Regulation and growth: Trump’s economic team will make all the difference for Wall Street

The JPMorgan Chase boss was talking to investors this week about where he sees the world after Monday (Washington DC time), when Donald Trump officially gets back the keys to the White House office.

Dimon has been arguing for years about slowly but steadily rising regulation since the Global Financial Crisis. And while the intentions have been well-founded, there has been a price to pay for business – namely lower growth, higher costs and less capacity for risk-taking.

Dimon says all he wants is a coherent, rational and consistent regulatory regime that allows banks to do their job. “It is possible to achieve both goals” of growing the economy and maintaining a safe banking system, he says.

By following Trump’s picks for the powerful roles, business is getting a complete picture of what to expect under a second Trump term beyond the headlines of last year’s gruelling election campaign. And the pendulum is fast swinging back in favour of business.

As Goldman Sachs CEO David Solomon said on a separate call: “There has been a meaningful shift in CEO confidence, particularly following the results of the US election.”

Solomon says he expects “tailwinds” from the overall business confidence and lighter regulatory environment: “I think the environment feels good.”

Still, the threat of tariffs is real, which could upset momentum. Trump has surrounding himself with pro-tariff figures. Trading partner Canada has already been in the firing line – even though it is one of the biggest energy exporters to the US, including gas and electricity. Mexico has also been thrown a 25 per cent tariff curve ball.

What is becoming clear – the bigger the threat, the greater the chance de-escalation follows, with tariffs being used as a bargaining chip for deal making. Shortly after the threats were levelled at Canada and Mexico, Trump said he had “productive” meetings with leaders of both countries.

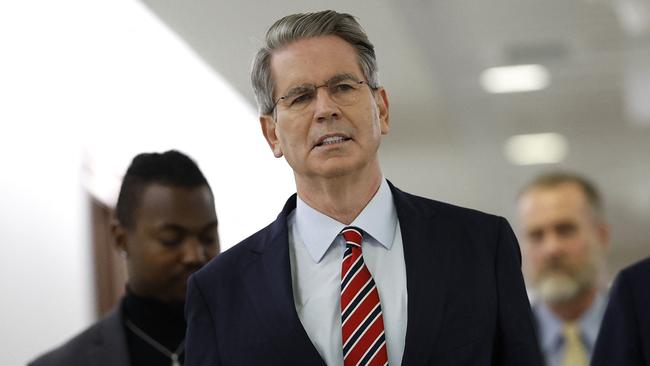

The one to watch for business will be Scott Bessent, Trump’s nominee for the plum Treasury secretary post.

Bessent is plugged into Wall Street after running hedge fund Key Square Capital Management, which at least until three years ago counted Australia’s Future Fund as a client. He quickly became Trump’s key adviser on the campaign trail.

Bessent, who previously ran the private investment vehicle of billionaire George Soros, spoke in Melbourne before the pandemic as a keynote presenter to the Sohn Hearts & Minds Conference.

There he suggested he was less hawkish towards China and spoke of the need for the US (then under Trump) and China to find some sort of agreement on trade given the importance both represented to the global economy.

Bessent’s naming as the Treasury pick in November sparked an immediate rally on Wall Street.

And it’s easy to see why. He has outlined a set of targets dubbed “3-3-3”.

That is a 3 per cent growth target, 3 per cent fiscal deficit target (currently more than double that figure), and a 3 million-barrel-a-day increase in US oil production (currently about 13 million barrels a day).

Whether he gets there or not, the big picture goals have put on the agenda the aim of reducing government debt. This increasingly has been worrying business leaders in the US about the sustainability of borrowings.

Indeed, energy is the other big theme of the Trump presidency, Liberty Energy boss Chris Wright has been named Energy secretary.

This week, The Wall Street Journal reported Trump is looking at day one orders rolling back restrictions on drilling oil, as well as resuming approvals for US exports of gas. Australia’s Woodside last year hedged its global exposure through the $1.2bn acquisition of the Driftwood LNG project in Louisiana.

Since being named as Treasury pick, Bessent has said his other priorities will be to deliver tax cut promises and push through tariffs. He has declared he wants to maintain the status of the US dollar “as the world’s reserve currency”.

The other key figure responsible for tariffs and trade will be Howard Lutnick, the billionaire and Trump confidant. As the long-time boss of private investment bank Cantor Fitzgerald, Lutnick is another Wall Street name shaping policy, although one who is far more hawkish on tariffs than Bessent. During the presidential campaign, Lutnick was one of the few business figures backing tariffs, saying they should be used “to build America”.

Elon Musk represents another in Trump’s orbit who is determined to make his mark by winding back regulation and finding savings in his capacity to lead the new department of government efficiency along with Vivek Ramaswamy. Musk has been keeping close to Trump, including as a regular presence at the incoming president’s Florida club Mar-a-Lago.

Apple CEO Tim Cook was among those at the New Year’s Eve party at Mar-a-Lago, alongside Trump and Musk. It is worth noting Musk had been pushing hard for Lutnick in the Treasury role, but Trump went his own way.

There is a shake-up in the officials running the top business regulators, although it is customary for heads to bow out under a new administration.

President Joe Biden’s hand-picked chair of the powerful Securities and Exchange Commission will stand down on Monday – the day of Trump’s inauguration. Gary Gensler was a controversial figure on Wall Street and drove much of the momentum for regulation, as well as spearheading a crackdown on crypto assets. Trump has named a more crypto-friendly pick for his replacement, a former commissioner, Paul Atkins. His nomination, like all others, needs to be approved by the US congress.

On cue, Gensler gave a whack to the Trump camp on the way out. This week filing a lawsuit against Musk alleging the multi-billionaire failed to properly disclose buying shares in Twitter ahead of launching a takeover for the social media play.

Another change will be around antitrust oversight with the exit of Lina Khan from the Federal Trade Commission. In the past four years, Khan has emerged as the public enemy of big tech, taking aim at Microsoft, Meta and Amazon. She has also been accused of slowing M&A, including knocking back Nippon Steel’s bid to buy out US Steel. Trump has named FTC commissioner Andrew Ferguson to replace her. Ferguson opposed several of Khan’s decisions during his time at the FTC.

One to watch will be Federal Reserve boss. Despite clashes with Jerome Powell during his first term, Trump has said he won’t try to replace the chair before the end of his term in 2026. Powell has said he has no plans to leave early. Just as well, given the US Fed is at the start of its rate cutting cycle. If that changes the heat will be on.

eric.johnston@news.com.au

Jamie Dimon, one of the most influential bankers on Wall Street, spelt it out: “It’s time to take a deep breath, do the right thing and continue to have the best financial system in the world.”