Spending goes backwards in NSW and Victoria as RBA rate hikes bite

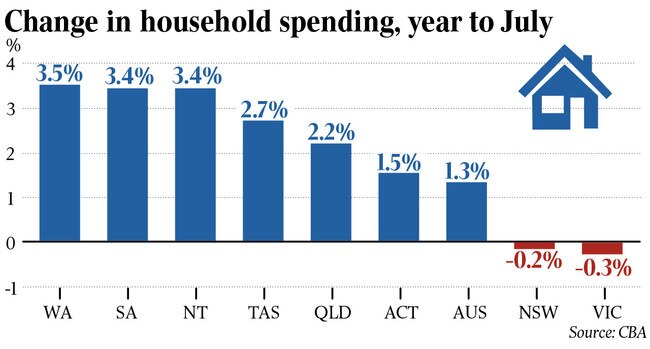

The country’s two most populous states were the only jurisdictions where spending was lower in July than a year earlier, according to a new analysis of household transaction data by CBA.

The Reserve Bank’s aggressive rate hikes are hitting households in NSW and Victoria the hardest, with the country’s two most populous states the only jurisdictions where spending was lower in July than a year earlier.

The inaugural CommBank household spending insights, based on online and card transaction data from the bank’s 7 million customers, showed annual growth in spending nationally has slowed to 1.3 per cent, from a peak of 18 per cent in August 2022.

Overall household spending in NSW and Victoria, however, dropped by 0.2 per cent and 0.3 per cent respectively, in the year to July, with the next weakest a 1.5 per cent increase in the ACT.

CBA chief economist Stephen Halmarick said the data suggested the squeeze from the dozen rate rises since May last year was hitting households hard, and particularly in areas where the debt burden was heaviest.

“The two biggest states, in NSW and Victoria, are going backwards. So I think that’s a pretty significant part of the story,” Mr Halmarick said.

“What will be happening here in the two big states? Well, housing is much more expensive. Inflation has been very high. So people are having to reduce their spending on everything else. And not just housing, but the cost of rent relative to income as well,” he said.

In contrast, spending in WA jumped by 3.5 per cent annually, and 3.4 per cent in South Australia and the Northern Territory, while in Queensland spending was up 2.2 per cent. The report also showed sharply higher spending on insurance and recreation than a year earlier, offset by large falls in household goods and services.

Mr Halmarick said the analysis helped inform his forecast that the RBA was done with hikes and would slash rates by one percentage point next year. Financial markets are pricing in a 65 per cent chance of another move to 4.35 per cent by early next year.

Amid growing evidence of a slowing economy, Anthony Albanese said he would ask Chinese Premier Xi Jinping to scrap the remaining trade restrictions on Australian wine, lobsters and beef when the two leaders next meet, potentially as soon as next month on the sidelines of the G20 leaders summit in New Delhi.

Amid a gradual thawing in the relationship with our largest trading partner, China two weeks ago announced it would remove punitive tariffs on our barley, imposed in May 2020 and which had been the subject of a complaint to the World Trade Organisation.

Last week, China restored Australia as an approved tourist travel destination, and in a speech to the Ai Group on Monday evening, the Prime Minister said the later development “will mean tens of thousands of new holiday-makers visiting Australia, putting millions of dollars into our economy”.

“These are the result of the deliberate, consistent and principled approach we have taken to stabilising the relationship. Looking to co-operate where we can, being prepared to disagree where we must – and always engaging in our national interest,” he said.

Mr Albanese said the resumption of the $900m-a-year barley trade with China was “a huge win for Australian farmers and Australian jobs”.

“It’s also a big win for China. Because – once again – they will be getting access to the best barley in the world. And all those points hold true for Australian wine, Australian lobster and some of our beef exporters as well, where there are still trade impediments in place,” he said.

“We want to see these removed, in the best interests of everyone. And I’ll certainly be taking the opportunity to make that point when I next have the chance to meet with President Xi.”

The Prime Minister in his speech lauded the resilience of the national economy, including the lowest unemployment rate in nearly five decades, alongside a record high proportion of Australians participating in the workforce. “There are encouraging signs that inflation has passed its peak. And wages are growing at their fastest rate in a decade.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout