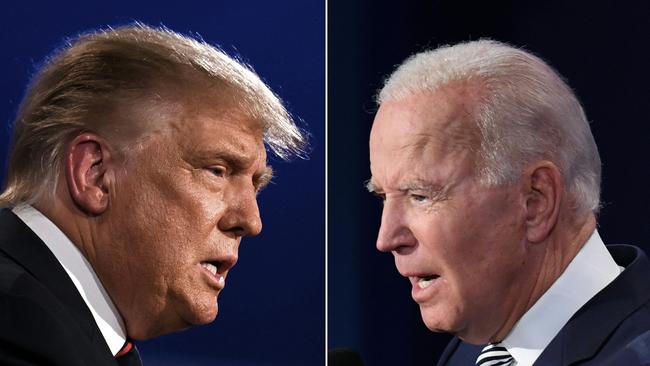

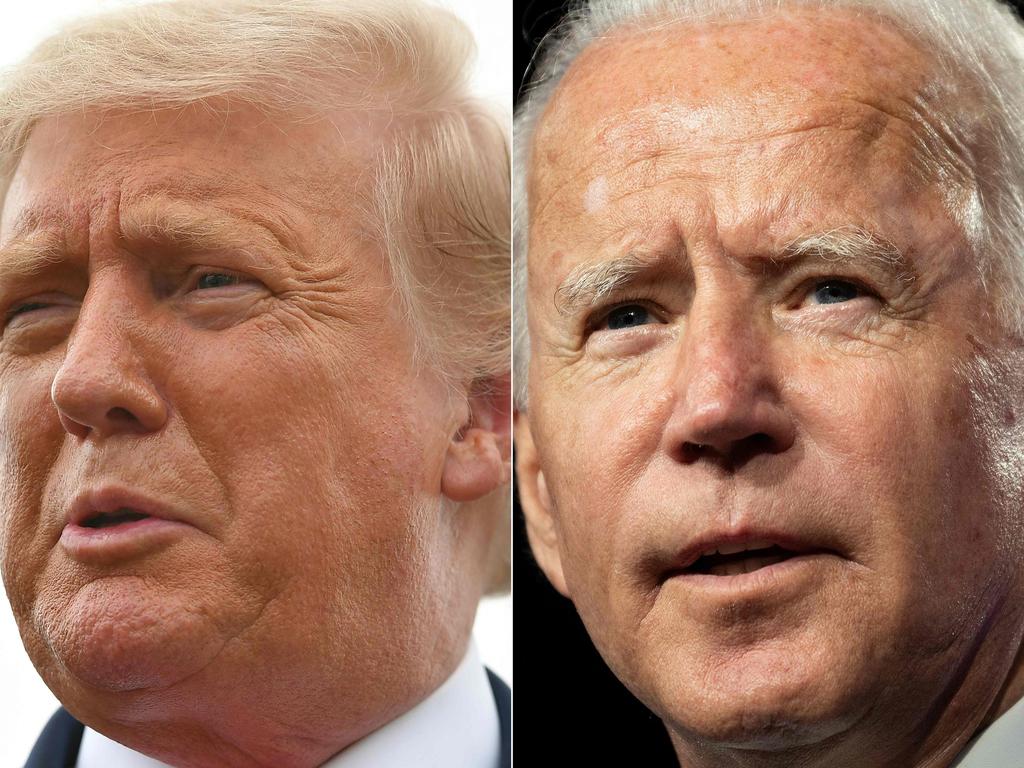

Markets will fear US presidential election result delay as Trump diagnosed with Covid-19

Prior to Trump going down with the virus, in the wake of the chaotic US presidential election debate, three clear sharemarket scenarios had emerged tied to the election result.

Now the new uncertainties will be superimposed on those original scenarios

Each of the original scenario has a very different outcomes for the American and global sharemarkets plus the US dollar, so it’s important for readers to understand the impacts of the different election results as well as watching the progress of the Trump infection.

The opinion polls tell us that Joe Biden is set to win easily but American opinion polls are notoriously inaccurate when it comes to elections.

Donald Trump failed to land a killer punch on Biden in the first debate, so “scenario one” assumes that the polls are right and Biden wins clearly on election night. Moreover the Democrats get control of both houses in Congress.

It’s true that Biden plans increased taxes on corporations and high income individuals but he is also planning an enormous spending campaign. That avalanche of government money will almost certainly boost the US sharemarket and probably the dollar as well.

“Scenario two” is that Trump wins clearly and retains control of Senate.

That’s business as usual and the market will probably be strong, particularly as it would represent relief that the nation had escaped the dangers of scenario three and the higher taxes of a Biden win. However the avalanche of money planned under Biden will not take place.

Under both Trump and Biden, the current Trump China polices are not likely to fundamentally change, although Biden may be more moderate.

Of all the scenarios, number three is perhaps the most likely and certainly the most dangerous for markets — a completely chaotic election outcome.

The US constitution and state rules were not written to make it easy to resolve a situation where the outcome is disputed.

The Trump camp expects there will be a vast number of postal votes lodged that will favour the Democrats. Their validity will be challenged by the Trump camp, vote by vote, and this will run up against the time deadlines imposed by the constitution. So the first part of the chaos scenario comes via the US postal vote system.

In the US there is a so-called “interregnum” — the 79 days between the election and the presidential appointment. There are numerous date designated steps.

For example, on December 14 the electors (state politicians) must meet from all 50 states to cast their ballots for president; then on January 3 the newly-elected Congress is seated; on January 6 the House and Senate meet jointly for a formal count of the electoral vote.

If postal votes are still in a quagmire by December 8 then the December 14 process, when the various states have to appoint electoral college representatives to vote for the presidential candidates, becomes uncertain.

The normal expectation is that they will elect representatives in accordance with the popular vote but there is no constitutional requirement for them to follow the popular vote.

Accordingly it is possible that those states where the Republicans control the legislature will put forward Trump-voting people to the electoral college, irrespective of what the vote appears to be.

If Biden controls both houses of Congress that strategy might fail, but if the Republicans hold the Senate then Vice President Mike Pence has enormous power to decide who will be president. But if Pence appoints Trump that will be challenged, so it’s possible that there will be two candidates — Biden and Trump. If that can’t be sorted out it is even possible that US House of Representatives leader Nancy Pelosi could be president.

In all this mess courts will be deeply involved and ultimately the Supreme Court may decide who is president. This month’s Trump nomination to the court could conceivably result in him retaining the presidency.

The above is a brief summary of the mechanism and there are many other complexities. If scenario three eventuates markets will be in turmoil and it is likely that shares will fall sharply as well the dollar. Gold will be a winner.

Whoever becomes president will not have a long-term mandate so there would be prolonged street riots, so the uncertainty in the market could extend beyond January 20.

There are many American commentators who fear that this will take place because they don’t think Biden will sweep the polls on election night.

Accordingly, investors need to prepare for that situation but, of course, if Biden does emerge as a clear winner on election night without postal votes and Trump concedes, then watch the market roar.

The uncertainty in the US system will make it very difficult for America to promote its system of democracy as the pre-eminent political system in countries that are still deciding which way to go.

As soon as Wall Street learned that President Trump has acquired the COVID-19 virus the share futures market slumped. The virus threatens to make the election process to select the 46th president of the US even more uncertain.