RBA vows no limits to economic rescue bid

Reserve Bank governor Philip Lowe has vowed there will be ‘no limits’ on its unprecedented intervention in the bond market.

Reserve Bank governor Philip Lowe has vowed there will be “no limits” on an unprecedented intervention in the bond market as the central bank joins international counterparts launching a wave of unconventional monetary policies that will see trillions of dollars pumped into global financial markets.

The RBA on Thursday pulled the trigger on a long-awaited economic stimulus and monetary policy package, similar to quantitative easing programs launched by the US Federal Reserve during the global financial crisis, in which the local central bank will purchase billions of dollars worth of Australian government bonds in a bid to keep the yield on three-year treasuries at a low “target” of 25 basis points.

That would take yields significantly lower than the 60-basis-point trading range of the securities before the announcement and provide cheap funding for banks and businesses by lowering interest rates across the financial system.

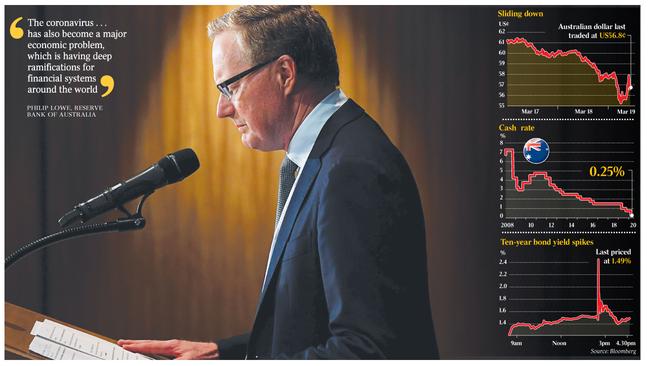

Along with a reduction in the official cash rate to a new record low of 0.25 per cent, the lowest point the RBA is prepared to take interest rates, Dr Lowe also unveiled a $90bn funding pool to help the banking sector extend cheap loans to small businesses, which was immediately topped up by Scott Morrison with a plan to inject $15bn through the Australian Office of Financial Management to keep the securitisation markets functioning.

At the same time, the RBA will pump billions of extra funds into the short-term interbank lending market to maintain functionality and investor confidence in the banking system, which has been creaking under the strain of a collapse in the economy triggered by the coronavirus pandemic, already sparking the steepest bear market in share prices on record and freezing global credit markets.

The dollar collapsed to an 18-year low under the new near-zero interest settings, while turmoil in global equity and money markets had seen a rush of money flow into US dollars. Last night the dollar was trading at US56.1c.

The RBA’s historic move followed an array of central bank “bazookas” fired overnight on Thursday as governments prepare to unleash trillion-dollar stimulus packages as the wheels of the financial system grind to a halt.

The unprecedented action was resorted to after equities and treasuries markets were hammered in tandem by a significant wave of liquidation as money managers scramble to protect their assets in cash holdings, resulting in an unwanted spike in bond yields.

Equities and bond prices usually move in opposite directions as investors sell off positions in riskier shares into safer government bonds, making the tandem sell-off concerning for financial stability.

“The Reserve Bank board did not take these decisions lightly,” Dr Lowe said.

“But in the context of extraordinary times and consistent with our broad mandate to promote the economic welfare of the people of Australia, we are seeking to play our full role in building that bridge to the time when the recovery takes place.”

Because of the influence government bond rates have in determining the price of almost everything, policymakers have had to pull out all stops to keep yields from rising ahead of an expected tsunami of corporate defaults as supply chains buckle due to economy-wide shutdowns to prevent COVID-19 from spreading.

Analysts and economists were immediately spooked by a sharp increase in yields on Australian 10-year bonds following the RBA announcement, appearing to signal that the central bank’s program would not achieve its goals by neglecting to purchase longer-dated securities, but Dr Lowe said the RBA would be prepared to buy any asset to achieve its targeted yields, starting on Friday.

“We were prepared to buy government bonds right across the maturity structure,” Dr Lowe said.

“There are no limits on what we can buy or how much we can buy. Nothing is off the table.

“We will do whatever is necessary to achieve that target.

“What’s happening, and you saw this happening again today, there is widespread liquidation of position around the world. There is something global going on here. Investors are very nervous about the future.”

The European Central Bank on Thursday announced a €750bn ($1.4 trillion) asset purchase program. ECB president Christine Lagarde said “extraordinary times require extraordinary action” and there would be “no limits” on the central bank’s commitment to protecting the single-currency union.

It followed other measures, including planned cash payments to US residents, credit guarantees for businesses in Germany, and a Swedish stimulus worth 6 per cent of the Nordic nation’s economy to keep banks lending to companies.

The move from the RBA eclipses the level of support for the local economy extended during the GFC, in which the AOFM underwrote the residential mortgage-backed securitisation sector when funding markets froze, and is more ambitious in its “quantitative” element than previous bond-buying programs, which put an upper limit on the amount of bonds central banks were prepared to purchase.

Westpac chief economist Bill Evans labelled the program a “bold” move. “All these measures are to be applauded and will support the Australian financial system at this difficult time,” Mr Evans said.

Global ratings agency Moody’s vice-president John Truijens said the emergency funding facility would help mitigate the impact on securitisation markets, while the small business funding facility would provide “affordable liquidity for individuals and small businesses at a time of significant economic disruption”.

“The financial support will help many small businesses and self-employed borrowers pay their existing debt and thereby reduce arrears rates and losses in securitisations backed by such debt,” Mr Truijens said.

However, respected central bank watcher, JPMorgan analyst Sally Auld, said the brief jump in the yield on 10-year government bonds from 1.6 per cent to 2.5 per cent showed there was still “some uncertainties” about the program. Meanwhile, yields on three-year bonds came down from 60 basis points to 35 — still slightly higher than the 25-basis-point target.

“The fact that 10-year yields have continued to move higher post the RBA’s announcement suggests that the market is yet to be convinced,” Ms Auld said.

“That three-year bond yields are still about 10 basis points above the stated target seems to imply that the market will judge the central bank on its actions, and not words.”

Greg Moshal, chief executive of non-bank lender and securitiser Prospa, said the intervention into the securitisation market would have “a direct and tangle effect” on Australian jobs and the economy.

“Our government has stepped up and provided that fast response and we stand ready to do the same,” Mr Moshal said.

Capital Economics senior economist Marcel Thieliant said if the spreads on corporate bonds continued to widen, the RBA might eventually have to expand its bond buying program to other sorts of assets. Because the difference between the US short-term business lending rate and official interest rates was the highest since the GFC, Mr Thieliant said there was “a risk that funding costs of Australian banks rise further”, hence the RBA “may eventually decide to buy bank bonds or mortgage-backed securities”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout