Coronavirus: Banks offer $8bn small business loans lifeline

Banks will defer small business loan repayments for six months in a move said to be worth as much as $8bn.

Banks will defer loan repayments for six months to small businesses struggling under the impact of the coronavirus pandemic, in a move that Australian Banking Association boss Anna Bligh said could inject as much as $8 billion into the pockets of SMEs.

“Banks will make sure this deferral is available to any small business in critical need because of COVID-19,” Ms Bligh said. “Australia’s banks have supported the country through difficult times in the past and continue to do so.”

“Small businesses can rest assured that if they need help, they will get it.”

Josh Frydenberg said the “unprecedented move by the banks is a game-changer”.

“It will provide a big boost to the confidence of small businesses at this difficult time. The banks have stepped up to the plate and are playing their role as part of Team Australia,” the Treasurer said.

Pointing to the “devastating” impact on smaller firms as a result of the health crisis, Ms Bligh said banks were receiving an “exponentially increasing volume of calls from small businesses in distress and who are unable to meet repayments”.

The assistance package will start Monday and apply to more than $100bn of existing home loans. Ms Bligh said that, depending on the take-up, this could “put as much as $8bn back into the pockets of small businesses as they battle through these difficult times”.

She said lenders were acting “as fast as possible for small businesses to avoid more people being out of work and falling into mortgage distress”.

“Banks are putting in place a fast track approval process to ensure customers receive support as soon as possible.”

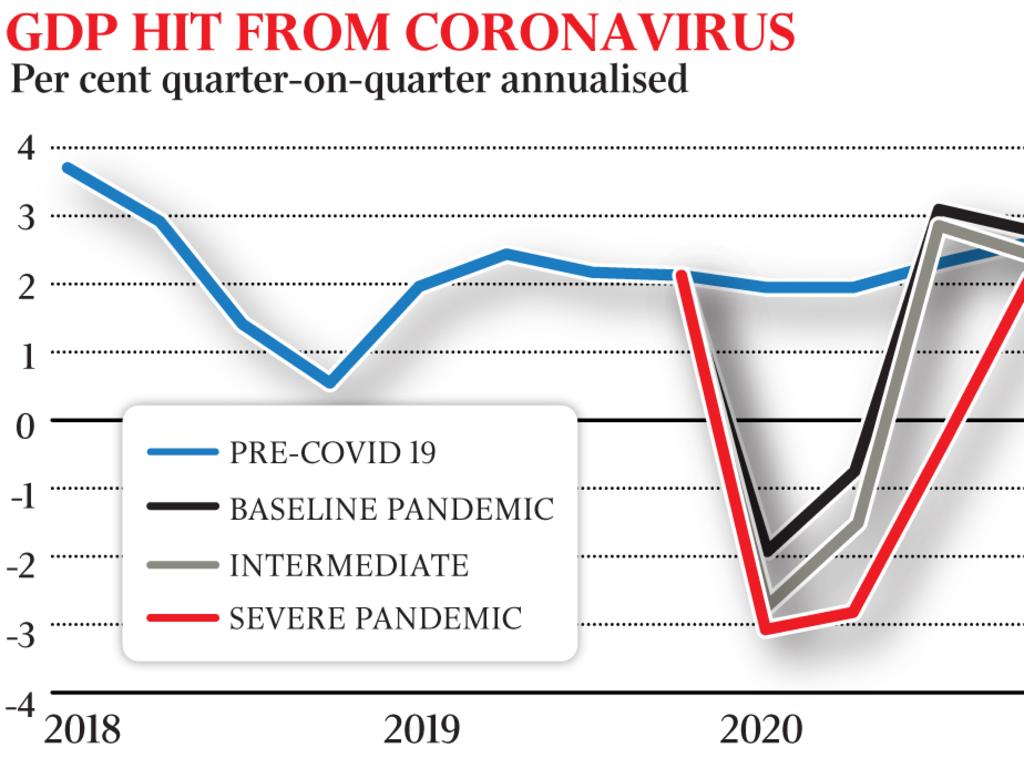

On Thursday Reserve Bank governor Philip Lowe delivered an emergency interest rate cut, slicing the official cash rate to 0.25 per cent, as part of a package of monetary measures aimed at ensuring credit continues to flow through the economy. As part of that package, Dr Lowe announced he would flood the banking system with $90 billion in a historic and open-ended commitment to doing “whatever is necessary” to help the economy navigate its way through the coronavirus emergency.

Ms Bligh said the banks’ assistance package “dovetailed” with the RBA measures, and on Friday major lenders responded to the central banks promised flood of cheap cash.

NAB, Westpac and ANZ all slashed rates across a range of small business loan and overdraft products of up to 2 percentage points, following similar moves by Commonwealth bank the day before. Banks also cut fixed-term mortgage rates by up to 1 point, with ANZ also reducing variable home loan rates by 0.15 percentage points.

NAB, Westpac and ANZ also offered a deferral for up to six months for home loan customers struggling to meet their obligations, with ANZ saying the interest foregone would be capitalised into the value of the loan.

Westpac announced a $10 billion home lending fund.

All banks besides ANZ boosted term deposit rates.

NAB chief executive Ross McEwan said one third of Australia’s small to medium-sized businesses bank with the lender.

“We are going to be there for them,” Mr McEwan said.

Ms Bligh said the ABA and lenders had spent “hours and hours” over recent days and nights meeting with the Treasurer, regulators and with each other to craft their response, and that they would continue to do so.

“Banks stand ready to do whatever they can to help communities get through this.”

On Friday, S&P Global Ratings said the RBA’s term funding facility, and a similar measure in New Zealand, “should allay fears that the countries' financial institutions face an imminent funding or liquidity crisis due to the COVID-19 outbreak”.

The Australian revealed earlier this week that the government is considering a loan guarantee to keep businesses afloat as part of Scott Morrison’s second-round economic rescue package, expected to be announced within days, which could take the total government spend to more than $40bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout