RBA warns of more rate pain if we don’t lift productivity

The central bank has warned that our woeful productivity means inflation might stick around, stronger for longer, and that’s going to hurt everyone.

The Reserve Bank has warned Australia’s productivity slump could entrench high inflation, leading to extra interest rate hikes, job losses and stagnant living standards, as it foreshadows two more years of financial hardship for families.

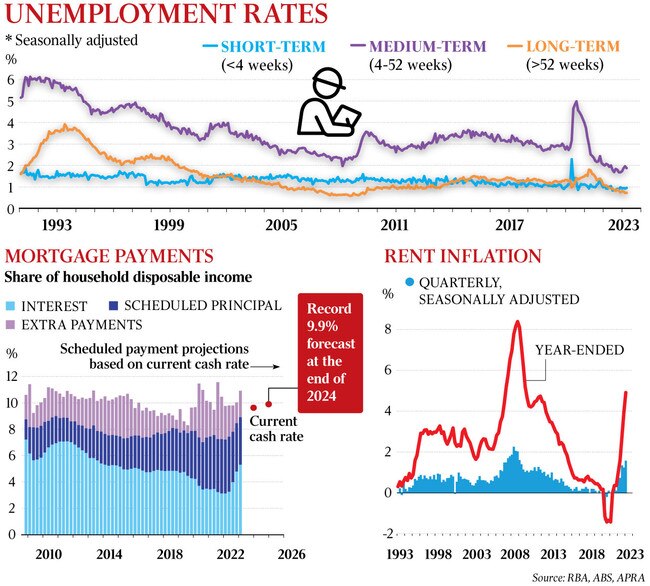

Days after it shocked home borrowers and businesses by raising its cash rate target to 3.85 per cent, the central bank said soaring rents, persistent energy inflation and a rising tax take from bracket creep would squeeze household disposable income, which fell by 3 per cent last year.

The RBA’s quarterly Statement on Monetary Policy, published on Friday, forecasts sluggish growth until the middle of 2025, but notes the controversial stage-three tax cuts from July next year will help to revive consumer spending at a time when mortgage repayments balloon to a record 9.9 per cent of disposable income.

“Inflation could turn out to be more persistent if productivity growth remains weak, the high inflation environment leads to firms expanding margins as their costs ease, there is greater feedback between higher prices and wages than expected, or if rents increase by more than expected,” the RBA statement reads.

In recent weeks, RBA governor Philip Lowe has zeroed-in on Australia’s woeful productivity performance in a messaging campaign that rallies governments, businesses, unions and workers to lift their collective game and embrace reform.

Dr Lowe told the National Press Club before Easter that raising productivity and boosting the economy’s “supply side” would help the central bank return inflation to target while preserving recent employment gains.

This week in a speech in Perth, he said: “We need to put our shoulder to the wheel here and do what we can to lift productivity growth because that’s the only way we can have faster growth in real wages.”

Jim Chalmers told The Weekend Australian Tuesday’s budget will feature an in-depth look at long-term structural shifts, “lay the foundations for another generation of growth”, and provide targeted help on living costs.

“So, we want to see people through and we want to set the country up, and those are the two jobs of the budget,” the Treasurer said.

The latest RBA statement, coming after a five-year review by the Productivity Commission in March, refers to productivity a dozen times. In its February statement, productivity was not mentioned at all, and only once in November.

The RBA said consumer inflation, now at 7 per cent, peaked in December, and will ease to the top of its 2 to 3 per cent mandate by mid-2025.

The central bank expects wages to be growing by 4 per cent by the end of this year, but is worried that if productivity does not accelerate, rising employee costs would stoke inflation, particularly in service industries.

“With productivity growth very weak over 2022, growth in unit labour costs was around multi-decade highs,” it said.

Westpac chief economist Bill Evans said “this dynamic is worrying” and “a considerable source of frustration” for the RBA board.

“Their policy instrument, interest rates, is doing its job in restraining demand as demonstrated by the significant downward revisions (from the already modest forecast pace) to household spending and investment growth,” Mr Evans said.

“But has had no real success in easing pressures in the labour market or, as is to be expected, boosting productivity.”

The rule of thumb is with wages growing at 3.5 per cent, for instance, productivity needs to be growing by at least 1 per cent for inflation to be in the middle of the RBA’s target band.

The RBA said its new forecasts “require productivity growth to increase to the relatively slow rates recorded in the years preceding the pandemic”, which averaged 1.1 per cent in the decade to 2020, the slowest rate in 60 years.

“Productivity growth is currently weaker than this, and that weakness could persist; that said, the effects of the pandemic have made it difficult to discern the underlying trend.”

In the six decades to 2020, annual productivity growth averaged 1.8 per cent.

The commission has estimated income per person would have been $11,500 higher had we maintained that record. Put another way, average per capita incomes would have been one tenth higher had faster productivity persisted.

The RBA has forecast growth in gross domestic product by the end of the year to slow to 1.2 per cent, from 2.7 per cent in December, with GDP per capita (a proxy for living standards) declining due to the migration surge.

With the population soon to be growing by 2 per cent, Commonwealth Bank head of Australian economics Gareth Aird said the bank’s and RBA’s “forecasts for GDP in 2023 imply a per capita recession”.

“We expect the economy to slow more quickly than the RBA does from here,” Mr Aird said.

ABS figures on Friday showed lending for new housing rose by 4.9 per cent in March, the first increase since January 2022.

The RBA said things would improve next year as “a pick-up in real household disposable income growth is supported by lower inflation, as well as the legislated ‘Stage 3’ tax cuts from mid-2024”.

Following 11 hikes in official interest rates over the past year, the RBA said “many households are experiencing a painful squeeze on their budgets, in part because of the fast pace of the rate increases”.

The statement noted that lower-paid workers, “who tend to spend more of each extra dollar than those on higher incomes”, had especially benefited from the very tight labour market.

But it saw a number of “headwinds” ahead for consumer spending, including a 3 per cent. after-inflation decline in household disposable income last year.

“While that decline largely reflects rising consumer prices, higher taxes as a share of income have also contributed as gross nominal incomes have risen relative to income tax thresholds,” the RBA said. “Higher net interest payments are expected to put increasing pressure on household budgets as fixed-rate loans expire and cash rate increases are passed through to borrowers’ payments with a lag.”

Real household net wealth fell by 10 per cent over 2022, driven by lower housing prices. But consumer spending is set to improve next year, with the stabilisation in house prices and “as the effect of the earlier monetary policy tightening wanes and the cash rate decreases, inflation moderates, household wealth recovers and tax cuts support disposable income”.

In an additional analysis, the RBA examined company profits and declared price gouging by business was not responsible for decades-high inflation, contrary to ACTU claims.

“If rising domestic profit margins were a significant independent driver of inflation, profits would instead have increased significantly relative to labour income over the past year,” the statement said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout