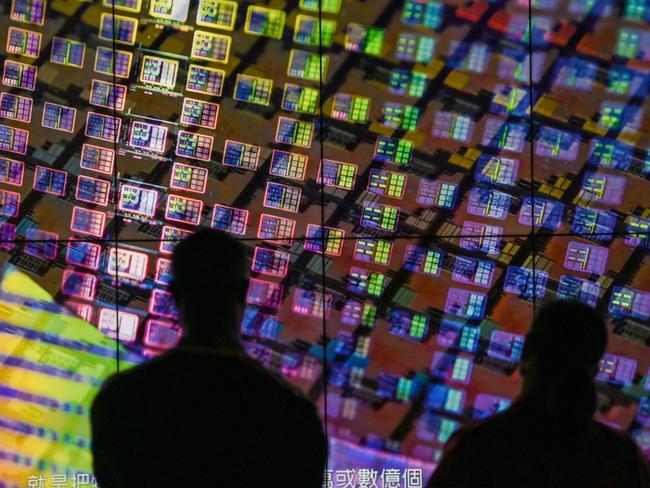

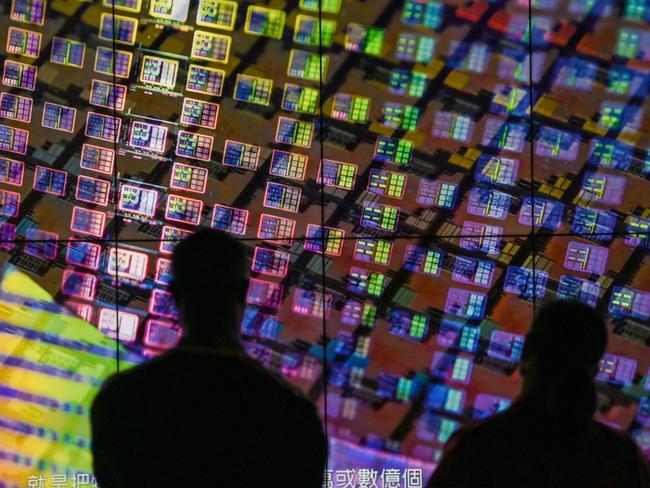

Chips on the table: Taiwan braces for a new era of Trump

Taiwan’s $100bn semiconductor industry is bracing itself for a possible Trump election victory, uncertain about what it could mean for one of the world’s most successful businesses.

Taiwan’s $100bn semiconductor industry is bracing itself for a possible Trump election victory, uncertain about what it could mean for one of the world’s most successful businesses.

Hosing down accusations that Labor was undermining the Reserve Bank’s inflation fight, governor Michele Bullock insisted surging public spending was not the main game.

Canberra is not off the hook for its expansionary budget when inflation is public enemy No. 1.

South Australia is clearly the region showing most urgency in mobilising towards the industrial and economic change needed to see AUKUS succeed. But our whole nation needs to step up, too.

ASX’s chairman got $550,000, its now CEO got $3.8m and others such as the chief risk and finance officers were paid as though the unfolding train wreck is nothing more than a technical glitch.

Unemployment lifted to 4.2 per cent in July despite an extra 58,200 people finding work, with economists saying it further dimmed the chances of an RBA cut being delivered this year.

China’s official figures show steel production in July was down 9 per cent on the previous month due to subdued demand, placing pressure on Australia’s iron ore producers.

With Reserve Bank governor Michele Bullock all but ruling out a rate cut this year, new jobs figures are likely to affirm the view that the central bank will keep the cash rate firmly on hold.

A rising flood of company failures and a spike in bad loans are on the horizon across the country in the coming 12 months, with Queensland most at risk amid soaring construction costs.

Research commissioned by Squadron Energy concludes Australia’s transition to renewable energy will provide more than $68bn in benefits and generate 20,000 new jobs.

As Australia-China relations improve, companies from Treasury Wine to Goodman Group will give insight into the new settings for business.

As one of the most expensive big banks in the world, the pressure was always going to be on CEO Matt Comyn to deliver some extraordinary numbers.

The homegrown drug company wants to be known as a smart manufacturer as much as for its role in helping to save lives.

The ongoing drug shortage means sick kids are receiving second-tier chemo, surgeries are being cancelled because of IV fluid shortages and ADHD meds are in short supply.

Deputy governor Andrew Hauser warns against ‘overconfidence’ on interest rates that could cause ‘poor analysis and decision-making that could harm the welfare of all Australians’.

For those that haven’t heard of homewares retailer e&s, megabrand JB Hi-Fi is about to change all that. This is why.

Surging living costs threaten the affordability of life insurance for millions of Aussies, as confusion and misunderstandings hurt too.

Despite conflict in the Middle East and Ukraine, the drivers of last week’s sharemarket sell-off are based on economics and earnings, not geopolitics.

Market corrections are normal and there’s no need to be terrified each time one hits, says veteran stockbroker Richard Coppelson – and he’s not a lone voice.

For brands like Netflix, Disney and Paramount, the era of peace in global streaming is delivering almost as much upheaval as the costly war.

Original URL: https://www.theaustralian.com.au/business/economics/page/30