Retail recession extends to June as cost of living bites

Retail trade volumes recorded their first year-on-year drop in over three decades, outside of the pandemic, confirming a consumer recession.

Retail trade volumes recorded their first year-on-year drop in more than three decades, outside of the pandemic, confirming a consumer recession that is driving a rapid slowdown in the nation’s economy.

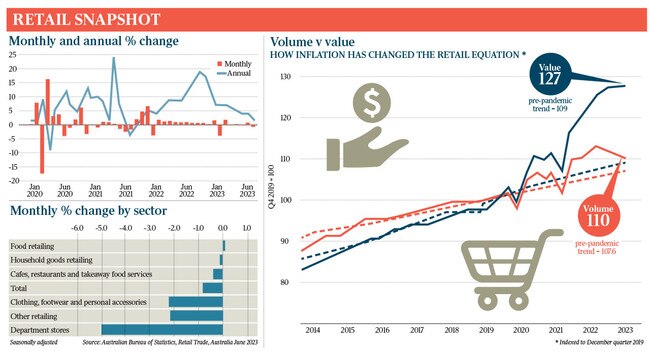

Figures from the Australian Bureau of Statistics revealed a third consecutive quarterly fall in after-inflation spending in the three months to June, as soaring prices triggered a pullback in shopping on essentials and luxuries, as well as in cafes and restaurants, for the first time since the Covid-19 Delta lockdowns in late 2021.

ANZ senior economist Adelaide Timbrell said: “This is more evidence that Australian households are responding to inflationary pressures and rising interest payments.”

As costs soared, the ABS data showed Australians spent more over the three months to June, but bought less.

For example, the quarterly 0.5 per cent fall in retail trade volumes was the result of a 0.4 per cent lift in nominal sales and a 0.9 per cent rise in prices, the ABS said.

That fall followed a 0.8 per cent contraction in March, and a 0.4 per cent drop in the December quarter.

JPMorgan economist Ben Jarman said the result “marks the third consecutive quarterly contraction, an outcome which has happened only once (during the global financial crisis) in the series’ 40-year history”.

Adjusting for inflation, June quarter retail sales were 1.4 per cent down on a year earlier, the seasonally adjusted data showed.

ABS head of retail statistics Ben Dorber said cost-of-living pressures were to blame for the three consecutive quarterly declines – the longest stretch since 2008.

“Outside of the pandemic period, this is the first time since 1991 that sales volumes have fallen compared to the previous year,” Mr Dorber said.

Clothing and footwear sales volumes were the only category to report a rise, of 1.1 per cent, in the quarter, which the ABS put down to end-of-financial-year sales, as prices in the sector fell 1 per cent.

Further evidence of a rapidly cooling economy comes days after the Reserve Bank held rates at 4.1 per cent for the second straight month, citing growing confidence that it would be able to meet is 2-3 per cent inflation mandate over the coming two years.

In a statement accompanying the decision, RBA governor Philip Lowe noted that the economy was “experiencing a period of below-trend growth and this is expected to continue for a while”, and that “household consumption growth is weak”.

However, Dr Lowe signalled that the RBA board believed the slowdown would not tip into a recession.

NAB head of market economics Tapas Strickland noted that despite the falls, retail volumes were still above the pre-pandemic trend, suggesting there was scope for further declines as spending normalised after the Covid boom.

Mr Strickland said the latest numbers should reinforce central bankers’ “concerns of slower growth and suggests the RBA will have to be pulled by the inflation data to hike again”.

In the wake of Tuesday’s decision, a growing number of economists believe that the most aggressive rate rise cycle since the late 1980s is now over.

Westpac chief economist Bill Evans said “rates are now on hold”, even as he noted that the central bank would remain “sensitive” to upcoming inflation reports. “It’s been quite a ride in terms of the last few months … but we think we’ve come out the other end now and we’re looking for a period of rates stability,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout