CBA’s Matt Comyn: banks strong enough to keep paying dividends

Commonwealth Bank CEO Matt Comyn has played down suggestions Australia’s banks will suspend dividends.

Commonwealth Bank CEO Matt Comyn has played down suggestions Australia’s banks could be required to suspend dividends, saying they are better placed to withstand the COVID-19 crisis than their offshore peers.

His comments followed measures by at least three central banks to implore financial institutions to halt dividend payments and in some cases share buybacks, including the European Central Bank and Bank of England.

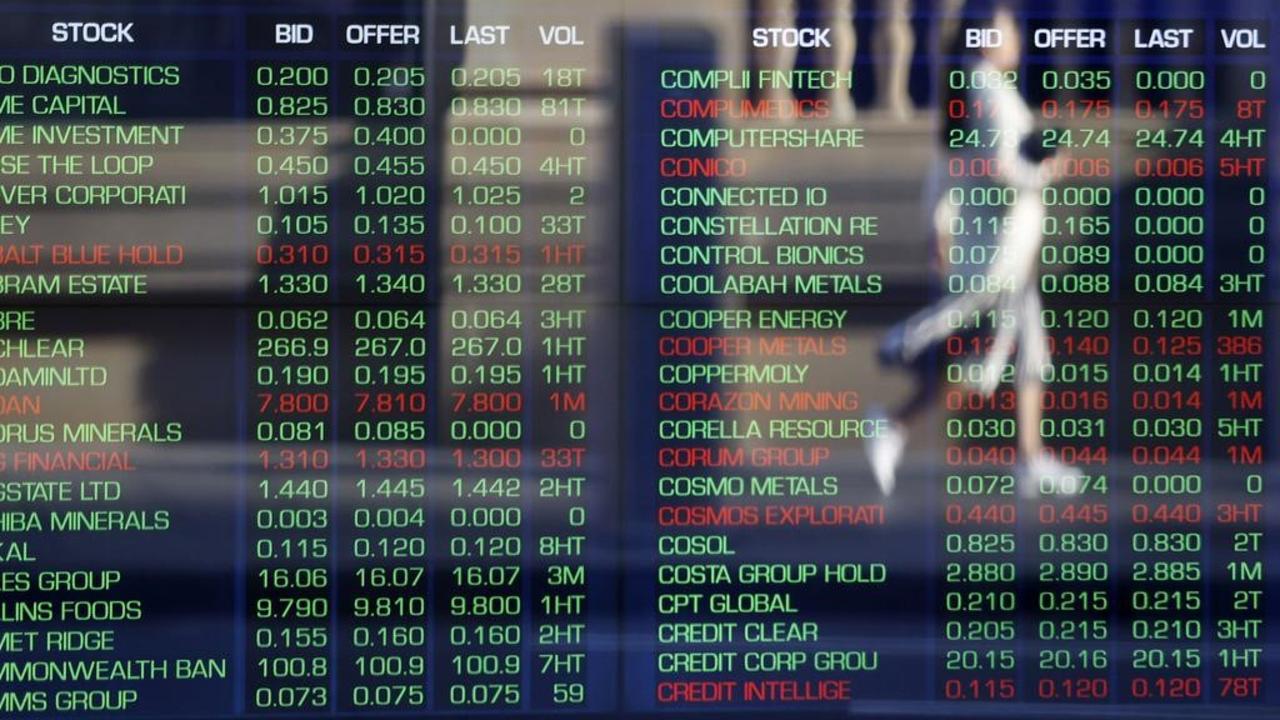

The Reserve Bank of New Zealand followed suit on Thursday with an order for banks to freeze dividends to support its banking system’s stability. Australian banks dominate the NZ banking market and the announcements spurred falls in their share prices that exceeded the S&P/ASX 200’s fall of almost 2 per cent.

Mr Comyn was talking to The Australian as he marks his second year in the role. Appointed in April 2018 to the then scandal-hit bank, Mr Comyn has steered the bank through the Hayne royal commission and worked to rebuild the bank’s fractured relationship with regulators and politicians.

As the recently appointed chairman of the Australian Banking Association, he has taken a leading role in the banking sector’s response to the economic fallout from the coronavirus.

Mr Comyn said Australian banks were in a “different situation” to banks in many other markets, particularly Europe, given their strong capital and financial positions, and that they were continuing to lend into the economy.

“The banks are unquestionably strong so we are holding substantially more capital at this point in the cycle, which is hugely important,” he said. “We are in such a strong relative position, that’s really important on a global basis … we are relatively strong both in terms of debt funding then in terms of equity participation.

“If you don’t have a strong banking system, which is certainly the case in parts of Europe, you just don’t have the financial capacity and firepower to be able to support the economy.”

Financial consequences

Mr Comyn highlighted that in the six months to December 31, the major domestic banks contributed 32 per cent of ASX dividends distributed to shareholders, which was “heavily skewed” to retirees and self-managed superannuation funds.

“The financial consequences [of suspending dividends] directly would be a problem,” he said.

Ethical Partners Funds Management’s Nathan Parkin said the banks could continue to pay dividends, but if the external situation worsened, they could instead step up their dividend reinvestment plans to conserve cash flows.

That would involve the issue of shares as some investors would opt to reinvest over taking cash.

“That could be a better way to handle it,” Mr Parkin said, as retail investors would take a “serious hit” if bank dividends were suspended entirely because they accounted for 42-55 per cent of the major banks’ shareholder registers.

“There is obviously going to be a need for debt provisioning that reflects the economic impacts. That will impact their [banks] level of dividends,” he added. “We don’t think that negates their ability to pay any dividends.”

Markets around the world are attempting to stave off deep recessions as the spread of the coronavirus causes lockdowns of communities and pushes businesses into hibernation.

CBA on Thursday said its level-one common-equity tier-one ratio stood at 12.1 per cent, and it was “well placed” to absorb the suspension of dividends by its New Zealand unit ASB. This week it also received another progress payment from acquirer AIA of $865m relating to the sale of its life insurance division.

After CBA paid out an interim dividend this week, Mr Comyn said the board would assess “a range of different scenarios” for its full-year payout deliberations.

He also expressed optimism that Australia would recover quickly after the COVID-19 fallout, given the contribution of exports — such as resources and agriculture — to economic output. “If you look at some of the capacity that is coming online, in China in particular, it has been quite significant in the last few weeks,” Mr Comyn said.

“There is certainly a possibility that we will bounce back faster than many other countries.”

Earlier this week, though, he predicted a sharp 10 per cent contraction in economic growth in the March quarter and the bank’s economics team expects a 7.5 per cent drop in the June quarter. For 2020, CBA estimates a 3.4 per cent contraction, with unemployment hitting 7.8 per cent in the next three months.

On the potential for higher provisioning to account for a spike in bad debts, Mr Comyn said it was too early to understand how the COVID-19 impact would play out.

“This is early on, there is still a lot of uncertainty and a broad range of economic scenarios that could eventuate,” he added.

Westpac’s new chairman John McFarlane on Thursday went further and warned that the coronavirus spread and its hit to the economy would probably lead to a rise in bad debts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout