Trade war will test US exceptionalism: Orbis

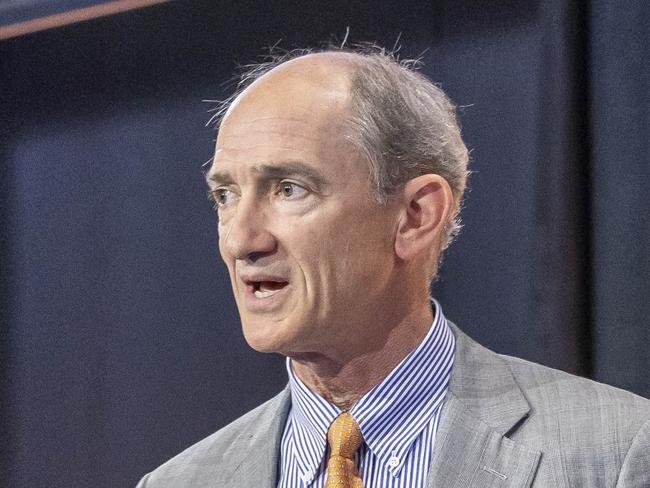

Contrarian investor Alec Cutler thinks US exceptionalism will be put to the test as markets increasingly realise that Donald Trump now cares less about the stock market and economy.

Contrarian investor Alec Cutler thinks US exceptionalism will be put to the test as markets increasingly realise that Donald Trump now cares less about the stock market and economy.

Despite a shock fall in employment in February, the central bank is unlikely to deliver back-to-back rate cuts.

If the WiseTech boss was another chief executive, he’d be long gone. Instead, a weak board had delivered a predictably weak response to his actions.

A recent revival in household consumption is set to last, the Reserve Bank’s chief economist Sarah Hunter says, even as some economists say spending growth might have been driven by heavy discounting.

OneSteel was never really a business under Sanjeev Gupta’s ownership. Steelmaking was just a by-product of the magnate’s financial engineering.

Administrators will turn their investigation to the ‘complex web’ of deals between the magnate and the collapsed steelmaker.

Australia’s growth forecast for next year has been downgraded as volatile international economic conditions fuelled by Donald Trump’s tariffs threaten to stoke global inflation, a new OECD report reveals.

A series of cascading executive moves in one day, including a high-profile defection, are reshaping the top of the nation’s banks.

The extraordinary price action among investments as diverse as bitcoin or Telsa had to come to an end, and here’s why.

Australia’s economic policy architecture remains ill-prepared for a more fractured, contested and shock-prone world. Whether we like it or not, we need to construct our own variant of whatothers have called the economic security state.

Throughout the history of food trade, tariffs have followed. That’s why its worth listening to the cooler heads at the farm gate.

The Treasurer faces a backlash from his own state after its GST allocation was slashed by $2.4bn.

Sharemarket turmoil and a grim outlook for investment returns is prompting many to question what effect all this will have on their superannuation.

‘Anything over 300km should be on a rail’: NFF boss hits out at supply chain standards. ‘The government is right and Bill Shorten is wrong’ on retaliatory tariffs: top economics adviser. Will consumers pay $8 for coffee?

Westpac chief executive Anthony Miller says the best answer to Donald Trump’s tariffs is to engage more with the rest of the world, rather than a retaliatory response to the US.

The boss of big-four bank NAB has more skin in the game than most in Donald Trump’s tariff war. There are also lessons for Australia out of this.

Setting up a super system for the accumulation phase is easy compared with the demands of supporting members in retirement, an industry expert says.

Cream, cheese, yoghurt and milk are increasingly finding their way into Chinese shopping trolleys, which creates a significant opportunity for Australian dairy producers.

Angus Taylor’s claim to have unveiled 34 economic polices in this term of parliament extends to taxpayer-funded mental health sessions, regulating vaping, increasing student visa costs, investing in ovarian cancer research and reducing the refugee intake.

It’s clear US President Donald Trump isn’t backing down from his aggressive trade policies despite sharp drops by stockmarkets, meaning shares could be in for even bigger falls.

Australian stocks turn down after an early rise. Morgan Stanley cuts ratings on Australian stocks. Nine appoints Matthew Stanton as CEO. ACCC finds issues with DP World’s acquisition of Silk. Boss buys stake in uranium player.

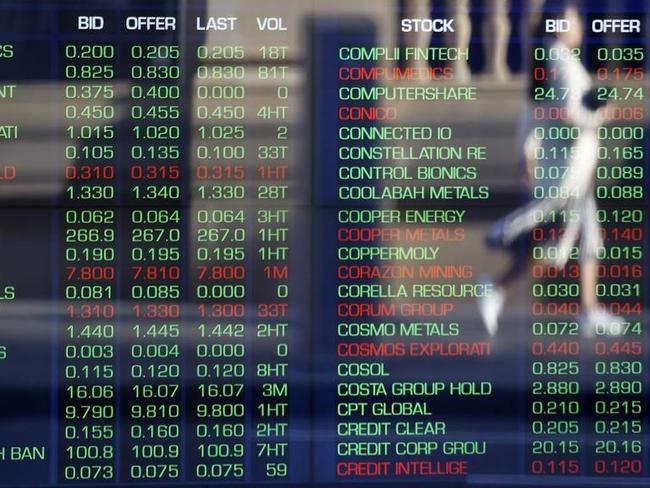

Investors wipe $36bn off the local market and push the ASX 200 to the brink of a “correction” as Wall Street tumbles continues to tumble. No exemption for tariffs on Australian steel, aluminium sent to US. Corporate regulator sues super giant.

Peter Dutton has intensified his threat to break up major insurers for anti-competitive behaviour, as the opposition messaging on its forced-divestiture policy appears increasingly muddled.

The Tarascio family has sold off a prime Melbourne site where it had planned a luxury tower for more than a decade, as financial conditions in Victoria sour.

If the first casualty of trade wars are markets, Donald Trump’s tariffs are a stunning form of economic self-harm.

Australian stocks trimmed half of a sharp intraday fall as US futures rebounded after recession fears hit Wall Street. Brookfield begins Healthscope sale process. Brickworks takes a writedown on US operations. Polynovo shares drop after CEO sent packing.

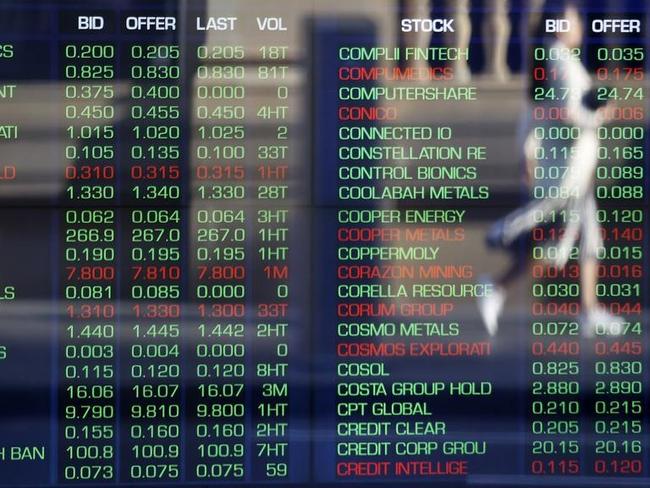

It’s the most uneven match up. Canada is betting it all on a former central banker with almost no political experience to take on Donald Trump’s tariffs.

Salter Bros understood to be leading race for Star’s Sydney hotel, as casino group reviews Bally’s last-minute offer. Stocks lift from six-month lows. Energy sector leads gains. Johns Lyng dives.

Project Antares was the radical plan CEO Steve McCann had quietly been working on for months. It fell into place just as the casino was about to run out of cash.

With Australia’s productivity performance in recent years dismal, policymakers should focus on areas of reform that could help to lift productivity and support new growth engines.

Original URL: https://www.theaustralian.com.au/business/economics/page/4