More than one in 10 unable to pay power bills, NAB survey reveals

One in 10 Australian households are unable to pay a gas, water or electricity bill as the nation’s cost of living crisis worsens.

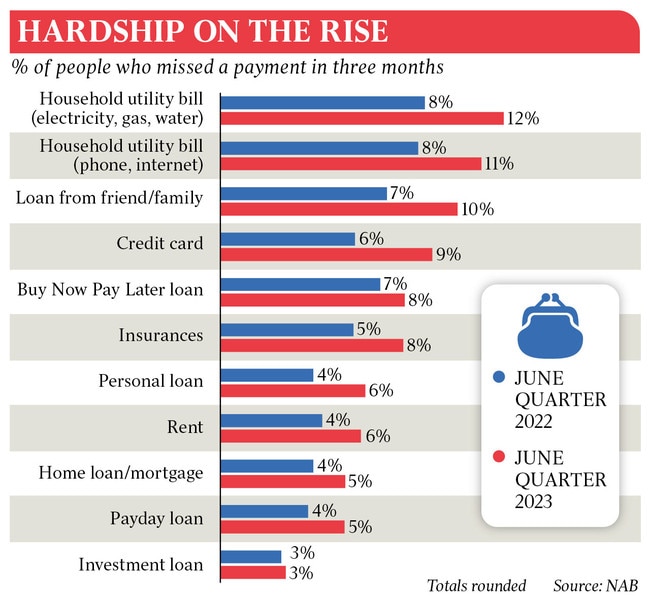

More than one in 10 Australians were unable to pay a gas, water or electricity bill over the three months to June, with a similar proportion saying they missed a payment on their phone or internet due to financial pressures.

The proportion of households reporting trouble making ends meet when it came to utilities bills, at 11-12 per cent, was markedly higher than the 8 per cent reported a year earlier, according to the latest financial hardship survey by major bank NAB.

ANU associate professor Ben Phillips said the share of Australians missing bills in the June quarter was “a bit higher than I would usually expect to see”, as was the 8 per cent reported a year earlier.

“Having said that, electricity bills and gas bills have increased sharply. The general findings that some financial stress was higher than last year is not surprising – a lot of the basics have gone up,” he said.

Monthly consumer price data released on Wednesday showed electricity costs were up 10 per cent to June, and gas prices were up by 22 per cent.

The NAB survey showed 9 per cent of Australians missed a credit card payment in the June quarter, versus 6 per cent a year earlier. The proportion of those who failed to pay an insurance bill lifted from 5 per cent to 8 per cent over the same period.

Inflation figures released on Wednesday showed a sharper than expected drop in inflation, from 7 per cent in the year to March to 6 per cent in June, providing scope for the Reserve Bank to hold the cash rate at 4.1 per cent for the second straight time at next Tuesday’s board meeting.

While the disinflationary trend now appears entrenched, prices for key essentials, such as utilities, food and rent remain higher than the headline figure and, in some cases, are accelerating.

There was better news in NAB’s survey on the resilience of indebted homeowners, with the share of borrowers saying they missed an repayment barely budging over the year to June, lifting from 4 per cent to 5 per cent.

Mr Phillips said despite the sharp increase in home loan costs over the past year, he was not surprised that the share of borrowers missing interest payments had remained broadly steady.

“Mortgage costs have increased very sharply, but they are coming off very low rates for a couple of years or so. A lot of people were probably able to save some money and get ahead on their repayments, so there would be a bit of buffer to get them through,” he said.

But Mr Phillips said interest rates had only reached high levels in 2023, and it remained an open question whether more homeowners would fall behind on their payments over the coming year, particularly should unemployment rise meaningfully from its near 50-year low of 3.5 per cent.

It was also the case that Australians typically met their housing obligations first.

“You pay your mortgage or rent, and then everything else is secondary to that,” he said.

The proportion of renters missing a payment in the June quarter also increased only modestly despite the rapidly rising costs, from 4 per cent to 6 per cent.

Treasurer Jim Chalmers this week confirmed that the Commonwealth would record a surplus of more than $20bn in the recent financial year, putting the nation’s finances into the black for the first time in 15 years.

Small businesses and an estimated 5 million households will receive hundreds of dollars off their next power bill, in a $3bn policy announced in the May federal budget, to be co-funded with the states and territories.

But the Treasurer said the Albanese government has no immediate plans for further cost of living relief, although he noted the better financial position could leave room for more assistance if required in “future budgets”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout