Trading Day: Crown under scrutiny in both Victoria, NSW, ASX lifts to 7-week high

NSW inquiry told of ‘failure of culture’ at Crown, while ASX closes up 0.5pc at 7-week high.

That's all from the Trading Day blog for Monday, October 12. Australian stocks closed up at a 7-week high, after Wall Street rose for a third straight session on Friday. The NSW Crown casino inquiry continues as Victorian authorities also look at the gaming giant, and the Diggers & Dealers forum starts in Kalgoorlie.

Cliona O’Dowd 8.36pm: Pressure on boards over climate change

One of the largest pension funds in the world has flexed its muscles with Australian corporates on climate issues, heaping pressure on the nation’s biggest mining and energy companies to take action to tackle the climate crisis.

The $US415bn ($553bn) California Public Employees’ Retirement System, or Calpers, the biggest pension fund in the US, has voted with activists to demand change at Australian majors including BHP, Rio Tinto, Woodside, Santos and AGL.

It has also taken aim at Commonwealth Bank ahead of Tuesday’s annual meeting, voting down the re-election of Rob Whitfield, the former long-serving veteran of Westpac Bank.

Mr Whitfield, who left Westpac in 2015, was the former head of that bank’s institutional banking arm during a period when Westpac failed to notify financial crimes regulator Austrac about millions of international funds transfers. Mr Whitfield was not named in any Austrac filings.

Elsewhere, Calpers has also taken aim at under-pressure Cleanaway, voting down the waste company’s remuneration report and the re-election of two board-endorsed directors amid bullying allegations levelled against chief executive Vik Bansal.

Calpers, which delivered a 4.7 per cent return for its members in the year ended June 30, is planning to step up its efforts on climate after revealing one-fifth of its public market investments are exposed to potential losses from climate change.

Glenda Korporaal 7.48pm: GS chair: We’re sick of working from home

New Goldman Sachs Australian chairman Christian Johnston is keen to get back into the office after working from his Melbourne home for much of the year.

He said he and many other business executives he speaks to in Melbourne were “well and truly over the lockdown”.

“We have been out of the office for six months,” Johnston tells The Australian from his home.

“I travel a lot in my job including spending half the week in Sydney and overseas”.

“For a while spending more time as home was good, but it slowly wears a little thin”.

“There was a honeymoon period (about working from home) but we are over that”.

His comments come as Victorian Premier Daniel Andrews suggested on Monday the state’s current lockdown strategy to combat the city’s second wave COVID-19 outbreak could be revised. Andrews said he would clarify any changes on Sunday.

Johnston said having to work from home made it harder for people to work in teams and for younger people to learn.

Paige Taylor 7.37pm: Rio ‘betrayed us’ over Juukan caves

Traditional owners of the ancient Pilbara caves destroyed by Rio Tinto have told how they wrongly believed the iron ore miner was trying to save the precious rock shelters the day before they were blown up.

The Puutu Kunti Kurrama Pinikura, known as the PKKP, thought Rio Tinto was trying to remove “blast” that had been place in blast holes at the site of the Juukan Gorge caves in an attempt to preserve those caves.

Instead, PKKP chief executive Carol Meredith said, Rio Tinto was making attempts to empty blast material from blast holes at three other nearby sites because they did not have government permissions to disturb those sites.

Paul Garvey 7.09pm: Defying Covid at Diggers and Dealers

Mining veteran Peter Cook has fought almost single-handedly to maintain the more irreverent side of Diggers & Dealers and may have delivered his finest moment on Monday night.

Cook, the executive chairman of Westgold Resources and one of the few people who can claim to have attended every single one of the 29 Diggers & Dealers, was scheduled to take to the stage in the back room at the Palace Hotel on Monday night to belt out a few AC/DC covers with his band, The Smoking Guns.

Also in the band is Castile Resources managing director (and former North Melbourne forward) Mark Hepburn, who was tasked with driving a truck full of instruments up from Perth on Sunday.

Cook is purportedly a more than handy bass player who was on the cusp of becoming a professional musician before he heard the call of mining in his younger days. From all reports he can also do a mean Jimmy Barnes impression.

Like all proper bands, The Smoking Guns have come armed with plenty of merchandise, including tour T-shirts and trucker hats.

Their performance will be the highlight of Canaccord’s cocktail party, one of a host of shindigs scheduled for around Kalgoorlie on Monday night. Both Macquarie and the newly merged Euroz-Hartleys had events lined up in pubs across town. More than a few chief executives are anxious about what Cook has in store for his presentation on Wednesday, given his tendency in previous years to use his time on stage to poke fun at some of the sector’s bigger names.

Ben Wilmot 6.18pm: Dunk Island developer floats rescue plan

Embattled fund manager Mayfair 101 is pitching a plan to turn around the fortunes of its redevelopment of the once iconic Dunk Island and Mission Beach into a $1.5.bn tourism hub.

The company said on Monday it would present a plan to the Federal Court at a hearing later this month in which it would outlay a way in which investors could recoup some of their investments.

However, pressure is mounting on the group which has been under scrutiny from the Australian Securities and Investments Commission and provisional liquidator Grant Thornton, which has taken charge of its M101 Nominees Pty Ltd entity.

The liquidators warned in the report to the court that even secured investors could suffer substantial losses and Mayfair is yet to reveal the details of its turnaround proposal.

Mayfair said in a statement that its proposal to secured noteholders would be presented in the Federal Court on October 22.

“The objective of the proposal is to give noteholders a clear pathway to the return of their capital,” Mayfair said. “A favourable outcome in Court will empower noteholders to make a decision on the future of their investment via a noteholder meeting,” Mayfair said.

The company said a “high calibre” team of restructuring and financing professionals had been assembled over recent months to ensure its noteholders and the Mission Beach and Dunk Island project were “protected from the impact of proceedings brought by the Australian Securities and Investments Commission”.

Investors in the Group’s secured debenture product, issued by M101 Nominees, are currently subject to provisional liquidation, and have their investment underpinned by the equity interest in the group’s investment in Mission Beach and Dunk Island.

But Bond family has repossessed the island resort after Mayfair could not meet its obligations and senior lender Napla has taken control of about 107 Mission Beach properties.

Mayfair said legal proceedings brought by ASIC had alleged there was no value in the security provided but said it “categorically rejects” this claim.

Mayfair claimed it had taken a “strategic approach” to acquire a “significant portfolio of complimentary real estate assets” in a region that has been dormant for nearly a decade, although the coronavirus crisis has prompted fears of an extended slowdown.

Mayfair said the way the properties had been assembled “paves the way for significant value to be created and released, and the long-awaited rejuvenation of the region”.

Mayfair said it had appointed Ashurst Lawyers to assist with coordinating a compliant, viable restructuring proposal which “it looks forward to presenting to noteholders with the Court’s consent”.

Mayfair managing director, James Mawhinney said he was “bitterly disappointed” by the significant impact the events of recent months have had on noteholders and the Mission Beach community.

The company founder last month vowed that investors in his stricken funds will recoup their losses by Christmas despite a preliminary liquidators’ report claiming the investment vehicle was in trouble from the outset.

At the time he labelled a Grant Thornton’s provisional liquidators’ report into the affairs of M101 nominees as largely unsubstantiated and said more funding was in train from a syndicate of wealthy families, which he declined to name.

Grant Thornton warned there is a low likelihood of the recovery of $44.4m which was advanced to another Mayfair company, known as Eleuthera, which served as Mayfair 101’s treasury unit.

Some $21.7m of this was used to pay a “large amount of operating expenses” of the group.

4.30pm: ASX closes at 7-week high

Australia’s S&P/ASX 200 share index finished up 29.73 points or 0.5pc at a 7-week high close of 6131.9.

The local bourse rose as S&P 500 crept up 0.3pc amid growing expectations of a Democrat cleansweep victory leading to major post-election stimulus.

US stocks will trade but the US bond market will be closed for Columbus Day, so it should be a very quiet night.

Monday’s rise made it six-days straight of gains for the S&P/ASX 200 with the index up 5.9pc in that period, the best six-day run since early June.

Link Administration surged 25pc on a 30% premium takeover bid worth $3.8bn (including debt) from PEP and Carlyle.

Bravura Solutions rose 8.9pc after acquiring Delta Financial Systems and the BNPL sector was strong with Zip Co up 5.7pc and Afterpay up 2.8pc.

Gold stocks were also solid performers with Evolution up 3.7pc and Newcrest up 1.7pc after spot gold surged 1.9pc to $US193o on Friday night.

Bapcor rose 3.2pc after reporting a 27pc rise in 1Q sales.

But the afternoon kicker came from banks with the four majors closing up 1.3-2pc on followthrough buying after Australia’s world-leading budget stimulus.

A serious test of resistance from previous tops in the 6160-6199 area is expected with a double bottom pattern targeting 6120, initial support potentially as high as 6185 and strong support from the former double bottom resistance and 200-day moving average near 6000.

Iron ore miners lagged with BHP down 0.4pc, Rio TInto down 0.9pc and Fortescue down 0.5pc.

Whitehaven Coal fell 5.7pc after Platts said China instructed steel mills and power plants to stop buying Australian coal, according to unnamed sources.

Lachlan Moffet Gray 4.15pm: Demetriou to face second day of questioning

Commissioner Patricia Bergin has examined the shareholder protocol allowing information to be provided to James Packer as a private shareholder and noted that “great care” has to be taken when doing so, pointing to a certain clause that mandates information only be disseminated for beneficial reasons.

“It looks as though the flow of information was not rigorously documented in terms of consideration that it was in the best interest...there seems to have been a free flowing of information so that Mr Packer was able to receive the information,” she said.

“This should have been your guidance when dealing with Mr Packer.”

Ms Bergin said going forward, with agreements of this type, communications must be recorded so information shared could be objectively examined, to which Mr Demetriou agreed.

“I’m not sure why it didn’t happen on this occasion, when the entities went to the extent of putting together the protocol but then having this very informal arrangement...it seems there was a great deal of trust in the directors telling Mr Packer what he wanted to know,” she said.

Shortly after this point the adjournment time was reached and Commissioner Bergin asked Mr Demetriou to return tomorrow morning to continue questioning.

Lachlan Moffet Gray 3.58pm: Packer ‘not just another shareholder’: Demetriou

Counsel assisting Scott Aspinall has moved on to asking Andrew Demetriou about a share protocol with James Packer that allowed him to receive company information ahead of other shareholders.

Mr Demetriou defended the protocol, saying it meant James Packer could more readily provide valuable advice to the company.

“I’ve always regarded Mr Packer as somewhat of a visionary,” Mr Demetriou said, defending Mr Packer as not just “another” shareholder.

“He’s a shareholder that’s had experience on the board, he’s a shareholder that’s had experience with the company,” he said.

Mr Demetriou said he was not aware that Michael Johnson requested financial modelling for Mr Packer to help determine the value of company CPH’s shares for a sale to the Lawrence Ho controlled Melco and agreed it was inappropriate.

Mr Aspinall then displayed an email some 18 months old Mr Demetriou sent to Mr Packer and his family trust outlining a board meeting and numerous financial indicators of the wellbeing of the company as well as reputational measures.

Mr Demetriou in the email also said in the meeting “I suggested we would become the most compliant, regulated business in Australia but risk becoming like the Australian cricket team,” meaning “timid,” and suggested a renewed focus on growing revenue.

Mr Demetriou explained that he simply wanted the company to be more courageous, but to be ethical at the same time - and was simply expressing concern at a lack of resources on the managerial level.

Lachlan Moffet Gray 3.24pm: Demetriou quizzed on director independence

Crown Resorts Neil Young QC was not aware of the material Andrew Demetriou had taken into the witness box and is now outlining it to Commissioner Patricia Bergin.

Included within the documents are a single page of notes, memorandum to board members and bank statements.

Mr Demetriou apologised for bringing the materials to the witness box.

“I was unaware that I wasn’t permitted to have a document, and I meant no malice by it,” he said.

Scott Aspinall has pulled up Mr Demetriou on an answer he gave just prior to having the notes discovered.

Mr Aspinall asked Mr Demetriou to explain what his conception of an independent director was when he began reading. When asked if he was reading, Mr Demetriou said:

“Well I know it. I recited it verbatim because I did so when I became a director.”

Mr Aspinall asked Mr Demetriou why he seemingly lied when he swore an oath to tell the truth, to which Mr Demetriou said:

“I’m not sure Mr Aspinall, but I acknowledged that I was reading it.”

Mr Aspinall has made Mr Demetriou recite what it means to be an independent director without use of notes, then displayed a Crown board charter in force when Mr Demetriou joined the board in 2015.

Mr Aspinall then brought up a newspaper article from May 2016 that cites three fund managers saying they do not regard Crown’s independent directors as truly independent, citing a Colonial First State report on Crown.

Mr Demetriou was named in the report and Mr Aspinall asked him why that might have occurred.

“I can’t speculate as to why they formed that view, I strongly disagree with that view,” he said, adding he had not seen the article.

“It is just an opinion and there might be fund members that think the opposite.”

Mr Aspinall asked Mr Demetriou if anyone else had suggested to him he might not be independent.

“I can’t recall anyone specifically saying that,” Mr Demtriou said.

Mr Aspinall then displayed an email sent between executives, Crown board member Antonia Korsanos, and Consolidated Press Holding executive/fellow Crown board member John Alexander from October 2017.

The email, widely forwarded to other CHP executives draws attention to the Crown board’s charter on independence, which forbids an independent director for being a “material supplier” of Crown of more than $2m per annum over the last three years.

As a previous executive of poker machine maker Aristocrat Leisure, the parties to the email chain realised Ms Korsanos cannot be made independent, but in doing so the composition of the board would fall under the recommended amount of independent directors.

Guy Jalland from CPH says he discussed the issue with “James”, being James Packer, and resolved pushing ahead with the appointment, favouring appointing another independent director down the line.

Scott Aspinall is now showing Andrew Demetriou a letter from legal firm Ashurst outlying reasons why Antonia Korsanos could not be considered an independent director given her former role at Aristocrat Leisure, with reference to ASX guidelines on board independence instead of the previously mentioned Crown board charter.

The exact content of the letter is withheld through legal privilege, but the letter does supply two constructions regarding the constriction of the ASX guidelines surrounding monetary thresholds.

Given the Crown board’s charter has a fixed $2 million p.a. threshold, Mr Aspinall asked Mr Demetriou which interpretation he favoured - Mr Demetriou agreed he supported the Crown board charter.

A subsequent board meeting in November of 2017 discusses these interpretations, and says an ultimate decision will be reached when a 2018 board charter is adopted.

A same day announcement to the stock exchange notes the appointment of Ms Korsanos but does not reference whether she is independent or not.

“Do you agree under the existing board charter that stood at this time, she was not an independent? “Mr Aspinall asked.

“According to the board charter, that is correct,” Mr Demetriou answered.

A note the following February from company secretary and general secretary Mary Manos to the board proposes removing the threshold as it is “Illustrative only and should not be a determinative factor,” instead replacing it with “qualitative” standards.

Minutes from a board meeting on February 21 2018 was displayed showing the board agreeing to remove the $2m threshold from the charter.

The revised board charter for 2018 was then displayed, showing the threshold of material interest was now “based on the nature, circumstances, activities of the director.”

“The reason it was changed, fairly clearly, is so Ms Korsanos can be made an independent director, don’t you agree?” Mr Aspinall asked.

“I think the reason it was changed - that was one reason - but also Ms Korsonos’s appointment and the process she went through highlighted we had a more stringent test than the guidelines...and maybe we should revisit our charter,” Mr Demetriou said.

Mr Aspinall then showed Mr Demetriou a section of the NSW Casino control act that classifies the supply of NSW gaming machines as “control contracts,” meaning they must be brought to the attention of the regulator when they are signed.

Mr Aspinall asked Mr Demetriou if he thought this raised issues with placing Ms Korsanos in an independent director’s role, as she was CFO of Aristocrat Leisure, who supply Crown with poker machines.

Mr Demetriou said it could be reasonably perceived as a conflict.

Commissioner Patricia Bergin asked if the reason for changing the company charter was to restore the number of independent directors on the board to a majority.

“One was a majority of independence yes,” Mr Demetriou said, adding that replacing Ben Brazil’s skill set after he departed and enhancing gender equality were other considerations.

Mr Aspinall then noted a lack of clear notification of this board charter change to shareholders and asked whether it was concealed.

“I don’t accept it was concealed. I regard it more of an oversight,” Mr Demetriou said.

“I can’t give you a reasonable explanation Mr Aspinall, other than it was an oversight.”

Mr Aspinall is now asking Mr Demetriou about the service agreement with Consolidated Press Holdings, Crown’s largest shareholder also owned by James Packer, which loans out CPH executives to Crown.

On Friday Harold Mitchell said he expected the agreement would be reviewed and potentially phased out.

Mr Demetriou said he supported it in principle, but:

“My view is that it should be reviewed and I believe it will be.”

2.43pm: Volkswagen Financial to remediate customers

Car financier Volkswagen Financial Services has agreed to remediate customers $4.1m and pay $600,000 in interest rate reductions on current contracts, after settling a claim brought against it by the Australian Securities and Investments Commission.

In a court enforceable undertaking, Volkswagen Financial Services agreed to take reasonable steps to remove default listings from credit bureau files.

It also included an acknowledgement of ASIC’s concerns in respect to Volkswagen Financial’s lending practices over the period 1 July 2012 to 30 April 2017.

ASIC has dropped its civil proceedings against the company.

2.15pm: China ban on Australian coal imports: report

Utilities and steel mills in China were verbally told to stop importing thermal and coking coal from Australia on October 9, according to a report by commodities information provider S&P Global Platts on Friday.

According to the report, state-owned Huaneng Power International, Datang International Power Generation Company, Huadian Power International and Zhejiang Electric Power were heard to have received the verbal notice from China’s customs. There was no clear timeline for the ban, Platts said.

“This isn’t the first time this year that Australian coal imports have been targeted by Chinese policymakers,” said Commonwealth Bank mining and commodities research director Vivek Dhar.

“Five state‑owned utilities were reportedly instructed by China’s National and Development Reform Commission on May 18 to not buy Australian thermal coal “for the time being” in order to boost local thermal coal prices.”

Mr Dhar said China’s coal imports from Australia were likely to be targeted more than other countries due “souring diplomatic ties” between China and Australia, following calls for an investigation into the COVID-19 outbreak.

“China’s overall coal import restrictions have been a persistent theme this year, as well as through the back half of 2019, as authorities look to boost self‑sufficiency and provide support for China’s coal sector,” Mr Dhar said.

“Given the unofficial nature China’s coal import restrictions, there is a great deal of uncertainty on how China’s coal import restrictions, and these latest restrictions on Australia, will play out.”

Whitehaven Coal last down 5.6 per cent at 99c and Yancoal last up 0.3 per cent at $1.99.

Glenda Korporaal 2.01pm: Bad news ‘didn’t go to Crown board’

Crown Resorts had a “failure of culture” which meant that some bad news about potential money laundering and concerns about staff in China was not elevated to board level, Crown director and former AFL chief executive Andrew Demetriou has told an inquiry in NSW on Monday.

Mr Demetriou, who joined the Crown board in 2015 after stepping down as chief executive of the AFL in 2014, told the inquiry into the suitability of Crown to hold a casino licence in NSW, that he was “shocked” at the news of the arrest of 19 staff in China in October 2016 having little knowledge at the time of whether Crown actually had staff in China.

In testy few hours of evidence before the inquiry, Mr Demetriou constantly rejected suggestions by counsel assisting Mr Scott Aspinall, that Crown turned a blind eye to money laundering.

He said Crown had been taking action to review its procedures on money laundering and was currently recruiting an executive who would oversee the process and report directly to the board.

But he admitted that he had not personally reviewed the detail of two bank accounts, called Riverbank and Southbank, despite media allegations last year that they had been used for money laundering and concerns expressed about the accounts by the banks involved.

He also said he was not aware of the name of one of the major junket operators which brought customers to Crown’s Australian operations despite his role as chairman of Crown Melbourne.

Mr Demetriou said Crown has consistently improved its controls around money laundering and its dealings with junket operators, an area where the inquiry has been focussing on.

“We constantly review what we do,” he said.

“We are an infinitely better business today than we were yesterday, and than we were a years ago and then we were three years ago,” he said.

But his comments about the lack of information going to the Crown board over key issues led to some sharp questioning by Mr Aspinall on whether directors should have actively asked more questions about the situation in China and on potential areas of money laundering.

Read more: Andrew Demetriou concedes Crown’s culture failed

Lachlan Moffet Gray 12.50pm: Demetriou defends Crown’s values

Commissioner Patricia Bergin has told Mr Demetriou that Crown should have been “acutely across” China’s announcement that they were to crack down on foreign gambling promoters

“These are the sorts of things when organisations take the benefit from overseas jurisdictions, they need to understand the dangers,” she said.

Mr Demetriou agreed and there was a short adjournment.

On the other side of the adjournment counsel assisting Mr Aspinall asked Mr Demetriou whether Crown should deal with junket Suncity head Alvin Chau, who has alleged links to organised crime.

Mr Demetriou agreed without argument that “on the balance” Crown “probably” shouldn’t be dealing with Chau.

Mr Demetriou has continued to defend the core values of Crown while admitting to some deficiencies in culture.

“The area of information flow that went to the approval of junket operators and the defects of the AML process, that information should have been forthcoming,” he said.

“We don’t expect that everything that’s been allegedly exposed or been criticised has been correct.

“I don’t accept that we knowingly broke the law in China, I don’t accept we were partnering with Junket operators, I don’t accept we were circumventing Visa regulations.”

Mr Aspinall asked if Crown was doing anything to address the culture of compliance. Mr Demetriou outlined numerous efforts the Crown are undertaking, such as appointing a head of compliance and crime and sub-heads in each state.

“I said it takes time to shift the culture in an organisation and we need to shift aspects of what we do, and we’ve begun that process,” Mr Demetriou said, but he did give a time frame for fixing the problem. A review into the culture of Crown is soon to commence.

“We haven’t sat on our hands and knees, we have addressed those issues and will address them,” Mr Demetriou said.

Mr Aspinall then showed Mr Demetriou a document from October of 2019, after this inquiry was announced, that showed Crown settling with Zhou Qiyun, a junket operator with alleged links to money laundering who had been detained in 2012 - but not jailed, by the Chinese authorities.

Mr Aspinall asked how it could be that such problems were still arising with Crown.

“As I said earlier, junket operators have been suspended,” Mr Demetriou said.

“I’m not privy to why we are settling with Mr Qiyun in October in 2019 other than the people charged with discharging duties with Mr Qiyun saw no reason not to deal with Mr Qiyun.”

Mr Demetriou continued to insist that as Mr Qiyun practices in other jurisdictions, there could be an allowance for him to continue to operate with Crown, but denied specifically not knowing much about Crown’s business with him.

Ms Bergin put it to Mr Demetriou that the existence of these dealings meant Crown had contemporary issues.

“I accept there are issues that are contemporary, and that issues from time to time will continue to crop up,” he said.

She also asked whether it made sense not to judge junket operators on their ability to operate in other jurisdictions, but should lead the way in best practice.

“I would concur with that view, Madame Commissioner...I think we should be the best of the very best, yes,” he said.

Mr Aspinall asked Mr Demetriou if he was concerned that he was not aware that Mr Qiyun was among the top five largest junket operators Crown dealt with.

“No it doesn’t concern me, I take my role as a director very seriously and I don’t expect to know every intricate detail of every single client we deal with,” Mr Demetriou said.

Mr Aspinall asked whether Mr Demetriou should take more specific interest in individual operators given as chair of the Melbourne license, he has responsibility for protecting the licence’s viability.

“Not particularly,” Mr Demetriou said, saying his knowledge of how junkets operate at large is sufficient.

Money laundering questions

Counsel assisting Scott Aspinall proceeded to ask Mr Demetriou about the bank accounts of Southbank and Riverbank, two subsidiary companies of Crown that were linked to money laundering activity in media reports last year.

Mr Demetriou said he had not looked at the accounts, despite being aware of the issues raised in media reports, but has received updates from management on them subsequently.

Mr Aspinall displayed transaction data from the accounts showing strings of cash deposits at multiple locations of the Commonwealth Bank across Sydney under the mandatory $10,000 reporting limit where the transaction must be flagged with the financial crimes regulator.

“They should have been picked up, Mr Aspinall,” Mr Demetriou said.

Commissioner Patricia Bergin said a publicly traded company should not have to have these issues drawn out by an inquiry, to which Mr Demetriou agreed.

Mr Demetriou was also not aware of the fact that concerns were raised by banks about the company’s accounts until the inquiry and was not aware presently that Crown was attempting to open new accounts under the companies’ names as late as last year.

Neither of these factors were reported to the risk management committee.

Mr Demetriou said he was also not aware that current CEO Ken Barton was involved in opening accounts from 2014 to 2019, and would not say if Mr Barton’s persistence in doing this was indicative of a cultural failure.

“I don’t know, is the short answer Mr Aspinall, because I don’t know the specifics about what you are referring to,” he said.

“But if the banks were raising issues, in one aspect that’s a good thing, because it’s raising issues we weren’t aware of.”

Commissioner Patricia Bergin said it should have been straightward for Crown to review its operations at a high level once the banks raised concerns, and expressed alarm that problems with the accounts persisted even after the inquiry was announced.

The accounts referred to in question have since been closed.

Mr Aspinall asked whether Crown was turning a blind eye to money laundering risks.

“I don’t accept at all that Crown’s ever turned a blind eye to anything,” Mr Demetriou said, saying that management reports indicate that just 0.3 per cent of transactions related to the account are problematic.

Commissioner Patricia Bergin has asked why Crown closed the accounts linked to Riverbank and Southbank investments pty ltd.

Mr Demetriou said the accounts were closed because there “Appears to be a process of aggregation, a structuring, that we should not be party to.”

Money laundering ‘blind eye’ denied

Ms Bergin asked whether that meant there were concerns that the accounts could have been used for money laundering, which Mr Demetriou agreed to.

But he refused to accept that Crown turned a “blind eye” to money laundering, even after Mr Aspinall informed him that in the deposit transaction fields, descriptions such as “Purchase of a house” were entered.

Mr Demetriou claimed not to have known about this.

Mr Aspinall turned to a letter signed by the entire Crown board in response to allegations raised by a 60 minutes programme last year that asserts Crown believed it was not breaking the law in China, despite having legal advice that could point to the contrary.

Mr Demetriou said at the time, that was his understanding of the situation, but he did not ask to see any of the legal advice.

Mr Aspinall then asked Mr Demetriou about the depth of his knowledge of the regulatory burdens on Junkets in Macau and in Australia.

Mr Demetriou named the Queensland government and the Victorian Commission for Gambling and Liquor Regulation as Australian regulators of junkets but could not name a specific overseas one.

The letter describe Crown’s junket-checking process as “robust” and Mr Aspinall asked Mr Demetriou if he would still describe it that way.

“I accept now that it had some deficiencies,” Mr Demetriou said, saying he would remove the word robust if he were to sign the letter again today.

The inquiry adjourned for lunch.

Bridget Carter 12.25pm: Link ‘undervalued by bid’

One of Link Administration Holdings’ major shareholders, Yarra Capital Management, believes a $3.8 billion takeover bid by Pacific Equity Partners and The Carlyle Group for the company leaves it undervalued.

More to come

Bridget Carter 12.11pm: HomeCo eyes $300m from spin off

The listed shopping centre company HomeCo is planning to raise about $300m from the initial public offering of its Daily Needs REIT.

The new spin-off will list on November 23 with a market value of about $850m.

It will have a debt level of 27 per cent and a dividend yield of 5.5 per cent.

More to come.

Bridget Carter 12.05pm: Hipages prices IPO

On-demand tradie platform Hipages has set the price range for its initial public offering, at $2.05 to $2.45 per share.

The range implies a value of between 4.3 times and 5.3 times its revenue.

The size of the company’s IPO will be between $89.1m and $100.4m, with $40m in primary proceeds and $49.1m to $60.1m in secondary proceeds.

The company’s market value will be between $266.5m and $318.5m.

News Corp, which owns 30.1 per cent of the company, will own 25.4 per cent once it is listed, while chief executive and co-founder Robert Sharon-Zipser will reduce his stake from 10.3 per cent to 6.5 per cent.

The company is listing through Goldman Sachs and its management roadshow starts Monday.

The bookbuild will be held on October 22 and the prospectus will be lodged on October 23, with shares to trade on a normal basis.

12.01pm: Link shares up as stocks stay flat

Australia’s share market was flat in quiet trading amid the Columbus Day long weekend in the US.

A private equity takeover bid for Link Administration and gains in gold miners, tech stocks were offset by falls in most sectors.

The S&P/ASX 200 index was up 0.1pc at 6106 after drifting in a tight range of 6094-6112.

Link shares rose 25pc after PEP and Carlyle launched a 30pc premium bid valued at $3.8bn.

Gold miners rose strongly with Evolution up 3.6pc and Newcrest up 2.3pc after spot gold rose 1.9pc to $US1930 on Friday.

Buy-now-pay-later stocks were also strong with Zip Co up 4.9pc and Afterpay up 2pc.

ANZ rose 0.6pc after JPMorgan upgraded to Overweight, while other banks rose slightly.

Energy stocks and iron ore miners were the main drags with Santos down 1.6pc and BHP down 0.7pc.

Bridget Carter 11.53am: Nuix prepares for IPO

Software company Nuix is expected to brief analysts this week for its initial public offering.

The analyst research meetings for the company are set to take place with investors in the first week of November.

The management roadshow will occur in the following week before the company lists in the first week of December.

More to come

Lachlan Moffet Gray 11.39am: ‘A failure of culture’

Counsel assisting Scott Aspinall has returned to an email that has been displayed many times throughout the inquiry, an email sent from a Crown employee to his superiors Michael Chen and Roland Theiler where the employee discusses the need to deposit a cheque from a figure with connections to the “underground network,” at threat of potential violence.

Neither Mr Chen or Theiler express concern over the client or the employee feeling unsafe.

Mr Aspinall asked if it was ever raised with the risk management committee, to which Mr Demetriou said it was not.

Mr Aspinall asked if perhaps the risk management committee was not being inquisitive enough in relation to potential risks.

“I don’t accept that Mr Aspinall,” said Mr Demetriou, who was not on the risk committee at the time.

“I do reject that because we had a risk framework in place, it just had deficiencies.”

Mr Aspinall asked what good a framework was if such a risk could be omitted.

“I don’t accept your proposition that it doesn’t get out and find out what’s happening...you can only deal with what’s before you,” Mr Demetriou said, saying the lines of communication were not sufficient.

“I think we can over analyse these things from time to time,” he said.

“The risk committee that I set on does a lot of perpetration and a lot of work...to understand our risk framework and the practices we have in place to mitigate risks.”

Mr Aspinall pointed out that issues raised in the inquiry never made it to the inquiry, and suggested the risk management process was never “activate”

“To say that there was no risk framework in place and was never activated is unfair. We had a risk management process in place,” Mr Demetriou said.

“It speaks more to a failure of culture.”

“So that’s more serious,” Commissioner Bergin quipped.

“In this situation, it is,” Mr Demetriou agreed.

11.37am: Early super withdrawals reach $34bn

At least $34.1bn has been pulled out Australia’s superannuation funds as part of the government’s COVID-19 early release scheme.

In the week to October 4, 31,000 applications were received by funds and $241m put out to members, according to the latest figures released by APRA. About 19,000 of those were initial applications and 12,000 were repeat applications.

About 4.4 million Australians have now dipped into their super fund for extra cash since the inception of the scheme.

Lachlan Moffet Gray 11.28am: Demetriou admits Crown ‘failures’

Andrew Demetriou is asked at the NSW casino inquiry if he remembers former board member Ben Brazil metaphorically “banging the table” after the China arrests in an effort to establish culpability.

Unlike Harold Mitchell, who did not recall such an event, Mr Demetriou said he did but denied Mr Brazil’s assertion that there was any “pushback” to the idea.

“I don’t recall pushback I think - I certainly remember Mr Brazil being very forceful in his views about the arrest and I certainly remember every board member expressing concern about the arrests and for the wellbeing of our staff...But I don’t remember any pushback,” he said.

Mr Demetriou said he did not consider the board failed in its duties at the time but agreed with Mr Aspinall’s summation of the issue as a “failure of management to escalate problems to the risk management committee.”

He also agreed that Crown had deficiencies in its anti money laundering regime and its dealing with junkets - firms set up to get high-rollers into casinos.

Moving on to junkets, Mr Aspinall moved on to ask Mr Demetriou if he knew the names of any junkets prior to the inquiry.

“Only the Suncity junket,” Mr Demetriou said.

“I knew there were other junkets but I only knew Suncity.”

Mr Aspinall has displayed an internal Crown document that details a junket operator Crown dealt with and his links to money laundering activity, asking whether Crown should deal with such an identity.

“On balance probably not, but I mean there’s a lot of allegations in there and it doesn’t say he has been convicted or jailed,” Mr Aspinall said.

On balance, it’s probably preferable not to be dealing with someone who has so many allegations against them.”

Mr Aspinall added that other factors had to be looked at, such as the person’s ability to operate in other jurisdictions and said the board would weigh up such factors leading up to its decision next June whether to continue dealing with junket operators.

“It’s not clear cut because if it were clear cut he wouldn’t be operating in any other jurisdiction,” Mr Demetriou said.

“I may also be asked the question why they are being approved entry into the country if they have any convictions against them.”

11.22am: Evans Dixon to rebrand

Under-pressure wealth management group Evans Dixon Ltd., is planning to change its name – subject to shareholder approval to E&P Financial Group.

“The Board believes that the change will align the Group’s trading brands and increase market awareness of the Group’s collective offering,” Evans Dixon said in a statement.

The move follows the “exit” of co-founder Alan Dixon amid steep investor losses for its US property fund business.

The planned move will see Evans Dixon also change its ASX code to EP1 (from ED1).

10.58am: Demetriou ‘shocked’ by China arrests

Counsel assisting Scott Aspinall has moved on to asking current board member Andrew Demetriou about his knowledge of Crown’s operations in China around the time of the arrest of a number of them in 2016 for promoting gambling to Chinese nationals.

Mr Demetriou, like fellow board member Harold Mitchell, said he had no specific knowledge about staff in mainland China at the time.

He did however know there were staff in Hong Kong. He agreed with Mr Aspinall’s classification that he “may or may not” have known about staff in China, but he would have thought they were doing nothing but processing visas.

After the arrest, Mr Demetriou said he was “shocked” and a board meeting was quickly conveyed.

But unlike Mr Packer and Mr Mitchell, Andrew Demetriou said he was aware of a similar crackdown on foreign gambling promoters in Korea prior to the arrest of the staff in China as he remembers discussing the issue with Michael Johnston ahead of a board meeting.

However, the potential impact of such a move on Crown was not discussed.

“It wasn’t because I didn’t think it was an important issue - I’m sure there were a number of particular things going on at that point of time,” he said.

Mr Demetriou said Mr Packer was not present at the time of the discussion.

Despite being aware of the Korean issue, Mr Demetriou said he was not aware of the Chinese government announcing their intention to crack down on foreign gambling promoters.

Mr Demetriou also said he wasn’t aware that prior to the arrest of staff in China one was called into questioning by police in Wuhan until recently.

“I’ve only been made aware of it through this inquiry,” he said.

10.53am: New ASX website hits problems

ASX’s new website has suffered a glitch in its first official day, with company announcements not displaying on the site.

ASX confirmed the disruption over Twitter. “All company announcements are available to view via brokers and news agencies,” ASX says.

According to the ASX’s website the most recent announcement was published at 9.01am. According to Bloomberg, there have been nearly 180 announcements released since then. ASX last traded at $81.81, down 47c.

Lachlan Moffet Gray 10.51am: No experience, no training: Demetriou

Crown director Andrew Demetriou says he had no prior experience in the gaming industry and no specific knowledge of gambling regulations in the jurisdictions Crown operated in when he joine dits board.

Nor did he receive any formal training on the subject of gaming regulation or anti money laundering (AML) when he joined in 2015, he told Counsel assisting Scott Aspinall.

“Not formal training Mr Aspinall, other than papers that had been presented to the board from time to time,” he said. “No, I never had any training in anti money laundering, no.”

However, like his colleague Harold Mitchell, Mr Demetriou said he recently conducted an AML course recently required of board members and learnt about the issue through his position on the risk committee.

Commissioner Patricia Begin also inquired as to whether Mr Demetriou was made to learn about the agreement Crown had with the NSW government underpinning the Barangaroo casino’s licence.

“I understood at the time and still do that the license requires we have tables and not gaming machines,” he replied.

Ms Bergin then asked whether he had any knowledge of the specific conditions of the agreement, which includes a clause preventing ownership of Crown falling into the hands of deceased gaming mogul Stanley Ho.

“Not specifically Madame Commissioner,” Mr Demetriou said.

“Only in the very, very broad sense.”

Mr Aspinall returned to the lack of training at induction and asked Mr Demetriou if he thought AML and regulation training for new board members was a good idea.

“It could only be helpful Mr Aspinall,” Mr Demetriou said.

Mr Aspinall asked Mr Demetriou about his role as chair of Crown Melbourne, licenses to Crown’s Melbourne operations.

Querying the length of time dedicated to Crown Melbourne board meetings of a few hours a month, Mr Aspinall suggested that the regulatory compliance work of the board was undertaken by the company’s board at large.

“I don’t accept that Mr Aspinall,” Mr Demetriou replied.

As Crown Melbourne oversees the businesses’s international VIP operations, Mr Aspinall asked Mr Demetriou if he ever received formal training on the matter.

“Not formal training Mr Aspinall, only from what I have read from board papers and the like,” he said.

Mr Aspinall then asked Mr Demetriou if he had any understanding of what a junket was when he joined the board.

“Um, not really - I just thought a junket was something I used to get accused of when I went travelling with the AFL, but I quickly familiarised myself with the definition of junket at Crown Resorts,” Mr Demetriou replied.

Mr Aspinall proceeded to ask Mr Demetriou about how risks should be mitigated when dealing with junkets in the future.

Mr Aspinall said there should be firmer communication between the risk compliance committee and the board, and maintained an insistence that the board should have the ultimate say.

10.20am: ASX in mainly flat start

Australia’s share market has been flat in mixed trading so far Monday.

It was last down 0.1pc at 6096.

Gains in the Tech and Materials sectors have offset falls in other sectors, with Energy weakest.

Bravura is up 4.9pc after an acquisition, Bapcor is up 3.9pc after its 1Q sales rose 27pc, Zip Co is up 3.7pc, Evolution rose 3.4pc after spot gold rose 1.9pc and Fortescue rose 1.5pc after extending its buyback.

But banks are taking a breather after strong gains last week with the four majors down 0.3-1pc despite JP Morgan’s upgrade to an Overweight rating on ANZ.

Lachlan Moffet Gray 10.14am: Demetriou grilled at Crown inquiry

Counsel assisting Scott Aspinall questioned current Crown board member and former AFL boss Andrew Demetriou at today’s hearing of the NSW inquiry into Crown’s suitability to hold a casino licence.

The inquiry is now underway, and coincides with the Victorian Commission for Gambling and Liquor regulation issuing Crown with a show cause relating to its use of international gambling promoters called “junkets.”

A show cause notice requires Crown to demonstrate why the commission should not take action in regard to laws governing the Internal Control Statement for junket operations, which regulate the gambling promoters.

Last week the Victorian gambling regulator revealed it was watching the NSW inquiry with interest.

Mr Aspinall has begun questioning Mr Demetriou along the same lines as he did other Crown board members, asking how he came to be on the board.

“I met Mr Packer’s father Kerry Packer in my role of Chief executive officer of the AFL when we began broadcast negotiations with PBL,” Mr Demetriou answered before explaining that after Kerry Packer’s death he started negotiating with James Packer.

“About 2012 I was approached by Mr Packer to see if I was interested in joining the crown board...when I finished at the AFL in around of june of 2014, he approached me again to see if I would be interested in joining the crown board,” he said.

Mr Demetriou then joined the board in January of 2015. Throughout the inquiry, we have heard that many other board members joined on James Packer’s request.

Also like other board members, Mr Demetriou informed Mr Aspinall that he had no prior experience in the gaming industry and no specific knowledge of gambling regulations in the jurisdictions Crown operated in.

Nor did he receive any formal training on the subject of gaming regulation or anti money laundering (AML) when he joined in 2015.

“Not formal training Mr Aspinall, other than papers that had been presented to the board from time to time,” he said.

“No, I never had any training in anti money laundering, no.”

However, like his colleague Harold Mitchell, Mr Demetriou said he recently conducted an AML course recently required of board members and learnt about the issue through his position on the risk committee.

“I have been privy to many, many briefings on the joining AML programme Crown has in place, being a member of the risk committee,” he said.

Commissioner Patricia Begin also inquired as to whether Mr Demetriou was made to learn about the agreement Crown had with the NSW government underpinning the Barangaroo casino’s licence.

“I understood at the time and still do that the license requires we have tables and not gaming machines,” he replied.

Ms Bergin then asked whether he had any knowledge of the specific conditions of the agreement, which includes a clause preventing ownership of Crown falling into the hands of deceased gaming mogul Stanley Ho.

“Not specifically Madame Commissioner,” Mr Demetriou said.

“Only in the very, very broad sense.”

Mr Aspinall returned to the lack of training at induction and asked Mr Demetriou if he thought AML and regulation training for new board members was a good idea.

“It could only be helpful Mr Aspinall,” Mr Demetriou said.

Mr Aspinall then asked Mr Demetriou if he received any information on Crown’s China operations when he joined the board.

Mr Demetriou said he didn’t, and he learnt about operations in China “Probably during the course of my first one or two board meetings that I attended and they were probably in the CEO report to the board, which reported on a number of matters.”

Mr Aspinall asked Mr Demetriou for his understanding of Crown’s activities in China prior to October of 2016.

“My understanding was that we were assisting our clients, or our potential clients, with visa processing so they could come to Crown,” he said.

Mr Aspinall then asked if he knew there were staff in China prior to their arrest.

“No, not specifically,” Mr Demetriou replied.

Eli Greenblatt 10.15am: Crown faces Victoria probe

Crown Resorts’ entanglements with government regulators have worsened with the Victorian government now issuing a “show cause” notice with the casino company just at the same time as its directors are being hauled before an inquiry in New South Wales over the operations of the business and its links to dubious junket operators.

Just as Crown director and former AFL boss Andrew Demetriou was called to give evidence before the Independent Liquor and Gaming Authority in NSW, Crown issued a statement to the ASX that it had been delivered a “show cause” notice from the Victorian regulator.

“Crown Resorts confirms that Crown Melbourne Limited (Crown Melbourne) has received a Show Cause Notice from the Victorian Commission for Gambling and Liquor Regulation (VCGLR) relating to Crown Melbourne’s compliance with its Internal Control Statement for junket operations (ICS) as required under the Casino Control Act 1991 (Vic),’’ the ASX statement said.

The ASX statement said the notice requires Crown Melbourne to show cause why disciplinary action should not be taken in relation to an alleged noncompliance with the ICS. “Crown Melbourne will respond to the Show Cause Notice and fully co-operate with the VCGLR in relation to this process,’’ Crown Resorts said.

“As previously announced, Crown has suspended all activity with junket operators until 30 June 2021 while it undertakes a comprehensive review of its processes related to junket operators.”

Bridget Carter 10.12am: Aware in rival bid for Opticomm

Aware Super - previously called First State Super - has put forward a rival offer for Opticomm at $6.50 per share, rivalling the latest bid by Uniti Group.

The offer values Opticomm at $645m.

It is understood that the proposal is by way of a takeover bid with an acceptance condition of just over 50 per cent.

OptiComm announced on September 8 that it had received a bid from First State Super, or Aware Super, offering $5.85 per share or $609m.

This was after Uniti Group had already put forward a proposal to buy the business in June by way of a scheme of arrangement, offering $5.10 a share for the company, equating to $530m, or $540m of cash and scrip, factoring in a dividend payment.

Uniti then came back and matched that offer on September 15, with a price at the time equating to $5.85 per share, comprising $4.835 per share cash and 0.80537 Uniti shares for each OptiComm share.

The OptiComm board recommended the earlier Uniti offer that matched the value of the earlier offer from Aware Super.

Uniti also secured a 19.5 per cent interest in OptiComm shares by way of call option and share purchase agreements.

OptiComm provides internet connection services to property developers and retail service providers and is considered “core-plus” infrastructure by some infrastructure funds.

OptiComm listed last year with a $208.2m market value, with shares being sold at $2 each.

Existing founders, including director David Redfern and Paul Cross, still own about 40 per cent.

Shares in Opticomm last closed at $5.96 with its market value at $620m.

Bridget Carter 9.55am: Link the target in $3.8bn bid

Private equity firms Pacific Equity Partners and The Carlyle Group have launched a $3.8bn takeover bid for Link Administration Holdings at $5.20 per share.

Working with Link is Macquarie Capital and UBS and PEP and Carlyle are advised by Jarden.

Link shares last closed at $3.99, taking its market value to $2.11bn. As part of the deal, Link shareholders have the option of retaining a stake in Pexa.

While the bid equates to $3.8bn including debt, on an equity value basis it equates to $2.8bn.

The offer is a 30 per cent premium to close.

In a statement to The Australian Securities Exchange, Link said Perpetual, which currently holds 9.65 per cent of Link Group, has sent a letter to the consortium, stating that it intends to vote in favour of the transaction at a share price of no less than $5.20 each, subject to no superior proposal and Perpetual continuing to hold its shares on the date of a meeting for the transaction.

It is also subject to Perpetual continuing to consider the proposal to be in the best interests of its members and only up to six months or less if it is not pursued.

The Link Group Board said the proposal was under consideration.

Lachlan Moffet Gray 9.51am: Demetriou facing Crown probe

The NSW independent liquor and gaming authority’s inquiry into Crown Resorts’ suitability to hold a casino licence will resume shortly, with current board member and ex-AFL boss Andrew Demetriou to take the stand.

Mr Demetriou has been a non-executive director of Crown since 2014 and is the chair of Crown Melbourne Limited, as well as a member of the responsible gaming and risk management committees.

It is likely then that Commissioner Patricia Bergin and the counsel assisting will quiz Mr Demetriou on the extent of his knowledge about the risks of detainment faced by Crown staff prior to their arrest in China in 2016 for promoting gambling, as well as his knowledge of the exposure of the “junkets’ Crown used to source VIP international gamblers to organised crime.

Last week the commission heard from many current and former staff of Crown, including James Packer, who owns approximately 38 per cent of the publicly traded company and once was chair and a board member before resigning for mental health reasons.

Mr Packer made headlines by offering to sell down his stake in the company in order to salvage Crown’s licence to operate their soon-to-open Barangaroo casino while board member Harold Mitchell indicated that the company would phase out an agreement by which member’s of Packer’s private company offer executive services to Crown.

Also notable was an hour-long stretch of the hearing last Tuesday that was closed to the public.

Within it, Mr Packer discussed with the Commissioner the contents of a threatening email sent to TPG capital boss Ben Gray during a discussion over taking Crown Private.

Mr Packer condemned his behaviour and pinned it on Bipolar disorder - the first time he has classified his struggle with mental health as a specific condition.

Perry Williams 9.46am: Deckart quits AGL

The AGL Energy executive in charge of developing an Australian LNG import project has quit the power giant to become chief executive of Tasmanian gas utility Tas Gas.

Phaedra Deckart, AGL’s general manager for energy supply and origination, will join Tas Gas on October 19 replacing current chief executive Cameron Evans.

Ms Deckart conceded in February the company had underestimated the challenge of developing Australia’s first gas import plant, with the project delayed partly due to mounting environmental opposition from communities on Victoria’s Mornington Peninsula.

AGL had originally targeted imports from its planned $250m Crib Point liquefied natural gas terminal in the first half of 2020 as part of plans to help ease a domestic supply crunch in the state and meet a gas shortfall in its own portfolio.

However, opposition from local groups and a decision by the Victorian government to conduct a full environmental assessment on the facility slowed momentum with first gas now likely in the second half of 2022.

A 10-week public hearing on AGL’s Crib Point facility starts on Monday.

9.38am: What’s impressing analysts?

ANZ Bank raised to Overweight: JPMorgan

Newcrest raised to Buy: Citi

Rio Tinto PLC cut to Hold: Shaw & Partners

Silver Lake cut to Hold: Canaccord

South32 cut to Hold: SBG Securities

9.36am: Orica flags lower earnings, results delay

Explosives manufacturer Orica has flagged lower earnings and the recognition of about $170m in costs in its fiscal year 2020 results, including a non-cash impairment of $65m in IT assets.

In an update to the ASX, Orica said it expects underlying earnings before interest and tax of slightly more than $600 when it delivers its full-year results next month, down from $665m the prior year.

That lower figure was due to the pandemic impacting developing markets more severely for longer, as higher supply chain costs, largely freight, continued to weigh.

The company said that as part of its system network optimisation to increase the utilisation of its initiating system network, its Minden and Hallowell plants in the US, as well as its Tappen plant in Canada, would cease production, costing about $80m.

Orica has also postponed the release of its full-year result by two weeks due after pandemic lockdowns delayed the closing and auditing of accounts.

The explosives maker on Monday said the need to provide remote training and support for a new internal system had led to the delays.

Chief Executive Alberto Calderon the two-week delay was a prudent measure.

Orica will report its results on November 20.

9.30am: Quiet start tipped for ASX

Australia’s share market should be quiet but well supported early this week.

Futures point to a flat open and the US bond market will stay closed Monday for Columbus Day, although the US share market will trade.

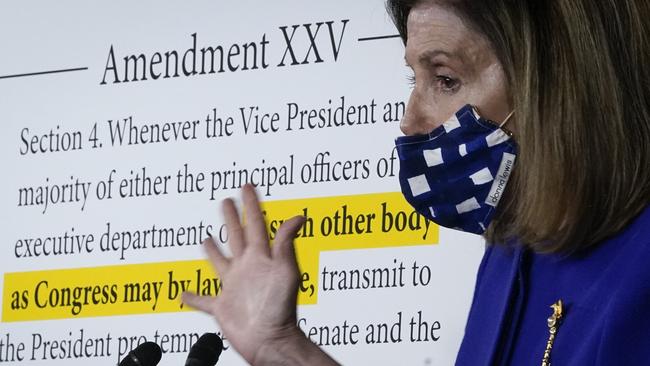

Global risk assets haven’t seen much reaction to weekend news that US House Speaker Nancy Pelosi said US stimulus talks are at an “impasse” and that Senate Republicans opposed a $US1tn proposal by the White House.

Real Clear Politics averages of US election betting odds have widened in favour of Joe Biden to 35.8 per cent, driving expectations of a Democrat clean sweep and large scale US stimulus after the election.

Thus the S&P 500 rose 0.9pc to a five-week high of 3477 and looks set to “melt up” to record highs pre-election, with the VIX hitting a 4-week low of 25pc and potentially heading down toward 20pc.

AUD/USD dipped only 0.4pc to 0.7211 before rebounding, suggesting weekend news that Victoria won’t reopen as much as planned next week isn’t seen as overly concerning either.

Australia’s world-leading fiscal stimulus detailed in last week’s budget should continue to help the S&P/ASX 200 even after it rose 5.4pc to 6102.2 points in its best week in 6 months.

While June/July/August tops in the 6160-6200 area offer resistance, a double bottom pattern continues to target 6220.

Chart support may be as close as 6185 and former double-bottom resistance and 50 and 200 day moving averages in the 5995-6016 area offer strong support.

The tech sector led Wall Street but materials should be strong with spot iron ore up 2.7pc to $US121, spot gold up 1.9pc to $US1930.40 and LME copper up 1.3pc, though WTI crude fell 1.4pc to $US40.60.

Westpac’s consumer confidence index is due Tuesday, employment data are out on Thursday, along with a speech by RBA Governor Philip Lowe at the Citi conference.

9.00am: ‘Resilient’ Bapcor lifts revenue

Car parts retailer Bapcor says that based on unaudited figures, revenue lifted 27 per cent for the three months through September, compared to the same period last year, despite the negative impact of COVID-19 restrictions in Victoria and Auckland.

