The week the banks turned mean

Cushioned by government support, Australia’s big banks are cutting their deposit rates for savings accounts and crushing their last remaining competitors.

Cushioned by government support, Australia’s big banks are cutting their deposit rates for savings accounts and crushing their last remaining competitors.

There’s only one rule that billionaire investor Howard Marks says is worth following during market selldowns, and it holds true for rallies too.

Jim Chalmers will retain the power to override Reserve Bank decisions and there will be continuity on the board that sets interest rates, under a compromise offered by the Albanese government to secure Coalition support.

Private companies will face increased scrutiny as their ‘opacity presents an outsized risk’, says ASIC as it sets out its targets for the year ahead.

The reporting season has revealed a sharper picture of the economy, with consumers desperately trying to preserve their standard of living while anxiously awaiting an interest rate cut.

The probability of falling interest rates mean it’s time to get back into real estate assets and listed shares, says HMC Capital founder David Di Pilla.

The incoming Perpetual chief executive has form in bringing big lumbering organisations together. Can he also pull them apart?

Banks just don’t need savers like they used to thanks to more than $200bn in government funding from the height of Covid-19 underpinning their ability to cut deposit rates.

They may not be the biggest names on the ASX but companies like ARB, that was founded by a band of brothers in Melbourne’s suburbs, are seriously delivering for investors.

The regional lender has begun consulting with employees as it looks to axe as many as 600 roles as part of a simplification and digitisation drive, according to sources.

Calls for sugar taxes, ad bans on certain foods and gambling, and plain packaging in the lolly aisles would each be damaging but collectively could be devastating for small and large businesses.

The RBA minutes contain a slapdown for financial markets pricing in a rate cut by the end of the year, as it’s revealed how close the board came to increasing the cash rate in August.

Steve Johnston has a once-in-a-generation chance to rebuild his insurer from the ground up. He just needs to bring investors along.

A sharp fall in the iron price, spurred by weak Chinese demand, threatens to stymie Jim Chalmers’s efforts to deliver a third consecutive budget surplus.

As calls grow to expand regional and rural tax breaks, David Littleproud hints the opposition is considering changes to the zonal tax system.

National Australia Bank boss Andrew Irvine has an interesting take on how the nation’s economy is faring, and it’s a two-part story with some real pockets of pain.

Wall Street seems hopeful that Powell and the Federal Reserve will secure a soft landing, but the tightening won’t end here.

Meta has been accused by Westpac of failing to deal with a scam and fraud epidemic, with the big four bank taking aim at the tech player for failing to deal with fake posts.

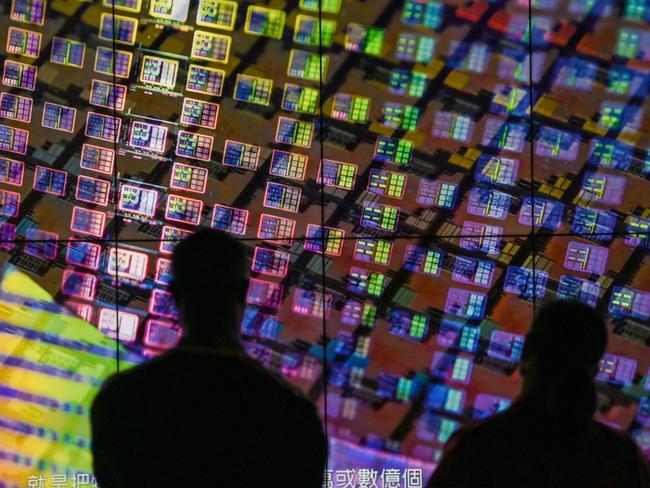

Taiwan’s $100bn semiconductor industry is bracing itself for a possible Trump election victory, uncertain about what it could mean for one of the world’s most successful businesses.

Hosing down accusations that Labor was undermining the Reserve Bank’s inflation fight, governor Michele Bullock insisted surging public spending was not the main game.

Original URL: https://www.theaustralian.com.au/business/economics/page/29