Health darling launches fresh bid to list on Nasdaq

Telix Pharmaceuticals won’t raise capital as it looks to capture the attention of more global investors under fresh plans to list on the Nasdaq.

Telix Pharmaceuticals won’t raise capital as it looks to capture the attention of more global investors under fresh plans to list on the Nasdaq.

There is little confidence the same board that fundamentally allowed an appalling corporate culture and poor leadership to thrive, can also fix it.

There are two reasons why central banks cut interest rates – ability and need. Australia’s exceptionally strong employment report for September all but eliminated the need.

Housing affordability and cost-of-living pressures have led to a change in investment strategies, with younger investors putting more cash into stocks and crypto than boomers.

The corporate regulator has reshuffled its leadership with two key appointments.

Perpetual hit with first strike. Stronger-than-expected jobs data may dash hopes of early rate cut. BHP iron ore production rises but China disappointment weighs. Regulator allows Star to keep Sydney licence. Uranium miners soar. WiseTech dives amid CEO scrutiny.

The billionaire founder of WiseTech Global, Richard White, has the backing of his board but there are active discussions about the chief executive taking leave from the tech major.

The Reserve Bank’s language has been much less hawkish since its August board meeting and that’s good news for homeowners struggling with the highest interest rates in over a decade.

The New York giant was dabbling with some sheds with ‘some power on the side’ but two lessons paved the way for its bumper acquisition.

A top Reserve Bank official gives a strong indication the central bank could be preparing the way for an interest rate cut.

Local sharemarket backs away from highs after US, China sell-off. AusSuper invests billions in US data center company. Woodside records 21pc revenue jump as production hits record.

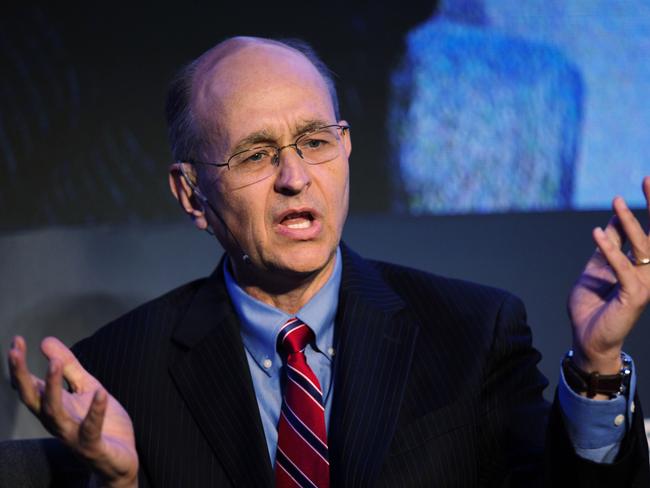

For Citi’s New York-based global economist, Nathan Sheets, the difference between a recovery and global recession are finely balanced.

Markets in the US and Australia are climbing a proverbial wall of worry but October has a reputation as one of the most volatile months of the year for stocks as the US election looms.

Although financial commentary is rife with near-term events and distant prognostication, almost none of this directly helps navigate sharemarkets. So what should we be looking for?

Investment bank Macquarie wants to build another AirTrunk, and the infrastructure supporting the tech revolution sits at the heart of its plans.

Commonwealth Bank is the only major expecting an RBA cut by December. Now it’s more confident than ever in that view.

The move will see Ms Bei Liu migrate the full $1.5bn from her Alpha Plus fund to a new firm with an as-yet undisclosed name.

ASX 200 ends up 0.5 per cent amid gains in the US and China. TPG sells fibre, EGW assets to Vocus in blockbuster deal. Web Travel dives on update. New bosses at Lendlease, Pacific Smiles. BCA puts councils performing poorly on housing on chopping block.

China says it will lift government debt to revive its economy but economists and investors were provided with little detail on the extent of the stimulus package.

Big tax cuts on top of high federal debt and less easy Fed policy could create perfect conditions for rising rates.

Original URL: https://www.theaustralian.com.au/business/markets/page/15