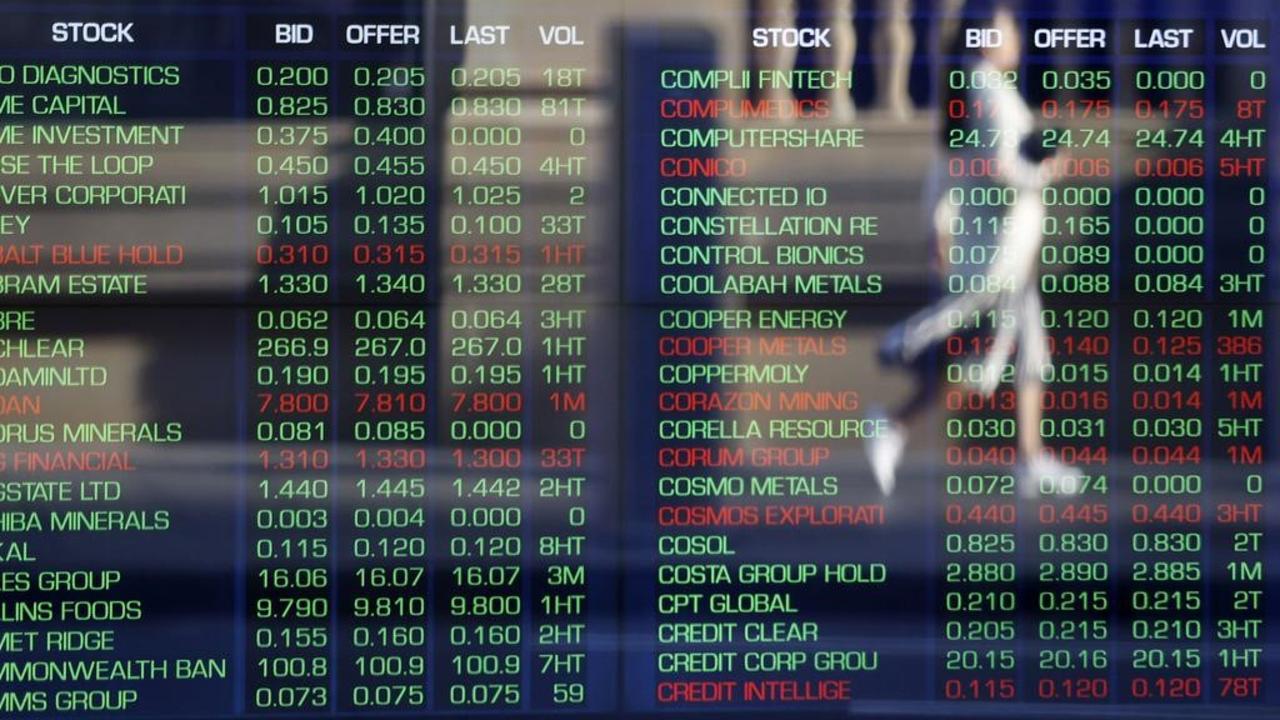

Dividends to dive as defaults hit banks

Standard & Poor’s tips a threefold increase in defaults at Australia’s biggest banks over the coming year.

Australia’s biggest banks are expected to weather a forecast threefold increase in defaults over the coming year, according to global ratings agency Standard & Poor’s, which has warned the lenders are poised to slash dividend payouts to investors.

The warning on the twice-yearly dividend distributions made by the big lenders came after several major British banks halted their dividends after the nation’s banking regulator warned the companies not to shell out billions of pounds to shareholders during the coronavirus crisis.

While no move has been made by an Australian bank to stop dividend payments or reduce the amount of profits paid to shareholders, this could change as the big four prepare to announce half-yearly results next month.

S&P on Wednesday said the annual $30bn profit produced by Commonwealth Bank, Westpac, National Australia Bank and ANZ would be big enough to allow the lenders to withstand credit losses 10 times the rate that hit the banks in 2019.

In 2019, the major banks booked $3.7bn in impairment charges and made $17bn in provisions.

S&P said it only expected credit losses of about three times last year’s levels over the coming year.

“The Australian major banks' earnings have headroom for a severe downside scenario, and would be able to withstand credit losses rising to about six times those in 2019, in combination with a 20 per cent decline in their interest and other operating income,” said S&P credit analyst Sharad Jain.

Mr Jain said the credit ratings of the major lenders were likely to remain unchanged during the crisis, even if the COVID-19 pandemic resulted in a longer-lasting economic shutdown.

The ratings agency is expecting the Australian economy to kick back into gear towards the end of the 2020 calendar year.

Although the Australian Prudential Regulation Authority said it would allow the lenders to dip into their “unquestionably strong” capital buffers, Mr Jain said he did not expect to see a reduction in the absolute amount of capital help by most large Australian banks.

But he said earnings and dividend payouts would be “substantially lower”.

“Australia’s major banks retain sizeable headroom within their earnings to absorb a multifold increase in credit losses in conjunction with a large contraction in interest spreads and fee income,” S&P said.

The ratings agency also warned that mutually owned banks had “lower headroom” to withstand a severe downturn due to their weaker profitability and lower credit ratings.

Macquarie Wealth analysts say the banking sector may be hit by loan defaults triggered by the coronavirus shutdown that exceed levels seen during the GFC.

Shaw and Partners analyst Brett Le Mesurier said the banking sector faced bad debt charges and credit losses of $34bn over the three years through to 2022. That was higher than the $21bn worth of credit losses sustained by the major banks during the global financial crisis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout