$553bn pension giant Calpers puts pressure on boards over climate change

One of the world’s biggest pension funds is taking on ASX-listed companies including BHP, Rio Tinto and CBA over climate change and governance.

One of the largest pension funds in the world has flexed its muscles with Australian corporates on climate issues, heaping pressure on the nation’s biggest mining and energy companies to take action to tackle the climate crisis.

The $US415bn ($553bn) California Public Employees’ Retirement System, or Calpers, the biggest pension fund in the US, has voted with activists to demand change at Australian majors including BHP, Rio Tinto, Woodside, Santos and AGL.

It has also taken aim at Commonwealth Bank ahead of Tuesday’s annual meeting, voting down the re-election of Rob Whitfield, the former long-serving veteran of Westpac Bank.

Mr Whitfield, who left Westpac in 2015, was the former head of that bank’s institutional banking arm during a period when Westpac failed to notify financial crimes regulator Austrac about millions of international funds transfers. Mr Whitfield was not named in any Austrac filings.

Elsewhere, Calpers has also taken aim at under-pressure Cleanaway, voting down the waste company’s remuneration report and the re-election of two board-endorsed directors amid bullying allegations levelled against chief executive Vik Bansal.

Calpers, which delivered a 4.7 per cent return for its members in the year ended June 30, is planning to step up its efforts on climate after revealing one-fifth of its public market investments are exposed to potential losses from climate change.

Calpers, which manages pension and health benefits for more than 1.6 million Californian public employees, including firefighters battling on the front line of the bushfires that have torn through the state in recent weeks, has called for mandatory reporting of climate risks in company financial statements and pleaded with the boards of listed companies in its portfolio to take responsibility for working towards net zero emissions by 2050.

Ahead of BHP’s annual general meeting on Wednesday, Calpers revealed it had voted in favour of a shareholder resolution demanding the mining giant pull out of industry associations where views were inconsistent with the Paris Agreement’s goals.

It also backed a second shareholder resolution urging BHP to adopt a moratorium on undertaking activities that would disturb, destroy or desecrate cultural heritage sites in Australia.

Both resolutions had been rejected by the BHP board.

Meanwhile it has emerged Calpers last week had voted in favour of a resolution brought by an activist group demanding the nation’s biggest carbon dioxide emitter bring forward the closure of its coal-fired power stations.

AGL in 2015 confirmed it would close its three coal-fired power stations at the end of their operating lives in a move that will see its Liddell plant shuttered by 2022-23 and its Bayswater operation closed by 2035, while Loy Yang A will operate until 2048.

The Australasian Centre for Corporate Responsibility wants all three plants closed by 2036, which is the latest point AGL’s own analysis shows they need to be shut by in order to limit global warming to 1.5C above pre-industrial levels.

At the annual meeting last Wednesday, 20.4 per cent of shareholders voted in favour of the ACCR proposal.

Calpers’ vote in favour of the resolution conflicts with the advice from influential proxy advisers ISS, CGI Glass Lewis and Ownership Matters, all of which urged shareholders to side with management and vote it down.

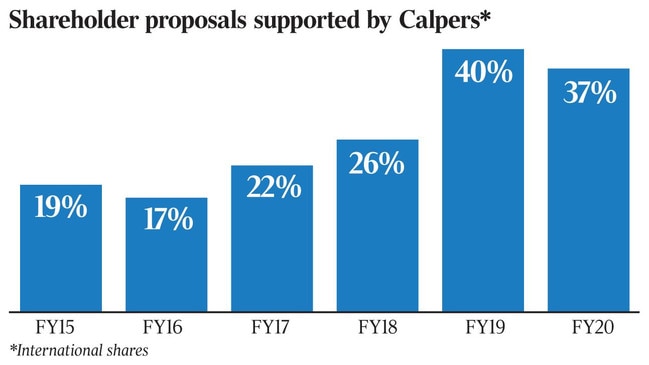

Like the proxy advisers, Calpers makes its views well known ahead of any vote. It publishes its proxy votes in advance in a bid to influence other shareholders and in recent years has been steadily voting in favour of fewer management proposals while veering toward greater support of shareholder resolutions.

