Bain to look under Insignia hood after upping offer

Insignia has granted suitor Bain Capital limited due diligence after the PE firm matched rival CC Capital’s offer for the wealth manager.

Insignia has granted suitor Bain Capital limited due diligence after the PE firm matched rival CC Capital’s offer for the wealth manager.

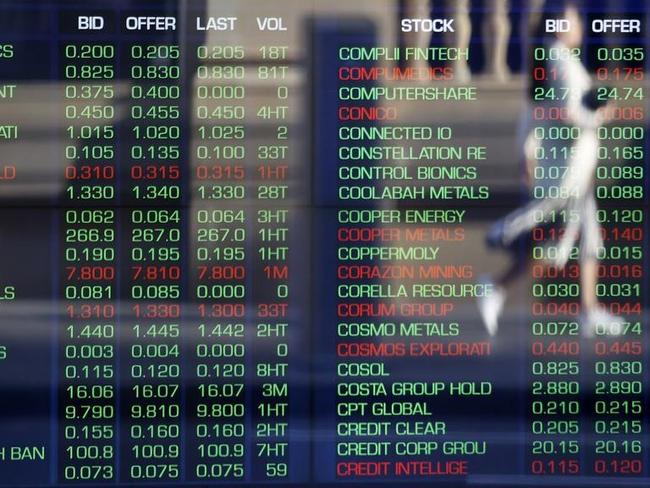

ASX down after most US stocks fell. Department store chain, Premier shareholders show huge support for merger. Bain boosts Insignia offer to $4.60 per share. Evolution drops on downgrades. Fortescue ships record amount of iron ore.

The new Trump administration’s massive spending plan will certainly flow through to a handful of Australian companies already enabling artificial intelligence.

Fund managers are calling on ANZ to urgently rectify compliance issues, including within its under-pressure retail bank, given the risks posed by regulatory fines and further capital outlays.

Australian Foundation Investment Company boss Mark Freeman has cautioned on the outlook for equities and bank valuations.

A red tape ‘razor gang’, a review of the tax system and a growth agenda are top of the Financial Services Council’s wish list for the next federal government.

In the lead-up to the next federal election, the government’s rhetoric must be matched by concrete policy commitments that would fuel a private sector-led economic recovery.

ANZ is yet again in hot water with the Australian Securities and Investments Commission which is examining allegations it incorrectly calculated interest on thousands of savings accounts.

There’s plenty of volatility to come, but by playing under Donald Trump’s new world order, business is poised to thrive.

Sydney-based BNPL company Procuret has gone into voluntary administration, with a sale or recapitalisation now being considered.

The Finance Sector Union, which is preparing a new round of wage negotiations, says the government should intervene to stop banks closing their branches, particularly in regional areas.

With everyone else too big or distracted, HSBC is NAB’s for the taking if the global giant decides to walk away from the local retail banking market.

The nation’s ‘greenest’ super fund, run by the $140bn UniSuper, was one of the industry’s worst performers in 2024, despite a hefty allocation to listed equities.

Regional towns across Australia are seeing a surge in demand for lending as businesses beef-up operations to meet households leaving the cities for affordable housing and a better lifestyle.

Even if Star gets through its current issues, NSW is playing with fire over the casino’s longer-term future.

The sharemarket is expected to rise on Monday but the rest of the week could be volatile as markets wait to see incoming president Donald Trump’s executive orders.

The nation’s second-largest super fund sees a better return outlook for real assets following equities’ strong performance.

Super funds delivered bumper returns in 2024, with the best of the lot a retail fund focusing on younger members. See the top 10 performers.

The new boss of Star is surviving on just a few hours of sleep a night trying to save the casino and thousands of jobs. Even if he gets through this, does it have a long-term future?

The bidding war for one-time basket case Insignia Financial tells you the pendulum is swinging back from not-for-profit domination towards retail superannuation providers.

Superannuation payouts upon death can be delayed, heavily taxed and completely confusing. Here’s how to take back control.

BOQ is the latest to be exposed for charging fees against the accounts of dead customers and now it will be up to regulators such as ASIC to decide whether a financial penalty is warranted.

The pendulum is fast moving back in favour of business as the incoming US president fills the world’s most powerful economic roles.

The Australian dollar hovering near five-year lows makes Australia look even more attractive to private equity firms hunting for bargains, fund managers say.

Financial advisers say the Albanese government did not undertake the proper steps before introducing a scheme which has left a $130m-plus bill to many small business owners.

Companies seeking cash to cover bad tax debts have soared, but not all of them are able to access it.

The ATO has shifted into a new tax-collection phase and will be increasing efforts to recoup money from small businesses behind in repayments.

As the world watches Trump’s return in the US and political events in Europe, the offshore exposure of Australian super funds is actually growing.

In lieu of accessing the housing market at the same age as their parents’ generation, many young Australians are choosing to invest in other, sometimes riskier, asset classes.

Small banks must get bigger to compete against the majors and the head of one challenger believes the mutual sector could be reduced to just 10 contenders in a decade.

Original URL: https://www.theaustralian.com.au/business/financial-services/page/9