“The automotive aftermarket is a resilient industry and historically has performed strongly in difficult economic circumstances,” said chief executive Darryle Abotomey.

“Recent trading is another example of its resilience assisted by the increase in sales of second hand cars, reduction in use of public and shared transport modes as well as government stimulus.

“We envisage that the impacts of COVID-19, including the expected increase in domestic tourism and increased use of vehicles will continue to drive the Bapcor businesses.”

The company said it expects to deliver a strong result for the first half, though the second half remained unclear due to the current economic uncertainties.

8.54am: Origin adds Atlas, Withers to board

Origin Energy has appointed Coca-Cola Amatil chair Ilana Atlas to its board, as well as former Fairfax NZ chief executive Joan Withers.

Ms Atlas, who is also a non-executive director of ANZ, will join Origin’s board in February. Ms Withers, who is a non-executive director of ANZ NZ, will join the board later this month.

Origin Chairman, Mr Gordon Cairns said,

“We are delighted to welcome Joan and Ilana to the Origin board,” Origin chairman Gordon Cairns said.

“Together, they bring to the board extensive experience in highly customer-centric and disrupted industries and deep expertise in transformation, risk and governance and culture.

“The diverse background and skills of Joan and Ilana will further strengthen the Origin board and complement the expertise of the existing directors in oversight of the company.”

8.46am: Cooper claims emissions first

South Australia-based Cooper Energy says it’s set to become the nation’s first carbon neutral domestic gas producer, having fully offset its emissions for fiscal year 2020.

“Our strategy is focused on producing natural gas for south-east Australia, in south-east Australia. This means our operations have a comparatively low level of emissions intensity which may otherwise exist with long pipeline transmission,” said managing director David Maxwell.

“We saw an opportunity to completely offset our emissions well ahead of 2050 and we took it.”

The company has been reporting its greenhouse gas emissions since 2014.

“We plan to fully offset our carbon emissions annually recognising the long-term benefits to our business, the environment, and the communities where we operate,” Mr Maxwell said.

“Over the coming year, we will be seeking government certification from Climate Active as a carbon-neutral organisation.”

8.30am: Evolution ‘ahead of forecasts’

Evolution Mining says it is tracking ahead of its full-year production forecasts as it posted a preliminary production figure of 170,021 ounces for the three months through to September, while net bank debt dropped to $180.3m, down from 196.4m in the June quarter.

The company is forecasting full-year gold production to be in the range of between 670,000 and 730,000 ounces.

“It’s great to start the new financial year with continued positive momentum,” said executive chairman Jake Klein in a statement to the ASX.

“Our operations are performing well and it is pleasing to be ahead of where we had planned to be at the end of the first quarter.

“Most importantly, the business continues to generate sector-leading cash flow per ounce and our balance sheet remains strong with net debt reducing even after rewarding shareholders with their 15th consecutive dividend of $153.8m.”

The preliminary quarterly production figures were released this morning to coincide with the annual Diggers and Dealers Mining Forum, which starts today in Kalgoorlie, Western Australia.

8.17am: Fortescue extends buyback indefinitely

Fortescue Metals Group says its on-market buyback will be extended and continue indefinitely.

Fortescue launched the buyback program in October 2018

“The buyback program has been extended as it remains an important part of the successful

execution of Fortescue’s capital management strategy,” the miner said on Monday.

The extension of the share buyback does not require shareholder approval.

“The number of shares purchased and timing of any buyback will depend on Fortescue’s share price and market conditions at the time,” it added.

6.22am: Branson’s Virgin Orbit in raising

Richard Branson’s Virgin Orbit is looking to raise up to $US200 million in a funding round that could value the satellite-launch business at around $US1 billion, according to people familiar with the matter.

The fundraising comes as the British billionaire’s sprawling travel-to-finance empire and the wider commercial space industry have been hit hard by the coronavirus pandemic.

Virgin Orbit said in August it had hired LionTree Advisors and Perella Weinberg Partners to look at potential financial transactions. Those banks are now charged with helping it raise between $US150 million to $US200 million by as early as the end of the year for capital expenditure and to fund satellite launches, according to the people familiar with the plans.

Dow Jones Newswires

5.18am: ASX to edge down at open

Australian stocks are set to open slightly weaker as global markets continue to be driven by speculation over the US election and a stimulus deal for the US economy.

The SPI futures index was this morning down five points, or 0.1 per cent.

On Friday, Australian stocks finished flat but rounded out a 5.4 per cent weekly gain.

The prospects for a US stimulus package, and the coronavirus, will continue be dominant issues for markets in an otherwise relatively quiet week. Australian jobs data is released on Thursday, and the US third quarter earnings season is also about to get under way.

The Australian dollar is higher at US72.07.

Brent oil is down 1.1 per cent to $US42.85.

Spot iron ore is up 2.2 per cent to $US125.85.

5.20am: Stimulus talks at impasse: Pelosi

House Speaker Nancy Pelosi said negotiations with the White House over a new coronavirus aid package remained at an impasse Sunday, as Senate Republicans remain wary of more spending.

In a letter to House Democrats on Sunday, Mrs. Pelosi said the administration’s latest $US1.9 trillion offer, submitted Saturday, provided inadequate funding and no national plan for testing, contact tracing and treatment of the coronavirus.

“This past week, the president demonstrated very clearly that he has not taken the war against the virus seriously, personally or nationally. This attitude is reflected in the grossly inadequate response we finally received from the administration on Saturday,” Mrs. Pelosi wrote. “Until these serious issues are resolved, we remain at an impasse.”

House Democrats have pushed for $US75 billion and a national plan for testing, tracing and treatment of the virus. Mrs. Pelosi said in her letter that the White House plan included about $US45 billion in new funding, lacked a national plan for testing and tracing and didn’t address the virus’s disproportionate impact on minority communities.

President Trump in brief comments on the issue said Republicans were still eager to reach an agreement.

“Republicans want to do it. We’re having a hard time with Nancy Pelosi,” he said Sunday on Fox News.

White House spokeswoman Alyssa Farah told reporters the White House offer was around $US1.8 trillion. A person familiar with the proposal said it included $US1.88 trillion in spending, with about $US400 billion of the funds reallocated from unspent money from earlier relief legislation, bringing the total cost to about $US1.5 trillion.

Dow Jones

5.00am: Wall Street recap

Wall Street stocks rose for a third straight session on Friday with tech shares leading the way amid hopes for a US stimulus package and rising confidence about coronavirus therapeutics.

The Dow Jones Industrial Average capped a positive week with a 0.6 per cent rise to 28,586.90. The broadbased S&P 500 gained 0.9 per cent to 3,477.13, while the tech-rich Nasdaq Composite Index jumped 1.4 per cent to 11,579.94.

After markets tanked on Tuesday following President Donald Trump’s abrupt move to end stimulus talks, investors have cheered his about face in subsequent days that has him cheering for a deal.

The White House on Friday beefed up its offer, proposing a $US1.8 trillion package as Trump himself said on a radio show that he favoured an even larger package.

But Senate Majority Leader Mitch McConnell said there was not enough time to complete the talks before the election.

Still, analysts said the gains reflected confidence there would be a package soon.

The market also was boosted by a write-up in the New England Journal of Medicine that Gilead Sciences’ drug remdesivir resulted in “consistent, clinically meaningful improvements” in coronavirus patients, the latest positive indicator about a leading treatment. Gilead rose 0.8 percent.

That news follows announcements by Regeneron Pharmaceuticals and Eli Lilly earlier in the week on Covid-19 therapies that have boosted confidence in effectiveness of the treatments for the virus.

Technology shares led the market, with Amazon winning 3.0 percent, Google-parent Alphabet 2.0 percent and Netflix 1.4 percent.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout