Taiwan braces for impact of a Donald Trump win on global chip industry

Taiwan’s $100bn semiconductor industry is bracing itself for a possible Trump election victory, uncertain about what it could mean for one of the world’s most successful businesses.

Taiwan’s $100bn semiconductor industry is bracing itself for a possible Trump victory, uncertain about what his policies could mean for one of the world’s most successful businesses and the global chip supply chain.

Australia, with security ties to the US as its major ally and economic ties with China as its major trading partner, is keeping a close eye on the tectonic shifts in the sector.

Donald Trump has made it clear he does not feel as bound to support Taiwan as strongly as US President Joe Biden, who declared the US would come to Taiwan’s aid if it were attacked by China.

Mr Trump’s comments that Taiwan is a long way from the US and that the island needs to spend more on its own defence have increased uncertainty over its long-term security at a time China’s activities in the South and East China seas are causing concern.

In a recent interview with Bloomberg, Mr Trump accused the Taiwanese semiconductor industry – which supplies more than 90 per cent of the world’s high-end chips – of stealing intellectual property from the US. This is expected to increase pressure on Taiwanese companies, particularly the giant TSMC, to set up more production plants in the US.

In recent interviews, Mr Trump said of Taiwan: “They took all of our chip business. We should have never let that happen.”

He also pointed out that Taiwan was “immensely wealthy”, implying that it should be prepared to spend a lot more on its own defence.

Readers of the Taipei Times were warned recently to “brace for potentially tougher trade hurdles if former US president Trump is re-elected”. It warned that Mr Trump would aim to “target China and other countries with new or higher tariffs to restore the US economy to its former glory”.

“Taiwan might not benefit from a new US administration under Trump and could face new tariffs on technology projects and other items,” it said.

Publicly, Taiwanese officials are taking a diplomatic approach to the potential new US president, who could have a powerful influence on their nation’s economic prosperity and security from next January.

Taiwan’s Economic Affairs Minister, J.W. Kuo, said Mr Trump’s remarks were not anti-Taiwan and were no cause for alarm. He said Mr Trump’s remarks had come from his concern that the US should not have to pay for the cost of being policeman to the world.

“Trump is a businessman who weighs things in terms of cost, and for him the US cannot bear the cost of being the world’s policeman all by itself,” he said. He said Mr Trump had probably been “misled” into thinking Taiwan had snatched the US chip business.

“My personal view is that this has to do with our insufficient efforts lobbying Washington.”

But privately, senior figures in Taiwan are worried about having to deal with Mr Trump if he returns to the White House.

Economic success

Former Australian diplomat Kevin Magee, who headed the Australian representative office in Taipei from 2011 to 2014, told The Australian that senior people in Taiwan were concerned about Mr Trump’s unpredictability and were uncertain about what policies he might implement and how they would affect the semiconductor sector, which is one of the cores of Taiwan’s economic success.

He points out that in late 2016, just after he was elected president, Mr Trump took a phone call from Taiwan’s new president Tsai Ing-Wen and foreign minister Joseph Wu, a show of support for Taiwan which was almost unprecedented following the US’s recognition of Beijing in 1979. “No other American president has ever spoken directly with the Taiwanese president,” Mr Magee said.

On the other hand, he said, Mr Trump’s America First approach had him put pressure on TSMC, Taiwan’s leading semiconductor company, to set up a production plant in the US. The company is building a factory in Arizona but progress has been slow, and many Taiwanese with knowledge of the industry privately criticise what they see as the US’s lax work ethic and the much higher cost of production compared to their industrious island.

“The people around Trump (when he was president) put pressure on the Taiwanese and they gave in almost immediately,” Mr Magee said. “They said: ‘OK. We’ll build a factory just to get him off our backs’.

“They started building it, but they are finding real problems because they (the Americans) are not as efficient as the Taiwanese and the US has union labour.

“They are building a multibillion-dollar factory in Arizona, but Trump might want more.”

Some argue that Taiwan’s key role in the global semiconductor industry provides it with a “silicon shield” – meaning that its role is so critical in the global supply chain that Western powers would be forced to defend Taiwan if it was attacked.

But Mr Magee points out that there are forces in the Republican Party who argue that the world is far too dependent on the high-end chips coming from Taiwan, particularly after the explosion in demand for chips for artificial intelligence, and that it would be safer for the world to relocate the high-end production of chips out of Taiwan.

“In an ideal world, Trump would probably like to close all the plants in Taiwan and move them to onshore US,” he said.

Marina Zhang, associate professor at the Australia-China Relations Institute at Sydney’s UTS, said a Trump election in November “would have significant geopolitical implications, especially for Taiwan”.

“Taiwan’s crucial role in geopolitics and advanced semiconductor manufacturing underscores the risk of a new Cold War, potentially leading to a technological ‘iron curtain’ that could disrupt semiconductor supply chains and the sustainability of the entire tech industry,” she said.

“The fallout might result in bifurcated technological standards and networks, fragmenting the global economy. While Australia is not a major player in the global semiconductor industry, it is strategically positioned between the US and China.”

Potential twist

Dr Zhang warns that if China ever gained control over Taiwan, “it could potentially impose an embargo or demand exorbitant fees for semiconductor supplies to democratic nations”.

Another potential twist concerns what a possible president Trump might decide to do with Biden administration legislation introduced in 2022 seeking to ban the sale of high-end chips to China, including by companies outside the US.

On the one hand, it could be that Mr Trump continues the policy as part of a trade war with China. The regulations have angered many in the semiconductor supply chain who have made money from selling to China.

Some speculate that Mr Trump could relax the policy if it could be used as some form of bargaining chip with China for a concession that might benefit US industry, or as a favour to some of his supporters in Silicon Valley.

“What might make a big difference is where he (Mr Trump) goes on US chip controls against China,” said John Lee, a director of the consultancy East West Futures based in Berlin, who is a former senior analyst at the Mercator Institute for China Studies and an official with the Australian Departments of Defence and Foreign Affairs and Trade.

Such is the unpredictability of Mr Trump that he could go in two opposite ways, “either striking a deal to relax the controls (which will receive strong resistance within the US system) or going nuclear, e.g. by banning all chip-related exports to China.”

“I can’t see the latter happening in practice, since the US semiconductor industry leaders are still (despite the stricter controls) heavily dependent on selling to China and will strongly resist this.”

He argues that the crucial role of Taiwan in the global supply chain will continue to be one of the critical factors.

“The reality is that despite growing political pressures on the chip supply chain, it is difficult to shift activities quickly, since the technologies involved are complex and the current international specialisations have evolved over decades,” he said.

“Everyone in the global industry is probably stuck for years to come in the geopolitical dilemma of Taiwan being such a key link in the global chip supply chain.”

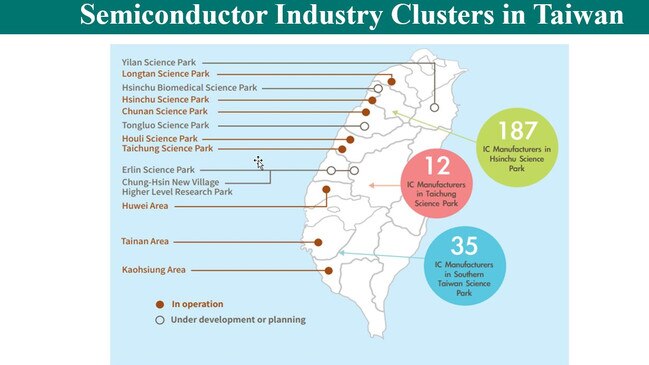

The success of Taiwan’s semiconductor sector goes back to the 1970s, when Taipei realised that the Western world, including Australia, was shifting towards recognising the regime in Beijing under a heavily nuanced “One China Policy”.

Taiwanese officials began to look at ways to boost their economic and industrial resilience, setting up the Industrial Technology Research Institute in 1973.

The institute recruited Chinese-born, MIT-trained engineer Morris Chang from the US, where he had been working at Texas Instruments, in 1985.

Mr Chang went on to establish the Taiwan Semiconductor Manufacturing Company, the world’s first dedicated semiconductor foundry, in the Hsinchu Science Park, an hour’s drive southwest of Taipei, in 1987.

He is now one of Taiwan’s national heroes, and hailed globally for his success in developing the world’s most sophisticated chip manufacturing processes.

Taiwan’s exports of semiconductors are now worth more than $US184bn ($278bn), nearly 25 per cent of Taiwan’s GDP.

Increased risk

While TSMC did come from a US-educated Mr Chang, and its role is to manufacture high-end chips – not design them – it has developed a production process for making the most sophisticated chips that few can match.

The US sanctions on selling high-end chips to China have caused short-term challenges for Chinese industry but increased pressure from President Xi Jinping to develop the sector in China.

Mr Lee points out that “Australia is seeing our region become more densely linked to China through digital technologies and supply chains”.

“Semiconductors are the foundation for all this, and the US effort to restrict Chinese access to these technologies is so far not slowing down the trend, with electric vehicles being the case in point,” he said.

“Australia needs to learn to manage increased supply chain risk, whether it’s the risk of a war over Taiwan blowing a hole in the global supply chip supply and all the industries built on top of it, or of our supply of smart data-collecting EVs being made in Southeast Asian countries by Chinese companies using Chinese technology.”

It’s a complex series of interlinkages between industry and geopolitics which could see big shifts if Mr Trump is elected in a few months.

While Australia is a technology taker, with no serious prospect of becoming a player in the chip sector in the short term, its economic future will be shaped by the possible US/Taiwan/China political and industrial power plays ahead.

Glenda Korporaal travelled to Taiwan as a guest of the Taiwanese government.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout