Hagger, Debelle to advise swelling billionaire ranks

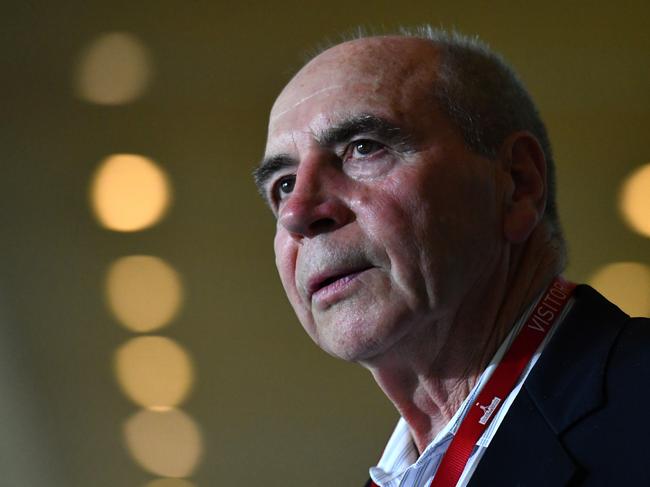

Andrew Hagger has joined with former Reserve Bank stalwart Guy Debelle to establish an advisory firm for ultra-wealthy families, as the number of Australian billionaires swells.

Andrew Hagger has joined with former Reserve Bank stalwart Guy Debelle to establish an advisory firm for ultra-wealthy families, as the number of Australian billionaires swells.

Business payments defaults are at a record high and credit reporting bureau CreditorWatch says a ‘perfect storm’ of conditions is on the way for the hospitality sector.

CEOs felt they went the extra mile by investing up big for Australia, only to be ambushed on industrial relations.

Tabcorp chief executive Gillon McLachlan says he expects staff to attend the office five days a week, putting an end to the Covid-era work-from-home phenomenon for the wagering giant.

Although reforming the interest-rate setting board of the RBA has stalled, a former senior manager says there’s still a good reason to reignite the process.

Young Australians are being hammered by an unaffordable housing market and widespread cost of living pressures as loan arrears surge in the past year.

BHP boss Mike Henry has publicly moved on from Anglo American but the London-listed former target remains even more vulnerable.

It’s not yet an AirTrunk, but Macquarie is looking to get on the ground floor with another digital infrastructure investment in Asia.

Coalition MPs are pushing the Opposition Leader to promise generous income tax cuts at the next election, with some arguing for an adoption of the original Morrison government stage three reform.

Macquarie sees signs of a pick-up in infrastructure deals as interest rates start to come down and economic growth holds up better than expected.

Judo Bank founder Joseph Healy, who lost his son in tragic circumstances, plans a start-up whose centres offer a full range of mental health services.

Australia has a new fiscal ‘basket-case’, but it’s not the Northern Territory or Victoria, according to one of the nation’s most respected economists.

Despite the ever-present economic gloom, new electric vehicles and hybrids are prominent among a wave of assets businesses have sought funding for, Commonwealth Bank says.

It’s an odd thing in a democracy that unelected central bank officials are granted unfettered economic power, however independence is viewed internationally as best practice.

Tasmania’s Premier and Treasurer have declined to say when they will halt the state’s sharp descent into debt, as promises of a distant surplus appear undermined by treasury warnings.

Union leaders have accused the Reserve Bank of signalling that ‘workers should get the sack’ after its chief economist Sarah Hunter said the labour market was still too tight and driving inflation.

Imagine a future where Australian shoppers buy their products at fair prices, businesses thrive on healthy competition, and our economy stands resilient against global challenges.

Government plans to reform the Reserve Bank by introducing a dual-board system – one for setting interest rates, the other for day-to-day governance – have stalled and are in danger of being tossed out entirely.

Thousands of Australians face personal insolvencies this financial year as households dig into their savings to pay debts, a government authority says.

The boss of one of Australia’s largest employers says the RBA is on track to beat inflation as he calls on the Labor government to overhaul the economy.

Original URL: https://www.theaustralian.com.au/business/economics/page/25