Prime Minister Scott Morrison says no advice on blocking bank dividends has been given

PM says Australia has no current plan to mimic the dividend ban being forced on banks in the UK and New Zealand.

Scott Morrison said Australia’s powerful Council of Financial Regulators considered tough rules on suspending bank dividend payments but that such a move has not been decided at this point in time.

The Prime Minister’s comments followed a New Zealand order for banks across the Tasman to suspend the payments of dividends or redeem their hybrids in a bid to preserve capital.

The Reserve Bank of New Zealand made the order on Thursday morning to support the stability of the New Zealand banking system during the coronavirus pandemic. Each of Australia’s big four banks also own substantial operations in New Zealand prompting fears that they would be prevented from channelling profits back home and hurting their ability to boost capital. ANZ has the biggest exposure to New Zealand with nearly 20 per cent of its risk weighted assets there.

Mr Morrison told reporters in Canberra that restricting dividends payments in Australia had been considered by the Council of Financial Regulators but “that’s not a move that’s been decided at this point”.

“I’m aware of the decision of the New Zealand agencies [but] at this point the Australian Government, through our financial regulators, we have not received that advice to move to that level,” he said.

Australian bank regulator APRA, which is a member of the Council of Financial Regulators, on Tuesday said it is was monitoring the issue but would allow banks to make their own decision on dividends.

“APRA is actively engaging with banks to understand their intended approach to dividends, as well as other distributions to shareholders or employees, given current uncertainties. For the time being, decisions on dividends and variable remuneration remain matters for boards to determine in line with their obligations under APRA’s prudential framework,” the bank regulator said.

“Banks are well-capitalised, however APRA has advised banks that it expects them to prudently managing their capital, and ensure their actions in the foreseeable future are consistent with their ability to provide ongoing credit support to the broader economy.

APRA continues to monitor these issues and may review its guidance on these issues as circumstances evolve.”

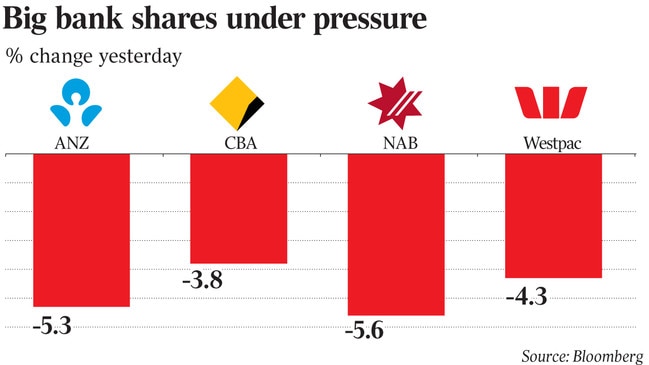

Even so Australian bank shares fell sharply with ANZ down 5.3 per cent, Commonwealth Bank down 3.8 per cent, National Australia Bank was off 5.6 per cent and Westpac down 4.3 per cent.

Reserve Bank of New Zealand deputy governor and general manager for financial stability Geoff Bascand said the restrictions on dividends “further supports the stability of the financial system by maintaining higher levels of capital during the period of falling economic activity resulting from the COVID-19 pandemic,”

“(The restrictions) will remain in place until further notice, with the aim of relaxing them when the economic outlook has sufficiently recovered” Mr Bascand said.

Commonwealth Bank said it is well-placed to absorb the suspension of dividends from its New Zealand subsidiary ASB, which is part of a sector-wide move announced on Thursday by the Reserve Bank of New Zealand.

CBA on Thursday said that dividends from its New Zealand business only affected its level one common equity tier one ratio, which stood at 12.1 per cent at the end of last year.

The group’s “strong” level one CET1 capital position meant it was “well-placed” to absorb the suspension of ASB dividends.

ANZ said the decision would prevent it from redeeming $NZ500m in capital notes on May 25. But it would still be able to make interest payments on those notes, the bank said. The terms of the capital notes also provide conversion into a variable number of ANZ ordinary shares in May 2020 and May 2022.

The bank noted the conversion into ordinary shares following the central bank’s decision was expected to lead to an increase in its common equity tier one position.

NAB said it did not anticipate that the restriction would have a material impact on its level one capital position, nor affect its level two capital ratio.

Westpac said the RBNZ’s term lending facility would only affect the level one capital ratio of its New Zealand subsidiary. The bank said it is “well capitalised” with a level two common equity tier capital ratio of 10.8 per cent and level one capital ratio of 11.1 per cent, as at December 31, 2019.

The RBNZ’s announcement follows similar restrictions on dividend payments to bank shareholders by the Bank of England and the European Central Bank.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout