RBA stuns with 11th rate hike since May last year to curb inflation

The RBA has stunned markets and home borrowers by raising its cash rate, warning of the risks of entrenching high inflation.

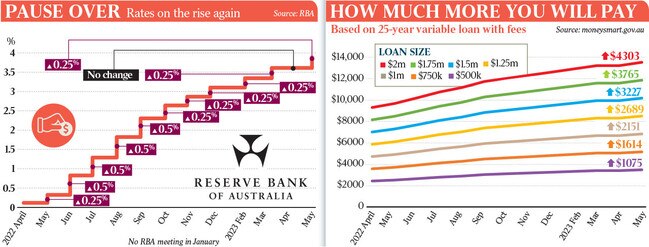

The Reserve Bank stunned financial markets and home borrowers on Tuesday by raising its cash rate by 25 basis points to 3.85 per cent, warning that a rapid rise in wage costs amid low productivity growth risked entrenching high inflation.

It was the 11th hike in official interest rates since April last year, with RBA governor Philip Lowe stating “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame”.

The sharemarket plunged to a six-week low and bond yields rose after the announcement, given financial market participants were expecting the central bank to maintain the “watch and wait” posture it assumed last month.

At the prevailing cash rate, a household with an average $600,000 home loan will have seen a $1300 rise in their monthly repayments over the past year.

Jim Chalmers said in Canberra it was “a really difficult decision for a lot of Australians who are already under the pump” and that inflation remained the primary challenge in the economy.

The Treasurer said next Tuesday’s budget would contain a cost-of-living package focused on “the most vulnerable Australians”.

“What we will try and do there is to make sure that the relief that we provide will be meaningful but won’t add substantially to this inflation problem that we’ve got in our economy,” Dr Chalmers said.

The RBA board is now more concerned about rising wage costs in the services sector and stagnant economy-wide productivity, even as the central bank expects economic growth to slow to an insipid 1.25 per cent this year and the jobless rate to rise to 4.5 per cent in two years.

In a speech in Perth on Tuesday evening, Dr Lowe said: “High inflation makes life difficult for people and damages the functioning of the economy. If high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.”

The RBA governor said that while the peak in inflation was behind us, it would take another two years for inflation to return to the bank’s mandated target range of 2 to 3 per cent.

“Services and energy price inflation is still high and likely to remain so for some time,” Dr Lowe told the dinner. “Looking overseas, we see worryingly persistent services price inflation. It is possible that circumstances might be different here in Australia, but the experience abroad points to an upside risk, especially given the high degree of commonality across countries in inflation dynamics recently.”

In his post-meeting statement, Dr Lowe also noted unit labour costs were also rising briskly, with productivity growth remaining subdued. “Wages growth has picked up in response to the tight labour market and high inflation,” he said. “At the aggregate level, wages growth is still consistent with the inflation target, provided that productivity growth picks up.

“The board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the historically low rate of unemployment. Accordingly, it will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms.”

KPMG chief economist Brendan Rynne said wages pressure, including the expected pipeline of increases in the public sector and via the upcoming Fair Work Commission minimum wage decision, would be maintained in the near term and was “likely to come from across the board”.

“The continuation of wages growth around 4 per cent per annum without a corresponding increase in productivity means these input costs are directly adding to inflationary pressures in a circular fashion,” Dr Rynne said.

“It would seem the RBA has recognised this as well and acknowledged that it will struggle to have inflation returning to the target band for at least another two years, even with some further increases in the cash rate.”

Ai Group chief executive Innes Willox said the RBA’s moves needed to be backed up by restraint in price setting and wage negotiations of businesses, governments, regulators and employees” as the economy stalled. “With the minimum wage case being determined over the next few weeks, the clear message is that wage restraint is now more important than ever,” he said.

ACTU secretary Sally McManus said the RBA had made the wrong call and accused companies such as Qantas of price gouging. “Working people are under immense pressure and this will make it worse,” she said.

Deloitte Access Economics head Pradeep Philip said the latest rate increase showed the RBA was “still playing recession roulette”.

“As the RBA statement notes, despite record low unemployment, wage growth has not spiralled and is still consistent with the inflation target,” Dr Philip said.

“With the recent independent review into the RBA reminding Australians that full employment sits alongside price stability in the bank’s mandate, it is important that the RBA exercises caution on rate rises until it has seen the impact of the last 10 fully pass through the economy.”

Ahead of the board meeting in Perth, financial markets priced in a virtually zero chance of a 0.25-percentage-point increase and most economists expected rates to remain steady after recent confirmation inflation was easing.

One of the few expecting Tuesday’s rate hike, Commonwealth Bank head of Australian economics Gareth Aird, said 3.85 per cent would be the peak in the cash rate in this cycle. “We continue to look for rate cuts in late 2023 as we believe inflation will fall more quickly than the RBA currently anticipates. And that the unemployment rate will lift more sharply,” he said.

The central bank is expecting even weaker economic growth this year of 1.25 per cent, down from a 1.6 per cent call in February, as the global economy slows, and a rise in the unemployment rate to 4.5 per cent in two years, from its current 3.5 per cent, a near 50-year low. Dr Lowe said inflation was expected to be 4.5 per cent in 2023 and 3 per cent in mid-2025.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout