4.20pm: Brazil quizzed on plans to take Crown private

Counsel assisting Scott Aspinall has raised an email chain from March of 2017 between Mr Packer and Mr Brazil where the pair take different ways to take Crown Resorts private.

Mr Brazil said it was a “set of various versions of theoretical transactions” more so than a serious conversation.

“I was exchanging thoughts with someone else who was very interested in Crown and answering questions about...take private or other M&A transactions,” he said.

The email chain, which can not be viewed by the public, referenced the “sanitising” of Crown’s China situation.

Mr Brazil said this was not a reference to a reputational cleansing, but an effort to ensure that: “Whatever problems that caused the China problems could be disinfected and fixed.”

Mr Aspinall then showed Mr Brazil a newspaper article from 2009 that referenced Mr Brazil as “brains,” a name that he admitted others sometimes called him.

The article also described him as a confidant of James Packer. Mr Brazil said he was in the sense that Mr Packer had some regard “for my thoughts”.

Also shown to Mr Brazil was an email apparently difficult to follow that included references to Mr Packer securing Mr Brazil tickets to see singer and Mr Packer’s former fiance Mariah Carey.

Mr Aspinall then asked Mr Brazil whether these materials raised portrayed Mr Brazil as an independent director, which he ostensibly was.

“Having regard to your history with Mr Packer and your friendship with him....would you not agree that a reasonable person might perceive that you might be aligned with the interests of Mr Packer rather than independent?” Mr Aspinall asked.

“I don’t agree with that,” Mr Brazil said, saying he on many occasions opposed decisions at board meetings favoured by Mr Packer.

“There’s been nothing that would skew me to act in the interest of anyone except Crown.”

Lachlan Moffet Gray 3.45pm: Brazil ‘did not know’ of subsidiary companies

Counsel assisting Scott Aspinall is now asking Ben Brazil about the extent to which the committee he sat on, the audit corporate governance committee, examined the company.

Mr Brazil said the committee only examined a statutory audit of the company, meaning that entities not required to be audited by the corporations act were not examined.

Subsidiary companies Riverbank and Southbank that may have been used to facilitate money laundering have been a recurring focus of the inquiry so far.

Mr Brazil said he did not know about these subsidiary companies as many group subsidiaries are grouped together in audit to the extent that the individual companies were “not material.”

Commissioner Patricia Bergin asked Mr Brazil if he considered this odd.

“I’m not sure it is odd, Commissioner,” he said.

Scott Aspinall asked why the Crown board never established a specific risk appetite, despite ASX corporate governance guidelines principles recommending they do so.

Mr Brazil said he could not explain why this never happened, despite belonging to the corporate governance committee.

“I can’t. I can’t, I would have imagined it’s something board members in general were regarded as having to be collectively responsible for,” he said.

Mr Aspinall then asked whether Mr Brazil raised concerns with other members of the board following the arrest of Crown employees in China.

“In the first in person meeting that occured after the arrests, after the discussion on the China arrests had gone on...I asked whether we had worked out whether we are culpable here,” Mr Brazil said.

“I was asked by Mr Rankin, who was chairman, what I meant by culpable.

“I responded and said that it was a pretty specific word. Discussion ensued...about whether it was in...good taste to be going through and interrogating the past practices, past conduct, of the employees who at that point were paying a very high price themselves.

“I was...not asking at that point about the limited suspect of people who had been detained. I was asking about the culpability about a much broader group of people.

“I responded at this early stage, the idea was you treated all those things as one as the same until you knew better.

Mr Brazil said he realised that no culpability had been established, but took a promise from Mr Rankin that there would be a “post-mortem” of the event conducted by law firm MinterEllision seriously.

Mr Brazil has told the inquiry that the “pushback” he received from other Crown board members after attempting to establish culpability for the arrest of 19 Crown staff in China in 2016 was not behind his decision to step down from the board the following year.

Instead, he said the responsibilities of his executive role at Macquarie had escalated and he felt he should resign.

“The China arrests happened however I believed that I needed to follow through on resigning from the board and so around, just before the 10th of January, I effectively or by and large turned in notice,” he said.

Counsel assisting Scott Aspinall then read a passage from The Australian’s Damon Kitney’s book about James Packer, The Price of Fortune.

Mr Aspinall read the following said by Mr Packer:

“I thought and think the world of Ben, he’s still a good friend and by 2009 in an act of true friendship, Ben had come onto the board to help me,” Mr Aspinall said.

Mr Brazil denied he joined the board to “help” Mr Packer as a friend.

Lachlan Moffet Gray 3.17pm: Ben Brazil questioned in Crown inquiry

Crown board member from 2009 and 2017 and head of James Packer’s new private investment vehicle 2B Investments Ben Brazil is now fronting the inquiry via video link from London.

Mr Brazil was also head of Macquarie’s CAF principal finance business between 2012 and 2019.

He is taking questions from counsel assisting Scott Aspinall, who is asking Mr Brazil about induction training he received when he joined the Crown Resorts board.

Mr Brazil recalls a lack of induction training for both himself and others, and agreed with Mr Aspinall that an education on the regulatory matters surrounding Casinos would have been useful.

“I think it couldn’t have hurt,” Mr Brazil said, who said that although his understanding of the regulatory matters of the field was “more than zero” it was somewhat “broad-brush” in nature.

“I wouldn’t have known specifics,” he said.

Mr Aspinall asked Mr Brazil whether he had an understanding of the term “suitability” while a board member.

Mr Brazil expressed familiarity with the concept but said under questioning the term “social license” was “front of mind” during board meetings more so than suitability, although he said that himself and the board understood that ongoing suitability was a regulatory requirement to retain a licence.

Mr Brazil said his total commitment to Crown as a board member and part of the audit and corporate governance committee occupied around three days a month.

Counsel assisting Scott Aspinall is asking Mr Brazil how the corporate governance committee he sat on functioned.

“The primary function it serves is to go through the corporate governance statement which is a substantial part of the annual report,” Mr Brazil said.

Mr Aspinall developed the committee’s charter, which stated the committee should compare corporate governance practices with the ASX’s general corporate governance guidelines and asked if anyone was monitoring if recommendations made by the committee were followed through.

He also asked how the numerous apparent failures to follow corporate governance guidelines revealed through the inquiry occurred.

“I would have said good corporate governance in all its dimensions was the first and last role of all board members,” Mr Brazil said.

Commissioner Patricia Bergin interjected to say that someone specific must be monitoring governance, especially within the company with a corporate governance committee and a risk committee.

“If you have a corporate governance committee, why do you have it?” she asked.

Mr Brazil said its “important function” was to “take a bunch of the burden.”

“It means, for example, the corporate governance statement is a significant and substantive document,” Mr Brazil continued.

“If the full board was charged directly with that it would be, I imagine, logistically more difficult than if the committee was charged with its preparation in the first instance.”

3.08pm: Aussie market continues to rally in afternoon trade

Australia’s share market has shied off a 5-week high, but is still having its best week in 6 months.

The S&P/ASX 200 is currently up 1.2 per cent at 6106 after hitting a peak of 6123.4 mid-afternoon.

Having risen each day this week, the index is on track for its first four-day gain in just over two months.

It is also up 5.4 per cent so far this week, heading for its best week since a 6.3pc rise in the week ending April 10th.

It comes as S&P 500 futures rise 0.3pc after the US benchmark surged 1.7pc overnight after President Trump said he will agree to fiscal stimulus on a piecemeal basis.

But the market is also betting on domestic economic recovery amid world-leading fiscal stimulus from the federal government, albeit the latest COVID-19 outbreak in Sydney is a bit concerning.

Among stocks that would benefit from domestic economic recovery, the major banks are 0.9-1.6pc, Macquarie is up 3.3pc, Wesfarmers is up 1.4pc, Seven Group is up 4.6pc, Downer is up 4.2pc, Seek is up 3pc and Boral is up 2.9pc.

The S&P/ASX 200 now has potentially strong support from its 200-day moving average at 6023. Today will mark the first two-day close above this important support/resistance line since February.

There’s also a double bottom pattern - formed by matching lows around 5770 in recent weeks - which should see a retest and potentially a break above the August rebound high at 6196.6.

Lachlan Moffet Gray 2.42pm: New MD for Holden

General Motors Australia and New Zealand has announced that Marc Ebolo will become its new managing director from November.

Mr Ebolo will replace temporary managing director Kristian Aquilina, who will be moving to a new role in the GM ecosystem as managing director of the Cadillac brand’s Middle East and International brand in Dubai.

Mr Ebolo comes to the role after two decades with GM and will oversee the winding down of the Holden brand, Isuzu New Zealand and the establishment of a new GM brand in Australia: General Motors Special Vehicles.

“In Australia and New Zealand, we will work very closely with our key partners – the soon-to-be-appointed GMSV dealers, Holden service outlets, Walkinshaw Automotive Group and Isuzu – to grow our businesses and theirs,” Mr Ebolo said.

“I look forward to working with our partners and to bringing to Australia and New Zealand exciting new vehicles from GM’s global portfolio, to compete in niche segments.”

2.15pm: Packer questioned on Crown, NSW regulator agreement

Commissioner Patricia Bergin is now questioning James Packer about the nature of the agreement between Crown and the NSW gambling regulator, including the stipulation that any condition imposed on Crown by the regulator had to be agreed to by Crown.

“When it comes to tax rates and levies to government, I agree that’s the way the contract is written,” Mr Packer said.

“I’m aware there are disputes about some proposals. I think at the end of the day they’ll be resolved...I don’t know, I am not a director.”

Mr Packer said that deal was negotiated due to provide income security for Crown, given the level of capital injection needed to build the Barangaroo casino.

Ms Bergin asked Mr Packer whether NSW should seek to license junkets similar to how it works in Queensland.

“I don’t see how it could hurt - I think casino operators and the government, regulators, AUSTRAC, all need to be working closer together,” Mr Packer said.

Ms Bergin notes that a closer dialogue between agencies has been a regulatory goal for 30 years and wondered if the outcome of the inquiry would change anything.

Laughing, Mr Packer said Ms Bergin was “underselling herself” and any of her recommendations would be listened to closely.

Ms Bergin raised Riverbank Investments and Southbank Investments, two shell companies raised earlier in the inquiry that are suspected to have facilitated money laundering, and said she wanted their bank accounts emptied and the companies deregistered.

Ms Bergin said Crown had to increase its internal anti-money laundering compliance activities, and presumed Mr Packer, were he a board member, would welcome a closer relationship with the financial crimes regulator AUSTRAC.

Ms Bergin related a provision in Barangaroo’s license that allowed for smoking in the casino.

“What is the basis for having smoking in a modern building like Barangaroo?” she asked.

“Some people enjoy smoking and the air filtration systems are going to be the most sophisticated, I am told, that have ever been developed or built in Australia,” Mr Packer said.

Ms Bergin asked if there would be staff in the smoking rooms - Mr Packer said there would be dealers.

“It must have something to do with the nature of the conduct that occurs, that is the gambling process,” Ms Bergin said.

“I guess so Madame Commissioner...smoking has been synonymous with many people with Casinos for a long time,” Mr Packer replied.

Commissioner Bergin asked Mr Packer if he would be OK with separating internally Crown’s money laundering administration from the “profit making aspects of the company.”

Mr Packer said he would be.

Ms Bergin is also asking questions about the circumstances surrounding former chair Robert Rankin’s departure from Crown.

“Did you part as friends?” she asked.

“I would say as associates, not as friends,” Mr Packer said.

Ms Bergin is also asked about the flow of information between Mr Craigie, Mr Packer and Mr Rankin of the risks to Crown’s staff in China leading up to their arrest and sought to clarify that the board was not properly informed.

Mr Packer’s time in the witness box has now finished and the inquiry has been adjourned.

Former Crown Board Member Ben Brazil will appear after the break.

Bridget Carter 2.05pm: 3P Learning takeover could be in jeopardy

Speculation is mounting that the $188.3m takeover by IXL Learning of 3P Learning could be in jeopardy, with major shareholder Viburnum Funds recently lifting its interest in the company.

On September 28, Viburnum lifted its stake in 3P Learning to 25 per cent from 22.89 per cent in the Mathletics owner, in a move some suspect could be an indicator that it could vote against the scheme of arrangement made by IXL.

Compounding that theory is that the 3P Learning share price has been falling in the past two days, on Tuesday closing at $1.245.

The deal was announced in August, but shareholders are still waiting for the scheme document to be lodged.

For the scheme to be approved, there needs to be 75 per cent of the votes cast on the resolution to be in favour and 50 per cent in the number of shareholders voting.

2pm: Nearmap gains on successful capital raising

Nearmap shares have made ground on Thursday after the aerial imaging company announced the successful completion of its share purchase plan which exceeded its $20m target, raising $23.1m. It followed a $72.1m institutional placement.

“I wish to thank shareholders for their support and participation in both the placement and share purchase plan,” said chairman Peter James.

“The total amount raised of $95.2m ensures Nearmap is now in an even stronger financial position and this capital raising will enable us to accelerate our growth investments and extend our leadership position in the growing global market of location intelligence.”

Nearmap last up 2.3 per cent at $2.49 each.

Lachlan Moffet Gray 1.40pm: Packer ‘won’t return to Crown board’

James Packer says said he takes “some responsibility” for the Crown Resorts VIP’s arm’s outsized appetite for risk.

He was being questioned by Commissioner Patricia Bergin at the NSW inquiry examining whether Crown and its associates, including Mr Packer, remain suitable to hold the high-roller licence at Barangaroo.

Mr Packer was asked about the nature of his service agreement arrangement that allowed him, as a mere major shareholder through his private company CPH, to receive information about Crown ahead of other shareholders.

The arrangement also meant Crown would pay CPH executives for services.

Ms Bergin said she was trying to determine why that agreement was struck as “CPH executives had already been providing services to Crown over the years in various modes for no fee.”

“Was it really more of a financial impetus that drove the establishment of the services agreement?” she asked.

“It was an attempt to stop the subsidisation of Crown by CPH,” Mr Packer said.

Ms Bergin: “These sorts of agreements are not necessary if you have representation on the board that works well - would you agree with that?”

Mr Packer agreed.

Ms Bergin: “You would accept, would you not, that you have a powerful personality?”

“That’s for others to say,” Mr Packer responded, later giving way and saying he does accept this portrayal.

Ms Bergin then asked if maybe then he accepted that the board acted with the ultimate interest of pleasing him.

“I never thought about it before Madame Commissioner until two days ago...perhaps you’re right,” he said.

Ms Bergin asked Mr Packer if Crown would restructure to address “dysfunction.”

“I think there certainly shouldn’t be major shareholder provisions going forward,” Mr Packer said.

“I think that the Crown board has a lot to think about in terms of who the right people are for the right jobs.

“I think caps on shareholdings may be something we should look at.

“I think this has been a terribly painful and terribly shocking experience for the board as it has been for me.

“I won’t be going on the board again.

“I think the board will be more independent than it was in the past.”

Lachlan Moffet Gray 1.35pm: Packer ‘aware’ of crime rumours

Ms Sharp is now discussing with Mr Packer about a Victorian regulator report that mentions the risks junkets pose to the introduction of money laundering through the infiltration of organised crime.

Submitting a transcript of an ABC 7.30 story from last Monday, Ms Sharp mentioned comments made by Martin Purbrick, ex head of security of the Hong Kong jockey’s club during the segment, where he talked about how executives could not reasonably be unaware of the links between organised crime and junkets.

Mr Packer said he did not agree with the observation.

Ms Sharp asked Mr Packer that since the “earliest times” of the Melco-Crown venture, had he understood that a number of Macau junkets have established links with organised crime.

“I understood there were rumours,” Mr Packer said.

“And you’ve been aware of those rumours the entire time you’ve had involvement in Melco Crown?” Ms Sharp asked.

“Yes.”

Ms Sharp has asked whether the granting of a casino license contains obligations for the operator.

Mr Packer agreed.

Ms Sharp established with Mr Packer that it was important that a casino operator only associate with business associates of good repute, then asked if Mr Packer placed “sufficient importance on it”.

“Not with the benefit of hindsight,” Mr Packer said.

Ms Sharp then asked Mr Packer if he had indeed “long been on clear notice of the risk between junket organisations and organised crime”

“Not the junket operators Crown Australia was dealing with,” Mr Packer replied.

Ms Sharp then drew to Mr Packer’s attention numerous media reports that named junkets connected to the Crown that elaborated on potential links to organised crime.

She asked if Mr Packer had “no understanding” of the due diligence Crown took to ensure their junket partners were of good repute.

Mr Packer agreed.

“Is it the case that while you were executive chairman of Crown Resorts, the board set no guidance with respect to the risk appetite for junkets?”

“I saw that as Mr Craigie’s job,” Mr Packer said.

Ms Sharp restated the question to which Mr Packer answered: “I can’t recall.”

1.10pm: Banks face long, slow recovery: S&P

Australia’s banks are set to confront a long and slow recovery from the COVID-19 downturn, according to S&P Global Ratings, as low interest rates, weak credit growth and a drop in fee income threaten bank earnings.

While S&P Global Ratings credit analyst Sharad Jain said he still believes the banks’ reduced earnings should remain adequate to absorb elevated credit losses, the banks will struggle to regain pre-COVID earnings metrics even as credit losses recede.

Mr Jain said the biggest risks to the recovery of the banking sector was a large number of borrowers struggling to meet financial commitments, as well as delays in finding a COVID-19 vaccine, and the escalation of US, China tensions, which he said could prolong or deepen the economic downturn beyond S&P’s base case.

“Nevertheless, we believe that Australian banks should be able to preserve their creditworthiness in the next two years, despite the unprecedented economic disruption due to the COVID-19 outbreak,” Mr Jain said.

“A downgrade on the Australian sovereign remains the main risk to our ratings on the four major Australian banks and Macquarie Bank.”

Lachlan Moffet Gray 1.06pm: Packer denies ‘intimate’ ties with junket operators

The inquiry is now discussing Macau junket investor Meg-Star’s presence in Crown Melbourne, and the existence of one of its operators, Ngok Hei Pang.

Junket operators work to make it easier for high rollers to gamble at particular casinos.

Mr Packer says he does not have any specific knowledge of Meg-Star or of Mr Pang, maintaining he did not closely monitor what happened with junket operators.

Ms Sharp presented an email from January of 2018 discussing Meg-Star establishing a room in Crown Melbourne on a revenue share basis, a concept Mr Packer explained:

“There were two ways that junkets operated with casinos,” he said.

“One was they negotiated a rate that was a slight discount to the theoretical and took the ups and downs on the cards...revenue share just means that whatever the total revenue is, it would be split between the junkets at the Casino.”

“Is that a form of economic partnering?”

“Yes,” he said.

Ms Sharp asked if the email chain proved Mr Packer was being made aware of the activities of junket operators and monitored Crown’s relationships with them.

“No, I think i’ve met two perhaps three, in my life once - Mr Chau Mr Song, and I can’t remember who else,” Mr Packer said.

“I do not and never had intimate relationships with junket operators...and I had nothing to do with the management and running of these relationships.”

Ms Sharp restated her question, asking if he monitored any of the relationships.

Mr Packer said no, but then corrected himself: “I take that back, with Sun City I monitored it.”

Ms Sharp then asked him if he had awareness of key junket operators up until he resigned as director.

“No...I was aware of Song, I was aware of Sun City,” he said.

Ms Sharp asked if that extended to Meg-Star and Qin junkets.

“Well, they’ve been emailed to me, with that information on the email - to say that I was monitoring their relationships is a step too far,” Mr Packer said.

Ms Sharp asked Mr Packer if he was one of the “key driving forces” in bringing Macau junkets to Crown Casinos in Australia.

“Yes,” he said.

“Do you accept Mr Packer that casinos can be vulnerable to infiltration by organised crime?” she said.

“Yes,” Mr Packer responded.

Lachlan Moffet Gray 12.52pm: Tougher times at Crown’s London casino

Ms Sharp is digging deeper into James Packer’s communications with former Crown executive Ishan Ratnam and the discussions the pair had over “rebuilding” Crown’s VIP business in the aftermath of the Chinese crackdown on Crown staff on the mainland.

In particular, Ms Sharp highlighted an email from Mr Ratnam in 2017 discussing how business at Crown’s Aspinall casino was getting harder because of “credit and wealth checks”.

Ms Sharp asked Mr Packer if he knew what that meant.

“AML,” Mr Packer said, an abbreviation for anti-money-laundering.

Ms Sharp asked if business was getting tougher at Aspinall due to England’s “AML framework.”

“That’s my recollection Ms Sharp,” Mr Packer said.

Ms Sharp then read an email from August 2017 by Mr Ratnam that said:

“We are working through now with London on having credit through junkets to make third party bank payments not having proof of wealth.”

Asked for an explanation, Mr Packer said: “I’m not sure.”

Ms Sharp asked why people may need to have proof of wealth in London casinos.

Mr Packer said: “I wasn’t an expert on the UK regulatory framework and I am not a lawyer, I believe it has something to do with AML.”

Mr Packer said he could not explain what “to make third party bank payments” means.

Lachlan Moffet Gray 12.42pm: Packer part in Crown strategy ‘marginal’

Presenting Mr Packer with a Crown email chain from July of 2014 that contained updates on the VIP international business, Ms Sharp asked if he attended CEO meetings where those updates were discussed.

“I think I stopped participating sometime towards the end of 2013, in those meetings,” Mr Packer said, adding he couldn’t recall if he continued to receive the updates after he ceased attending the meetings.

Ms Sharp raised comments made by former Crown CEO Rowen Craigie where it was said the VIP international business updates were collated and discussed in meetings because Mr Packer was particularly interested in that side of the business.

“Not more so than the rest of the business,” Mr Packer said.

“Is it right that in 2012, 2013, 2014 and 2015 until you ceased being executive chairman that one of your roles was in setting Crown Resorts VIP strategy?” Ms Sharp then asked.

“No, I don’t accept I ever set the strategy at Crown Resorts,” Mr Packer said, adding that he “marginally” contributed to the strategy.

“Are you sure it was only a marginal contribution?

“Yes.”

Ms Sharp then asked Mr Packer if he ever met Michael Chen, president of international marketing for Crown and architect of the company’s strategy in mainland China.

Mr Packer said he met him once or twice.

Ms Sharp is now discussing a meeting Mr Packer attended with junket operator Sun City’s CEO Alvin Chau.

Mr Packer said he met with Mr Chau “because Sun City is from recollection the biggest junket operator in Macau.”

Mr Packer said that this meeting, as well as a meeting with another junket operator, were organised by former Crown Executive Ishan Ratnam.

The NSW inquiry is examining whether Crown and its associates, including Packer, remain suitable to hold the high-roller licence at Barangaroo.

Ms Sharp has asked if former Crown Executive Ishan Ratnam met with junket operators on the behalf of Mr Packer.

Mr Packer denied this, then backtracked and then said that was indeed what Mr Ratnam was doing.

Displaying an email from Mr Ratnam to Mr Packer in August of 2016 that contained information on Sun City and Neptune junkets operating in Shanghai, Ms Sharp asked if Mr Packer was aware of these junkets at the time.

Mr Packer said he was. Ms Sharp then showed a subsequent email from Mr Ratnam that laid out the difficulty of getting money out of China due to capital controls and asked Mr Packer if this was already known to him.

Mr Packer said it was.

Another email from Mr Ratnam in November of 2016 discussed VIP market trends, including a reference to Crown being less “aggressive” in their margins going forward.

Ms Sharp asked if this was connected to the arrest of 19 Chinese crown staff a month prior, but Mr Packer said he didn’t know what exactly Mr Ratnam meant.

“I think it’s a reference to being more conservative,” he said.

“Do you think it’s a reference to taking less risk?” Ms Sharp asked.

“Yes,” Mr Packer said.

Ms Sharp has displayed an email Mr Packer sent to Mr Ratnam in 2017 - after Mr Packer had resigned as chair - enquiring about Crown’s VIP business and asked whether that demonstrated his interest in that segment of Crown.

“I had an interest in the VIP business, I had an interest in all the businesses,” Mr Packer said.

Ms Sharp then shared multiple other emails from Mr Ratnam discussing aspects of the international VIP business, including meeting with “partners” in Asia and the establishment of a “fixed-room operator” in Crown Perth.

Mr Sharp then asked Mr Packer about his knowledge of junket operator Sun City’s fixed room in Crown’s Melbourne casino, and whether he knew it operated its own cash desk in the room.

Mr Packer said he was not aware.

Ms Sharp displayed an email containing a breakdown of high value patrons and their individual turnover during a period of August of 2017, which Mr Packer said he was likely to have read when it was sent to him at the time.

Ms Sharp asked if any of the people named on the list were junket operators.

“I’m not aware of any of those names,” Mr Packer said.

Ms Sharp singled out Sun City CEO Alvin Chau’s name on the list, which Mr Packer then recognised.

12.02pm: ASX surges 0.9% on broad-based gains

Australia’s share market has risen more than twice as much as projected by overnight futures.

The S&P/ASX 200 was up 0.9pc at a 5-week high of 6097.8 amid reasonably broad-based gains just before midday.

It is on track for a fourth-consecutive daily rise after gaining 5.2pc so far this week. If sustained at the close this will be the first 4-day gain since early July.

Apart from the overnight surge on Wall Street after the US President said he will agree to more fiscal stimulus on a piecemeal basis, the local share market remains in the afterglow of the world-leading fiscal stimulus outlined in the federal budget on Tuesday.

US futures point to further gains on Wall Street with S&P 500 futures up about 0.2pc and Regeneron shares up 3.5pc in afterhours trading after The US President touted it as a “cure” for COVID-19 in a video tweet.

The heavyweight Health Care, Mining, Financials and Consumer Discretionary stocks are the biggest contributors to strength with CSL up 1.6pc, BHP up 2pc, Macquarie up 2.1pc and Westpac up 1.4pc, Cochlear up 4pc and Wesfarmers up 1pc.

Zip Co leads the index with an 8.4pc rise after partner QuadPay hired a former PayPal executive as head of global sales, while Newealth rose 6.7pc on a big jump in funds under administration.

Property trusts were on the back foot with Mirvac, Growthpoint, Vicinity and Shopping Centres down 1.8-2.4%.

Overall share trading volume in line with the 20-day moving average was reasonable considering the NSW school holidays.

Lachlan Moffet Gray 11.55am: Packer reveals China debt problems

The inquiry has resumed and counsel assisting Naomi Sharp has presented Mr Packer with an interview he gave the Australian Financial Review in July of 2013.

Contained within the article are references to Mr Packer’s plans to treble Crowns’s share of the international VIP market, which Mr Packer agreed represented his thoughts at the time.

The article also said Mr Packer believed Crown’s share would grow through taking business from established gambling hubs in south-east Asia, which Mr Packer agreed seemed in line with his thoughts at the time.

Mr Packer also used the article to mount a defence, saying it showed his earlier stated intention that international VIP would only consist of one-third of Crown Barangaroo’s business.

“Can I also say that in the second paragraph it says that Crown Barangaroo would generate half its earnings from local players...and if you add the hotel and food and beverage on to that, you get to the 2/3rds of the EBITDA,” Mr Packer said.

Ms Sharp referred evidence given by Crown executive Michael Johnston to the inquiry wherein Mr Packer approached him in 2013 with the offer to appoint him to a VIP working group dedicated to resolving issues with that segment of the business, including currency controls.

Ms Sharp asked if the currency issues mentioned were related to Chinese government currency controls designed to prevent capital leaving the business.

“It may have,” Mr Packer said.

Ms Sharp asked if some of this difficulty included recovering debts from China.

“Crown had a bad period recovering debts around that stage. I think some of them were just bad debts,” Mr Packer said.

Ms Sharp then asked whether Mr Packer used junket operators because they could help circumvent Chinese currency controls.

Mr Packer agreed - then Ms Sharp asked if he ever considered if junkets used this ability to facilitate money laundering.

“No I didn’t,” Mr Packer said.

“Did it simply never occur to you?” Ms Sharp replied.

“I can’t recall,” Mr Packer said.

“Are you sure about that?”

“I believe so, Ms Sharp.”

Lachlan Moffet Gray 11.34am: Packer hoped for double-digit Chinese growth

Ms Sharp then asked Mr Packer if it was true he desired to bring the VIP junket model to Crown’s Australian operations.

“No, I disagree with that,” Mr Packer said.

“Are you sure about that?” Ms Sharp replied.

“Yes, because the percentage profit that the junket business could be in Australia was always going to be very minimal compared to the mass side of the business,” Mr Packer said.

“I’m asking for your views in around 2012,” Ms Sharp said.

“I thought that the inbound Chinese tourism market was going to continue to grow in Australia at double-digits,” Mr Packer said.

Ms Sharp asked if Crown’s Barangaroo Sydney business model was based on the international VIP traffic.

“From memory Ms Sharp the VIP component was about third of the budget of Crown Sydney,” Mr Packer said, adding that both domestic and international VIP inflows were important to the business.

Ms Sharp has shown Mr Packer evidence that Crown Sydney would “treble the volume of VIP business coming from Asia and in particular China” and that “unlike Echo, Crown has the advantage of being able to leverage its joint venture in Macau.”

Mr Packer said those were his views and intentions around 2012-13.

Ms Sharp asked if at the time his intention was to accomplish this through Crown’s Macau junket links.

“I believe it was,” Mr Packer said.

The inquiry is examining whether Crown and its associates, including Packer, remain suitable to hold the high-roller licence at Barangaroo.now taking a short adjournment.

11.26am: iSelect fined for misleading energy comparisons

iSelect has been ordered by a Federal Court to pay $8.5m in penalties for making false or misleading representations about its electricity comparison service.

iSelect admitted that it had misled consumers between November 2016 and December 2018 by saying it’s website compared all electricity plans offered by its partners and recommended the most suitable or competitive plan, when in actual fact, its commercial arrangements with energy retailers restricted the number of plans retailers could upload to the iSelect systems.

Therefore the recommended plans were not necessarily the most suitable or competitive, Australia’s competition watchdog said.

“iSelect was not upfront with consumers that it wasn’t comparing all plans offered by its partner retailers. In fact, about 38 per cent of people who compared electricity plans with iSelect at that time may have found a cheaper plan if they had shopped around or used the government’s comparison site Energy Made Easy,” ACCC Chair Rod Sims said.

“iSelect received commissions from the retailers when those consumers selected a plan via the iSelect website or call centre.”

Lachlan Moffet Gray: 11.09am: VIP business was shrinking: Packer

The casino inquiry has pivoted to Mr Packer’s dealings with former joint venture partner Melco in Macau.

“When you were negotiating this joining venture, it’s right that you travelled to Macau on at least six occasions?” Ms she asked.

“I can’t recall Ms Sharp, but that could be correct,” Mr Packer said.

Ms Sharp then showed Mr Packer an interview transcript that proved Mr Packer travelled to Macau on at least six occasions.

“At least six occasions, and with other executives,” Mr Packer said.

Ms Sharp asked if the purpose of the trips were for Mr Packer to undertake his own due diligence and form and understanding of how the casino business operated in Macau.

Mr Packer agreed, and Ms Sharp asked if he gained an understanding of the importance junkets played to the industry.

Mr Packer said that he did, but said he also formed a view that the VIP gambling business was diminishing in importance.

“So in that sense both Lawrence (Ho) and I believed that the VIP business was going to become proportionally a smaller share of the casino business over time,” he said.

Ms Sharp has continued to ask questions about the business model and relationships between junket operators and casinos in Macau.

She asked if Mr Packer understood it was for junket operators’ role to enforce debts against VIP customers, which he said he did.

Ms Sharp then asked if that meant an advantage of dealing with junkets is that it transferred the credit risk away from casinos.

Mr Packer said that it was.

Ms Sharp then asked Mr Packer about Melco-Crown’s Altira casino in Macau and whether there was a focus on drawing VIP gamers from mainland China.

“I can’t recall if that was a particular strategy,” Mr Packer said.

Ms Sharp then displayed an interview where Mr Packer discussed a deal Melco-Crown did with a junket called Amax to bring patrons into the Altira casino.

“That company had a relationship with another company called Amax, correct?” Ms Sharp asked.

“I can’t recall,” Mr Packer said.

Ms Sharp then said that Consolidated Press Holdings had a shareholding in Amax at the time, but Mr Packer could not remember if that was the case.

Mr Sharp then asked Mr Packer if he knew that a man behind this junket operator was a

“Ng Man-sun.”

Mr Packer said he couldn’t recall.

Bringing Mr Packer to a Crown Resorts annual report from 2008, Counsel assisting Naomi Sharp highlighted a paragraph that discussed the Altira casino’s relationship with junkets, and how it benefits Crown through insulating the company from credit risk.

Pointing to a 2012 interview Mr Packer conducted with the NSW government, Ms Sharp then asked if Mr Packer essentially oversaw Altira’s repositioning from a mass-market casino to a “junket casino.”

Mr Packer agreed with the statement.

Is it right at that time you realised the value that junket operators could bring to the casino business?” Ms Sharp asked.

“Well, Altira was a unique casino,” Mr Packer said.

Ms Sharp then asked if the relationship between Melco-Crown and its junket operators “was a one off partnership”.

Mr Packer said he did not know if partnership was the right term, but said, “they were certainly working together and seeking mutual benefit”.

Ms Sharp then showed Mr Packer a line from the 2012 interview where he described the relationship as a “partnership”.

After a lengthy pause, Mr Packer said “I use the word partnership in there along with other words”, but said at the time, he thought the word fairly applied to the situation.

11.03am: Gold price to remin choppy: Macq

The recently choppy pattern in the gold price is likely to persist into the US November presidential election, according to Macquarie analysts.

“Gold suffered a sharp correction after President Trump’s announcement that

negotiations on a fifth US fiscal package had failed, underlining why we

currently expect gold to behave as a “risk” rather than “defensive” asset,” analysts in Macquarie’s Gold Commodity Desk strategy team said.

Among the ASX-listed players, Macquarie favoured Silver Lake Resource for its organic growth, Westgold Resources for its operational leverage and Bellevue Gold for its exploration potential.

Lachlan Moffet Gray 10.49am: Crown’s wrong rebuttal to expose ‘reflects poorly’

Counsel assisting Naomi Sharp has shown James Packer an email from August 1 2019, the date of the publication of Crown’s open letter rebuttal to media reports in newspapers, and asked if it contained him asking Crown executive John Alexander about news regarding the advertisement.

The questions related to Crown’s response to a Nine-Fairfax expose on the gaming giant’s junket operations.

Mr Packer said it would have been one of the things he was asking about.

Ms Sharp then showed him the public letter that was published and asked if it was “in the most strident of language.”

Mr Packer agreed that it was “strong” in its language.

“Do you accept now that parts of this release are wrong?” Ms Sharp asked.

“Yes,” Mr Packer responded.

Ms Sharp asked if the publication reflected upon the judgement of the Crown Board - to which Mr Packer’s counsel Noel Hutley objected.

Rephrasing the question, Mr Sharp asked it again.

“No I don’t,” Mr Packer said.

“I think it reflects upon the information the directors were given.”

Ms Sharp asked if directors were generally responsible for documents that go out in their name.

“I’m not a lawyer Ms Sharp, but I presume though,” Mr Packer said.

Ms Sharp has asked Mr Packer again whether he thought an open letter published by the Crown board responding to media reports regarding Crown’s junket operations was incorrect.

“Yes, with the benefit of hindsight I do Ms Sharp,” Ms Sharp.

Ms Sharp then drew Mr Packer’s attention to a line that claims Crown no longer deals with all but one of the junket operators named by the media.

Ms Sharp asked if a reasonable person would infer from the letter that Crown claims it does not partner with junkets.

“No Ms Sharp,” Mr Packer said.

Commissioner Patricia Bergin has interjected to ask Mr Packer if he believes the letter asserts that the junket operators are “independent” of Crown.

“Yes I do,” Mr Packer said.

Ms Sharp then asked Mr Packer if he understood “at all relevant times” that Crown did partner with junkets, to which Mr Packer agreed.

Ms Sharp then read from the open letter: “Crown itself has a robust process for vetting junket operators” and said it was incorrect.

“With the benefit of hindsight, I agree with you, Ms Sharp,” Mr Packer said.

Ms Sharp then asked Mr Packer if by publishing an open letter containing many accuracies, did it reflect on the judgement of Crown Board members.

“Not at the time if the directors had been given incorrect information...with the benefit of hindsight, I accept it reflects poorly,” Mr Packer said.

Ms Sharp then progressed to ask Mr Packer about an interview conducted with him while he was executive chairman of Crown in 2012.

Ms Sharp read out Mr Packer’s answer to a question within that interview about his responsibilities as chairman.

“To monitor the strategy, the management, the capital employment and the operating results” is what Mr Packer said at the time, and Mr Packer said he still agreed with the statement.

10.36am: Budget positve for banks: Bell Potter

Bell Potter’s TS Lim has upgraded CBA to buy, saying there was plenty in the federal budget that would benefit the banking sector, despite an economic contraction, elevated unemployment and spiralling net debt.

One flow on benefit for the banks was support for business - including wage subsidies and small business tax concessions - that Mr Lim said would indirectly

benefit banks that lend in the SME/mid-market and smaller corporate space.

Mr Lim also said in a note to clients that support for consumers in the form of lower taxes would indirectly benefit banks engaged in mortgage

and other consumer lending.

He also noted a lack of a threat to Australia’s AAA sovereign rating from the budget.

“Given the major’s ratings are dependent on this sovereign rating, wholesale funding costs should be stable for now,” he said.

Mr Lim upgraded his recommendation on CBA to buy and increased his target price on Westpac after lowering its cost of equity by 50bp to 10.5 per cent.

Westpac was last up 1.2 per cent at $18.08 and CBA last up 0.1 per cent at $67.62.

10.23am: ASX surges at open after US gains

Australia’s share market jumped to a fresh five-week high in early trading after strong gains on Wall Street.

The SP/ASX 200 index rose 0.8pc to 6086.8 points, its highest level since September 4th.

Gains were broad-based with all sectors except Real Estate in the green.

Technology was strongest with Zip Co up 4pc after its partner QuadPay hired PayPal’s former head of sales.

Netwealth rose 4.3pc after reporting a strong inflow of funds under administration.

The biggest contributors to strength are BHP, CSL, ANZ, Westpac and Macquarie, with gais of 1-2pc.

Lachlan Moffet Gray 10.16am: Packer quizzed on junket expose

Counsel assisting Naomi Sharp is fronting the casino inquiry today and has begun by asking Mr Packer about 63 questions submitted to a Crown executive by journalist Nick McKenzie in the lead up to Nine-Fairfax’s expose on Crown’s junket operations.

A bespectacled James Packer has confirmed that he was aware the questions were sent, but that he was not aware of the specific nature of the questions.

Ms Sharp displayed to Mr Packer an email he sent to Crown Australian resorts CEO Barry Falstead on the day the 60 minutes story aired in July of 2019, and asked if Mr Packer had watched the program, and whether the issues raised were of concern.

“Of course they were,” Mr Packer said.

“Because they were casting Crown in a bad light and implying improper behaviours.”

Ms Sharp then showed Mr Packer an ASX media release put out by Crown in the aftermath of the 60 minutes program and asked if Crown executive John Alexander updated him on the creation and publication of the document.

“Updated is a strong term. I wasn’t shown the contents of the media release but I was told that a media release was planned,” Mr Packer said.

Displaying an email Mr Alexander sent Mr Packer from July 29 that contained updates on the status of the media release, Ms Sharp again asked Mr Packer if he was provided updates on the board’s response to the allegations.

After a lengthy pause, Mr Packer asked for the question to be repeated.

“I’m not sure he’s updating me on the board’s response,” Mr Packer said after the question was repeated.

Ms Sharp then showed an email that showed Mr Packer receiving a draft document describing how the Crown board would investigate the allegations sent by Mr Alexander.

“Did you read the draft board paper?” Ms Sharp asked.

“I presume I did,” Mr Packer said, who also said he most likely followed up the issue with Mr Alexander.

“I can’t recall but I wouldn’t be surprised if I did.”

‘Zero’ input to Crown hitback

Counsel assisting Naomi Sharp has shown Mr Packer an email he sent to John Alexander and asked if it showed him asking about what was discussed at a Crown board meeting in the aftermath of media reports regarding Crown’s junket operations.

The emails are displayed via confidential link and unable to be viewed by the public.

Mr Packer said he wasn’t asking specifically about the board meeting in the email which contained the phrase: “Dear JA, what’s news?”

Ms Sharp then displayed another email to Mr Packer on July 31 2019 from Mr Alexander which contained a draft letter in response to the allegations raised in media reports for publication as newspaper ads.

Mr Packer agreed with Ms Sharp in saying this meant he was aware of the advertisement before it was published, as well as its contents.

Another email was displayed from the same date wherein Mr Packer asked Mr Alexander to talk on the phone.

Mr Packer said he couldn’t remember if he talked to Mr Alexander on the day, but that it was “most likely” that he did.

“Did you think it was likely you spoke about the proposed advertisement?” Ms Sharp asked.

“I can’t recall - but yes, I think it was most likely,” Mr Packer said.

Ms Sharp then asked how much input Mr Packer had into the advertisement.

“Zero,” Mr Packer responded.

Lachlan Moffet Gray 10.00am: Packer faces third day of grilling

James Packer is about to return to the virtual witness box aboard his $200m yacht for a third consecutive day of questioning by the Counsel assisting the NSW Independent liquor and gaming authority’s inquiry into Crown Resorts.

The inquiry is in essence examining whether Crown is a company that should hold a gaming licence in NSW.

It has already examined numerous controversies relating to the casino-hotel operator including the use of junkets in China and the 2017 arrest of 19 Crown staff by Chinese authorities.

The inquiry has also examined whether an abandoned deal by Mr Packer to sell half his shares in Crown to Hong Kong gaming magnate Lawrence Ho violated a deed made between Crown and the state board prohibiting any part of Crown falling into the ownership of Mr Ho’s late father, Dr Stanley Ho.

The deed of understanding underpins Crown’s licence to operate Sydney’s Barangaroo hotel and casino - something Commissioner Patricia Bergin could recommend the government revoke at the conclusion of the inquiry.

So far the inquiry heard that Mr Packer engaged in “shameful” behaviour by threatening a man later revealed to be businessman and former TPG employee Ben Gray over a failed deal to take Crown Private.

Mr Packer also said he did not give any thought to the fact that he may violate the deed of arrangement with the NSW gambling regulators through selling shares to the younger Mr Ho, saying he left it all to his legal team.

He also claimed that he had no knowledge of the risks inherent to his Chinese staff despite evidence being presented to him showing that his executive team were aware of the legal risk of promoting gambling in the country, as well as statements from the staff where they expressed fear.

Instead, Mr Packer pinned the blame on his executive team.

The inquiry also heard that Mr Packer continued to issue explicit instructions to Crown’s executive team after his resignation as chairman - Mr Packer said these were “recommendations.”

Packer still Crown’s all-pervasive prince

Bridget Carter 9.56am: Another UBS loss to Barrenjoey

DataRoom | Another member of the Australian equities sales team from UBS, Jenna Cork, has departed the Swiss bank to join Barrenjoey Capital.

Ms Cork will follow her former boss at UBS, George Kanaan, out the door, along with his other UBS team members, Chad Mikhael, David Pender, Stuart Brownrigg, Tim Aurel-Smith and James Ledgerwood.

Barrenjoey has recruited UBS’s Australian infrastructure head Jarrod Key and his team member Darren Tan, the bank’s co-head of capital markets Australia Barry Sharkey and Australian media banker Peter Nelson in the past week.

Ms Cork has worked as a UBS equity sales trader in Sydney since 2008.

The departures mark the end of an era for the trading room floor of the Swiss bank.

Mr Kanaan has worked at UBS as its Head of Australian Distribution since 2005, running equity sales and the sales trading desk, carving out a new, lucrative market in institution-to-institution block trades.

The UBS blocks desk was started in 2012, and Mr Kanaan’s team has printed deals worth well over $100bn.

Magellan Financial Group last month confirmed it was funding the new venture Barrenjoey Capital along with Barclays Capital.

The investment banking venture is headed by former top UBS Australia executive Guy Fowler.

9.55am: Transurban traffic volumes slump

Toll roads operator Transurban has updated the market on the September quarter, unveiling an average daily traffic figure down 25.2 per cent for the period.

While volumes were down overall, Transurban said that traffic continued to improve from April lows in Bisbane, Sydney, the Greater Washington Area and Montreal. Melbourne traffic continued to be heavily impacted by COVID-19 restrictions.

The company said that it continues to explore a number of opportunities across each of its markets, and had commenced a process for the potential introduction of equity partners into its Greater Washington Area assets, which would release capital into the business.

Still, chief executive Scott Charlton said in a speech released to the ASX ahead of the company’s AGM today that Transurban was well positioned for the future.

“The core long term fundamentals of our business remain unchanged, and we expect traffic to continue to grow in all of our markets over time,” he said.

“The five regions we operate in all have large populations, and despite the temporary impacts from COVID-19, they are all expected to continue to grow substantially over the medium and long term.”

Read more: Transurban reveals traffic slump, says workers keen to get back to office

9.52am: CSL signs final vaccine agreement

CSL said its flu-vaccine subsidiary, Seqirus, had finalized an agreement with the Australian government to supply 51 million doses of a coronavirus vaccine candidate being developed by the University of Queensland.

The vaccine still needs to be proven effective. A Phase 1 study is under way, and CSL said it hopes to complete recruitment for a large-scale Phase 2b/3 study by March. The agreement includes an upfront financial commitment from the government to support the development of the vaccine.

CSL previously signed an initial agreement with the government to produce the University of Queensland vaccine. It also agreed to produce about 30 million doses of an Oxford University/AstraZeneca vaccine candidate, which is designed to work through a different approach, for the Australian market.

“Given the considerable risk, effort, cost and uncertainty associated with the development of these novel vaccines, it is too early to calculate with any certainty the financial impact to the company,” CSL said in a statement.

Dow Jones Newswires

9.50am: What’s impressing analysts?

ARB cut to Underweight: JPMorgan

Aristocrat cut to Neutral: Macquarie

Altium started at Positive: Evans & Partners

Champion Iron started at Outperform: BMO

Corporate Travel raised to Outperform: RBC

Costa cut to Sell: Morningstar

Downer raised to Overweight: Morgan Stanley

Eagers Automotive cut to Sell: Morningstar

Fortescue restarted at MarketPerform: BMO

Sandfire raised to Neutral: GS

Secos Group started at Buy: Canaccord

Tyro Payments started at Neutral: GS

Wesfarmers raised to Outperform: Macquarie

Whitehaven raised to Lighten: Ord Minnett

Xero raised to Outperform: RBC

9.40am: ASX set for five-week high

Australia’s share market should hit a fresh five-week high and potentially rise more than indicated by overnight futures following a surge on Wall Street.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open up 0.3pc at 6054.5, its highest point since September 4th, but the chart favours a bigger rise, with a double-bottom pattern targeting 6220 in the short term.

Also, the 200-day moving average may turn into support after the index closed above this line for the first time since August. If so, that would be a very positive development as it would suggest that the uptrend from March may be resuming.

World-leading fiscal stimulus in Australia and expectations of even lower rates and a bond buying program from the RBA are also positive for shares.

But while the S&P 500 rose 1.7pc to a 5-week high close of 3419.45, led by cyclicals, after President Trump said he would support targeted stimulus, there is room for renewed disappointment on US fiscal stimulus in the short-term.

“With the exception of support for airlines, Democrats are opposed to a piecemeal approach to stimulus because it reduces their leverage in negotiations, in which they are trying to convince Republicans to provide more funding for state and local governments,” says NAB’s Tapas Strickland. White House economic advisor Larry Kudlow told CNBC that the chances of one-off stimulus bills passing was “probably….low probability stuff.”

House Leader Pelosi also played down the prospects for agreement, stating “it’s hard to see any clear, sane path in anything that he’s doing.”

The US market has also been encouraged by the prospect of a Democrat “cleansweep” after Joe Biden’s lead in betting odds hit a new high for the election campaign.

But it’s possible that this is as good as it gets for Biden’s chances, and a contested election which delays much-needed US stimulus still can’t be ruled out.

9.32am: ELMO buys UK’s Breathe

HR software company ELMO has acquired UK-based Breathe, a small business HR platform with more than 6,700 customers.

The sale consisted of an initial payment of £18m ($32.4m) and an earnout cash payment subject to the achievement of financial targets, which is expected to be £4m.

The acquisition gives ELMO access to the UK market, where Breathe will cross-sell additional existing ELMO HR modules into its customer base.

ELMO also plans to launch Breathe in Australia and New Zealand, which it says is a $660m market opportunity.

“The acquisition of Breathe is an important step in ELMO’s evolution as a provider of cloud-based HR solutions. Strategically, Breathe is a very compelling, fast growing business,” ELMO chief executive Danny Lessem said in a statement to the market.

“We are now able to transform the way people are managed, either in office or remotely across all market segments, improving productivity, performance and overall wellbeing of millions of workers across Australia, New Zealand and also the United Kingdom.”

The announcement came ahead of the company’s annual general meeting today.

9.24am: Trump renews relief measure calls

President Trump renewed his calls for Congress to pass individual coronavirus relief measures, including airline aid to avert widespread layoffs, after he ended negotiations with Democrats on a larger package until after the election.

With time running short before the November 3 vote, Mr. Trump and his aides shifted their focus to passing a series of bills, an approach Democrats have consistently rejected as at odds with their goal of a broad multi-trillion-dollar aid package to deal with the effects of the pandemic. Mr. Trump’s abrupt pivot cast new uncertainty over the prospects of more government relief.

“The stimulus negotiations are off,” White House chief of staff Mark Meadows told reporters. “We’re looking at the potential for stand-alone bills.”

The monthslong effort between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin to reach a broader agreement ended after Mr. Trump earlier tweeted that he had “instructed my representatives to stop negotiating until after the election.”

Hours later, the president called on Congress to approve some additional assistance for airlines, as well as funds for a small-business aid program and direct checks for many Americans.

“If I am sent a Stand Alone Bill for Stimulus Checks ($1,200), they will go out to our great people IMMEDIATELY. I am ready to sign right now,” Mr. Trump tweeted.

Mrs. Pelosi said that Democrats were opposed to passing individual bills in the absence of a broader deal, calling that a “missed opportunity” on Wednesday. “It’s hard to see any clear, sane path in anything he’s doing, “ she said on The View, when asked about Mr. Trump’s tweets. “All he has ever wanted in the negotiation was to send out a check with his name printed on it.”

Dow Jones

9.16am: Sezzle unveils third quarter sales boost

By now, pay later player Sezzle has reiterated its merchant sales guidance as it said active customers rose 178 per cent year on year for the third quarter while usage had risen for 21 straight months.

Underlying merchant sales for the period grew more-than trippled to $US228m ($318m) for the quarter.

Sezzle said its guidance of an underlying merchant sales of an annualised run rate in excess of $US1bn remained.

“We are excited to produce another record quarter of results as our product offering continues to prove its resiliency as well as its necessity during these difficult times,” chief executive Charlie Youakim said.

“Our strong performance in 3Q is reflective of an improving Sezzle consumer profile along with the continued acceleration of eCommerce in the marketplace.”

9.10am: Regeneron +3% on Trump comment

Regeneron Pharmaceutical shares jumped 3% to $6.09 in afterhours trading after US President Trump said its antibody theraputic was a “cure” for COVID-19.

“I think this was the key. It was unbelievable. I felt good immediately...we are trying to get it on an emergency basis. I’ve authorised it...It just made me better. I call that a cure...”, Mr Trump said in a tweet.

9.00am: Ampol mulls closing Lytton refinery

Fuels retailer Ampol says its weighing up the closure of its Lytton refinery as the facility had booked a earnings before interest and tax loss of $141m for the first three quarters of the year.

The company said it would commence a comprehensive review of the Brisbane refinery and its related supply chains to determine the best operating model over the medium term, given the challenging operating conditions this year.

The review would consider options including closure and permanent transition to an import model, the continuation of existing refining operations and other alternative models of operation, including the necessary investments required to executive each option.

“Global economic conditions triggered by COVID-19 have put significant pressure on refining, as evidenced by our performance in the first half and the significant losses announced today,” said chief executive Matt Halliday.

“We must continue to deliver strong returns on capital and this review will allow us to be proactive in determining the best course of action to protect our balance sheet, improve earnings certainty and maximise shareholder value from our integrated supply chain.

“The review is also an important step to ensure the ongoing competitive cost of liquid fuel supply to our customers.”

8.47am: Southern Cross ad bookings ‘stronger’

Radio station owner Southern Cross Media has told the market it is eligible for the extended JobKeeper program, which requires revenues to be down 30 per cent on the prior period.

The company said it expects to receive $12m in wage subsidies from September 28 through to January 3.

Still, the company moved to reassure shareholders by saying that advertising bookings for the December quarter are stronger and that its balance sheet continued to strengthen. The company does not expect to be eligible for JobKeeper beyond January 3.

Southern Cross operates 98 radio stations across its Triple M and Hit networks. In August, the company said its monthly ad revenue had begun to steadily improve, following big falls in April and May.

John Durie 8.27am: ACCC probes two WA deals

The ACCC is focusing on the building materials sector in two new Western Australia-based merger investigations including the sale of Midland Bricks to BGC.

The latter deal, worth around $60 million will leave WA with just two brickmakers, BGC and Brickworks, and the ACCC typically blocks so-called three into two mergers.

The second deal combined two fibreglass roofing manufacturers Ampelite and FGW, with the latter based in WA.

The companies make polycarbonate and clear roofing products used extensively for backyard pergolas and garages where lighting is needed.

Both deals are due for decision in December .

8.07am: Citigroup fined for ‘serious ongoing deficiencies’

Federal banking regulators fined Citigroup $US400 million and ordered America’s third-largest bank to fix its risk-management systems, citing “significant ongoing deficiencies.”

In a consent order agreed to by the New York bank’s board, the Federal Reserve faulted Citigroup for falling short in “various areas of risk management and internal controls” including data management, regulatory reporting and capital planning. The Office of the Comptroller of the Currency said the fine was punishment for the bank’s “longstanding failure” to remedy problems in its risk and data systems.

The Wall Street Journal earlier reported that the Fed and the OCC were planning to reprimand Citigroup for failing to improve its risk-management systems -- an expansive set of technology and procedures designed to detect problematic transactions, risky trades and anything else that could harm the bank.

Citigroup has said it is taking steps to address regulators’ concerns, among them, a planned overhaul of its risk systems. The expected regulatory rebuke accelerated planning for Chief Executive Michael Corbat’s retirement, the Journal previously reported. Mr. Corbat felt the expensive, multiyear overhaul was best left in the hands of his successor, Jane Fraser, the Journal reported.

“We are disappointed that we have fallen short of our regulators’ expectations, and we are fully committed to thoroughly addressing the issues identified in the Consent Orders,” the bank said in a statement. “Citi has significant remediation projects underway to strengthen our controls, infrastructure and governance.”

Dow Jones Newswires

7.10am: ASX tipped to open higher after Wall St gains

Australian stocks are set to open higher after Wall Street was lifted by Donald Trump’s partial reversal of his earlier decision to end talks on a stimulus package.

At around 7am (AEDT), the SPI futures index was up 25 points, or 0.4 per cent.

On Wednesday, the S&P/ASX 200 surged 1.3 per cent to 6036.4 points, its best close in five weeks, with stocks exposed to the domestic economy outperforming after the budget.

The Australian dollar was higher at US71.35.

Brent oil was down 1.5 per cent at $US41.99.

7.05am: Wall St rebounds on Trump stimulus switch

US stocks climbed after President Trump appeared to soften his stance on a further stimulus package for American households, airlines and small businesses.

The Dow Jones Industrial Average rose 525 points, or 1.9 per cent, as of the close of trading in New York. The S&P 500 gained 1.7 per cent.

The Nasdaq Composite was up 1.9 per cent, a day after a Democratic-led House panel argued Congress should break up the largest tech companies on antitrust grounds.

President Trump’s fusillade of tweets whipsawed the market, but investors have begun to expect a Democratic victory in November, and more stimulus spending after that, said Oanda analyst Edward Moya. That belief, along with faith in the Federal Reserve, will likely help stem any selloffs, he said.

“There’s not much that’s really going to change everyone’s medium and longer-term game plan for this market,” he said.

Still, the short term can still be frenetic. Stocks fell sharply Tuesday after Mr. Trump dashed hopes for a new economic relief package before the November election: He tweeted that he had told his representatives to end negotiations with Democrats over the coronavirus-aid spending.