In the 2015 financial year, Calpers sided with corporates on 89 per cent of the 77,132 international management proposals it voted on.

Over time its support of management proposals has followed a downward trend and hit 75 per cent this year.

The trend line for its support of shareholder resolutions has moved in the opposite direction over the same period.

In 2015 Calpers supported just 19 per cent of shareholder proposals.

By this year that figure had jumped to 37 per cent, after hitting a high of 40 per cent in 2019.

The shift in support has corresponded with a rise in shareholder activism on a range of issues, climate change included.

In 2015, Australian climate activist groups Market Forces and the ACCR put forward four shareholder resolutions to ASX 200 companies on environmental, social and governance issues. Last year, the same two groups doled out 32 resolutions on ESG issues. And the support from shareholders continues to grow.

Last year, just 6 per cent of Rio Tinto shareholders supported a Market Forces resolution for the miner to set out a transition plan consistent with the Paris Agreement goal of limiting global warming to 1.5C, including disclosing short, medium and long-term targets for its scope 1, 2 and 3 greenhouse gas emissions.

This year, a similar resolution garnered support from 37 per cent of its shareholders.

Calpers sided with the climate activist group on both proposals.

The heavyweight fund, the sixth largest in the world, has also been among the shareholders heaping pressure on oil and gas majors Santos and Woodside.

Calpers was among the more than 50 per cent of Woodside shareholders who in April voted in favour of a resolution demanding the company commit to setting emissions targets in line with the goals of the Paris climate agreement.

The result was the highest recorded support for an emissions target shareholder resolution in corporate Australia and came despite calls from management to vote it down.

A similar vote hit peer Santos, the nation’s second-largest oil and gas producer, in the same month, with 43 per cent of its shareholders siding with the activist group.

Toe the line

Despite the surge in climate revolts from aggrieved shareholders, some of Australia’s biggest investors continue to toe the line and vote with management.

The nation’s $200bn sovereign wealth fund, the Future Fund, which holds positions in AGL, Santos, Woodside and Rio Tinto, among others, has voted against every ESG-related shareholder resolution put forward at annual meetings over the past three years.

The Peter Costello-chaired fund has previously pushed back against its critics, saying its job is to generate financial returns for the nation.

But as big Australian investors like the Future Fund vote against climate resolutions, others around the world are taking action. Blackrock, the world’s largest asset manager, last Wednesday voted in support of ACCR’s proposal demanding AGL bring forward the closure of its power stations.

Blackrock, with $US7.4 trillion in assets under management, earlier this year warned it would get tougher on companies not doing enough to combat the climate crisis.

ACCR director of climate and environment Dan Gocher said there was an increasing trend of European and US investors showing they were more prepared to take critical action to address climate risk than their Australian peers.

“Far too many Australian investors live in fear of blowback from a government committed to stalling progress on climate action. Increasingly, European and US investors see through the bluster and vote for what is in the best long-term interests of shareholders,” he said.

Calpers, in contrast to investors like the Future Fund, has become increasingly vocal in its climate stance, with its managing investment director of board governance and sustainability, Anne Simpson, last month calling on company boards to take responsibility for transition strategies toward net zero.

“We hire and fire the board, essentially. Our first goal is to make sure governance of these companies is aligned with Paris,” she said at a forum on climate and sustainability.

Warning it would be “a painful, difficult, bumpy, challenging path” to net zero by 2050, she called on companies to commit to targets and integrate climate risks into financial reporting.

“We’re of a size, $US400bn, we have nowhere to hide. There’s nowhere you can tidy away $400bn into a safe place when there’s a systemic risk like climate change.

“So the approach we’ve taken is to say the total portfolio needs to ultimately reflect a real economy aligned with Paris,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout