Philip Lowe: we are on way to taming inflation as RBA holds rates again at 4.1pc

RBA governor Philip Lowe has signalled growing confidence that the central bank was on the ‘narrow path’ that would bring inflation back under control without tipping the nation into recession.

Reserve Bank governor Philip Lowe has declared the nation is on track to bring inflation under control as higher interest rates work to slow the economy, allowing the central bank to hold rates at 4.1 per cent for a second month.

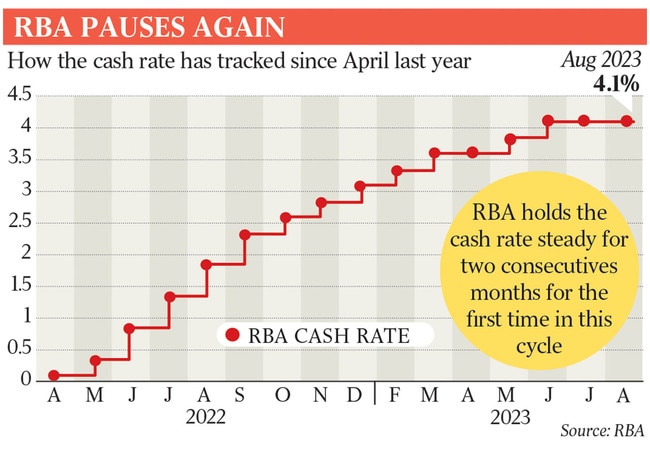

The RBA’s move prompted economists to question whether the most aggressive rate hike cycle in a generation – a rise of 400 basis points in 13 months – was at an end.

As Jim Chalmers said in parliament the RBA decision would be greeted with a “sigh of relief around Australia”, Dr Lowe said the punishing run of 12 rate rises starting in May last year was “working to establish a more sustainable balance between supply and demand in the economy and will continue to do so”.

Consumer price growth at 6 per cent was “still too high”, he said, but “the recent data are consistent with inflation returning to the 2–3 per cent target range over the forecast horizon and with output and employment continuing to grow”.

“In light of this and the uncertainty surrounding the economic outlook, the board again decided to hold interest rates steady this month,” he said. “This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook.”

Dr Lowe did not rule out that the rates reprieve could prove short-lived, saying there were “significant uncertainties” clouding the outlook.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon the data and the evolving assessment of risks,” he said.

Despite Dr Lowe’s warning, a number of economists said it was possible rates had peaked for now, while others trimmed their forecasts from two more hikes to one over coming months.

Capital Economics economist Abhijit Surya said that “while the board continued to strike some hawkish notes, there is a good chance that its tightening cycle is already over”.

CBA senior economist Belinda Allen said “our base case now is for the RBA to be on hold at 4.1 per cent for an extended period … although we acknowledge that the risk remains for another rate hike based on the forward guidance and the resilience in the labour market”.

Tuesday’s decision to hold rates will offer some comfort to mortgage holders paying up to 50 per cent more in loan repayments than they were in April last year.

Immediately following the announcement, the Treasurer said the rates pause would be “a welcome reprieve for Australians who are doing it tough enough”.

“There will be a sigh of relief around Australia, but people are still under the pump,” Dr Chalmers said. “We know that inflation in our economy is coming off but it’s still too high.”

Deloitte Access Economics partner Stephen Smith said the RBA had made “the right call” for Australia. “There is still work to be done to combat inflation, but that can no longer be achieved through higher interest rates,” he said. “Supply side inflation needs to be tackled through fiscal policy, investment and innovation to lift productivity, competition policy to improve efficiency, and tax policy to boost prosperity.”

Dr Lowe flagged that this Friday’s Statement on Monetary Policy would reveal a largely unchanged economic outlook. Inflation would reach 3.25 per cent by the end of next year, and would “be back within the 2-3 per cent target range in late 2025”.

Recent data was “consistent” with the central bank achieving its mandate, he said.

Still, the Australian economy was experiencing a period of “below-trend growth and this is expected to continue for a while”.

The labour market remained “very tight”, and the projected sub-par growth would see unemployment climbing from 3.5 per cent to about 4.5 per cent late next year. The economy would grow by about 1.75 per cent through 2024 – again, consistent with the bank’s May forecasts. The RBA governor, in his second last board meeting before he is replaced by deputy governor Michele Bullock in mid-September, said wages growth had picked up in response to the tight labour market and high inflation.

Economists believe only about three quarters of the hikes to date have hit mortgage holders, due to a massive overhang of fixed-rate mortgages and the two to three months it takes for RBA decisions to flow through to interest payments on variable home loans.

Among the “significant uncertainties” in the RBA’s outlook were the potential stickiness of services inflation as well as lags between cash rate moves and their impact on the economy. The bank also remained unsure how firms’ pricing decisions and workers’ wage claims would respond to a slowing economy when the jobs market remained so tight.

“The outlook for household consumption is also an ongoing source of uncertainty,” Dr Lowe said. “Many households are experiencing a painful squeeze on their finances, while some are benefiting from rising housing prices, substantial savings buffers and higher interest income.”

The RBA decision came as the surprise property market rebound extended into July despite soaring interest rates, which have driven a roughly 30 per cent drop in borrowing capacity.

Home values across the eight major cities rose 0.16 per cent in July, PropTrack data showed.

But Australian Bureau of Statistics figures showed new home lending for owner-occupiers dropped by 2.8 per cent in June, excluding refinancing. This was partially offset by a 2.6 per cent increase in investor commitments.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout