Inflation, interest rates and silly government games

You have every right to feel confused about what’s going on with interest rates. Here’s why Australia isn’t following other countries’ cuts – yet.

You have every right to feel confused about what’s going on with interest rates. Here’s why Australia isn’t following other countries’ cuts – yet.

When Northcape Capital’s Fleur Wright first visited Nvidia in 2018 there was no hint of the generative AI boom which erupted later. But she says it’s still early days.

Australian businesses are surpassing global peers when it comes to preparing for tough new climate-related disclosures, according to a report by consulting firm Capgemini.

Cochlear chief executive Dig Howitt says Australia needs to increase the research and development tax incentive threshold and dust off a Morrison government-era plan.

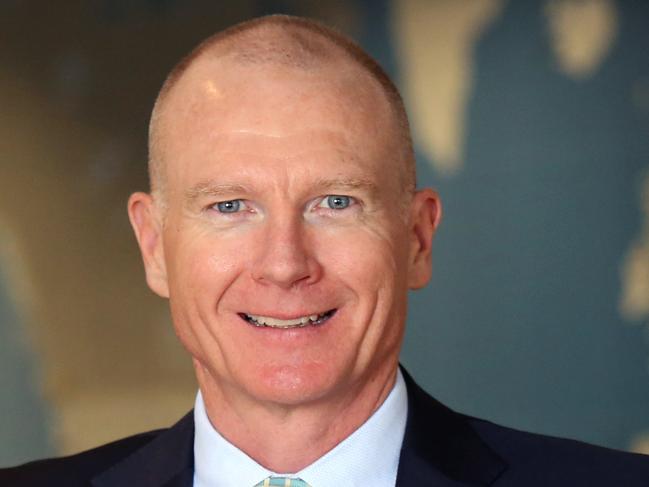

The government must reassess the level of fines levied on banks while ASIC should lobby for tougher penalties that act as a deterrent to those that flout market rules.

Our sharemarket is tipped to build on last week’s record close as investor enthusiasm continues over the condition of the world’s major economies ahead of local retail and US jobs data.

Chocolate lovers, your guilty pleasure is going to cost you even more because the world’s biggest cocoa producing region of West Africa is struggling with its harvest.

One in 20 mortgaged borrowers are at a ‘high risk’ of falling behind on their loan repayments, according to new analysis, as investors expect rates to remain on hold until next year.

The RBA says financial stress would be magnified if economic conditions deteriorate further than anticipated and inflation and interest rates were to stay high for longer than expected.

The reality is, the new CEO has very few levers to pull as the casino struggles to trade out of its mounting problems.

Former Reserve Bank governor Philip Lowe is disappointed with a Greens’ proposal to undermine the central bank’s independence.

Former RBA governor Philip Lowe, a new director of investment bank Barrenjoey, has urged policymakers to tackle tough supply-side reforms across the economy.

A record reduction in household power bills due to government energy rebates drove inflation in August to its lowest level in three years – but the temporary decline is set to be ignored by the Reserve Bank.

Billionaire Solomon Lew, a former RBA board member, has warned the Albanese government to stop bagging the RBA over interest rates and do the heavy lifting itself by beating down inflation.

The billionaire retailer has three big strategic issues to tackle to get his empire of Smiggle through to Just Jeans firing again.

As banks disappear from Australian country towns, crypto ATMs are proving popular in spots you may not expect.

The independence of the Reserve Bank is hanging by a thread. Jim Chalmers is extremely eager to see the cash rate reduced, which would then flow on to lower mortgage rates.

Michele Bullock marked her first year anniversary as the central bank governor with a shift in tone.

The RBA is digging in for a longer fight in inflation while fortifying its defences against political interference.

As other nations slash their interest rates and politicians demand cuts in Australia the RBA board has for the first time since March not considered the case for a rise.

Original URL: https://www.theaustralian.com.au/business/economics/page/23