Coronavirus: $150bn shares rout as oil crunch sparks panic

Investors wiped $150bn off Australian shares as plunging oil prices and the worsening spread of coronavirus sparked panic among investors.

Investors wiped $150bn off Australian shares, the dollar fell 5 per cent and bond yields hit record lows as plunging oil prices and the worsening spread of coronavirus sparked panic among investors and fanned fears of a global recession.

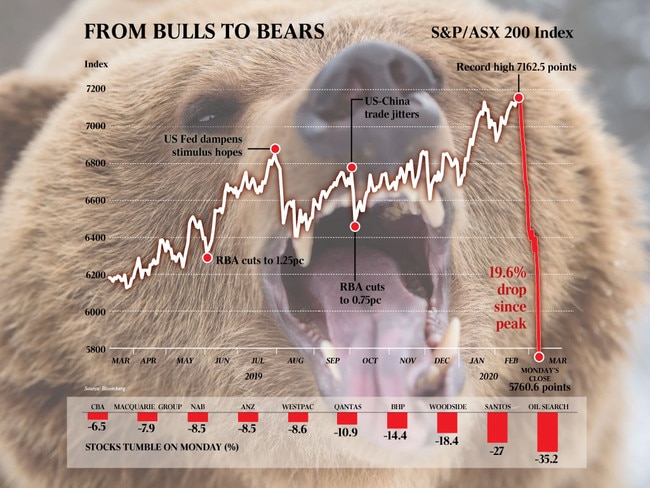

In its worst trading day since the 2008 global financial crisis, Australia’s benchmark S&P/ASX 200 share index plunged 455.6 points, or 7.3 per cent, to a 14-month low of 5760.60.

After key Asian markets closed sharply lower, the rout spread to Europe on Monday night. In early trading, London’s FTSE100 was down 5.3 per cent, while the German and French markets were down more than 6 per cent.

In the US, Wall Street joined the global sharemarket rout, with a 7 per cent dive forcing a temporary halt to trading.

The Australian sharemarket has plunged 19.6 per cent from a record high close of 7162.5 just over two weeks ago, putting it on the cusp of a “bear market”, defined as a fall of at least 20 per cent.

Blue-chip stocks were hit hard. BHP fell 14 per cent while market leader CSL was down 5.9 per cent. Among the big four banks, Westpac fared worst as it fell 8.6 per cent. ANZ and NAB each dropped 8.5 per cent, Commonwealth Bank shed 6.5 per cent and Macquarie Group shed 7.9 per cent.

Westpac chief economist Bill Evans slashed his forecasts for Australian economic growth to 1.6 per cent for the year and predicted a recession — defined as two consecutive quarters of negative economic growth — in the first half of this year because of the coronavirus outbreak.

The broader All Ordinaries index fell 7.4 per cent to 5822.40 for a $150bn loss of market value.

The energy sector tumbled 20 per cent, leading broadbased falls. Crude oil prices collapsed after the breakdown of talks between OPEC and Russia about extra supply cuts and reports that Saudi Arabia planned to punish Russia by producing an additional 10 million barrels a day.

Bell Potter’s head of institutional sales and trading Richard Coppleson said: “The oil shock was like a king hit from behind — no one even saw that coming. Value was huge as panic selling, forced margin selling and fears of what the US will do tonight saw some run for the exits.

“Margin selling was absolutely massive and that added to the heavy selling.”

Oil Search was smashed by 35 per cent to $3.30 a share, making it the worst performing stock in the S&P/ASX 200, while Santos dived 27 per cent to $4.89, Beach Energy plunged 19 per cent to $1.94 and Woodside Petroleum fell 18 per cent to $21.54.

Global benchmark Brent crude oil collapsed by $14.16 or 31 per cent to a four-year low of $31.02 a barrel and West Texas crude plunged 34 per cent to $US27.34, marking their biggest falls in decades.

The Aussie dollar briefly collapsed by 5 per cent to an 11-year low of US66.36c as investors rushed for safe havens, including Japanese yen and precious metals.

Spot gold hit an eight-year high of $US1703 an ounce, while 10-year bond yields in the US and Australia dropped to record lows of 0.4658 per cent and 0.552 per cent respectively.

Investors were bracing for potentially devastating falls on Wall Street overnight.

Crestone Wealth Management chief investment officer Scott Haslem said there was some historical evidence that a sharp and sustained decline in sharemarkets could have real economic effects.

“We know that the most likely immediate impact of market corrections is to undermine consumer and business confidence,” Mr Haslem said.

NAB will release its latest business confidence survey on Tuesday, followed by Westpac’s monthly gauge of consumer sentiment the following day.

Grant Samuel Funds Management adviser Stephen Miller said the sharp and accelerating losses on global financial markets suggested investors thought a global economic recession was “a probability, not a possibility”.

In Asian markets, Japan’s Nikkei 225 fell 5.1 per cent, South Korea’s KOSPI dived 4.2 per cent, the Hang Seng index fell 3.6 per cent and China’s Shanghai Composite lost 2.6 per cent.

Market watchers said the sell-off in risk assets was reminiscent of the global financial crisis of 2008.

“It’s definitely panic … this is GFC level,” said one trader.

“There’s a lot of option margin calls and margin lending selling.

“Everyone is panicking at the wrong time. I’m actually looking at buying in the next few days.”

Lucerne Investment Partners portfolio manager Jerome Lander said sharemarket and property investors were about to experience a reckoning that swept away the pretence of “fake wealth and artificial economy”.

In a note to clients issued on Monday, Mr Lander said investors were “reacting in horror to the reality of the coronavirus as it begins its exponential growth around the world”.

“This is a truly frightening pandemic with significant ramifications which much of the developed world is unlikely to cope with well,” Mr Lander said.

“Unlimited QE is likely but won’t help alter the destruction from the pandemic.

“These are truly dangerous times for all investors, but particularly for those holding large amounts of overvalued equity and property assets at fake economy prices.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout