Tasmania is nation’s new fiscal ‘basket-case’ after debt-heavy budget: Economist

Australia has a new fiscal ‘basket-case’, but it’s not the Northern Territory or Victoria, according to one of the nation’s most respected economists.

Australia has a new fiscal “basket-case”, with Tasmania overtaking the Northern Territory and Victoria for the dubious honour, according to a withering assessment of the island state’s latest budget.

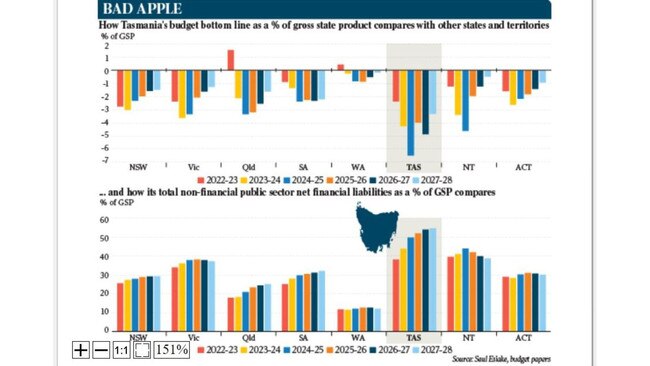

Economist Saul Eslake, whose recent report into his home state’s finances has been largely rejected by the government that commissioned it, said Thursday’s budget put Tasmania’s finances “on track to be the worst of any state or territory”.

“It didn’t have to be that way – but it is,” said Mr Eslake. “The deterioration in Tasmania’s public finances since the mid-2010s has been entirely attributable to government decisions to increase spending, without any consideration being given as to how that spending should be paid for.”

“That approach has continued in the 2024-25 budget.”

The budget, the first since the nation’s last Liberal state government was plunged further into minority at the March 23 state election, more than doubles state net debt to $8.6bn in 2027-28.

Treasurer Michael Ferguson, who on Friday refused to rule out minor asset sales, has insisted the debt level is the third lowest nationally, as a percentage of state growth.

However, Mr Eslake said this failed to take into account significant debt held by government businesses and higher than usual public service unfunded superannuation liability.

“When government business enterprises…are included, Tasmania’s total non-financial public sector cash deficits will be larger as a proportion of gross state product than in any other jurisdiction, including Victoria and the NT,” Mr Eslake said.

“And when Tasmania’s unfunded superannuation liabilities – which are proportionately much larger than those of any other state or territory – are included, as they should be, then Tasmania’s total non-financial public sector net financial liabilities are the largest of any jurisdiction.

“These comparisons raise the risk that, in the absence of any commitment to corrective action, Tasmania’s credit rating … may be downgraded.”

Mr Ferguson has argued the debt is largely funding intergenerational infrastructure and can be repaid sometime after his projected surplus in 2029-30 is achieved.

However, treasury assessments point to multiple risks that cast doubt on the promised surplus, which falls outside the budget period and after the next election.

Mr Ferguson and Premier Jeremy Rockliff have refused to say when the debt spiral will end and have not ruled out a fresh round of surplus-busting largesse at the next election.

Labor opposition treasury spokesman Josh Willie, under pressure to reveal his party’s approach to budget repair, accused the government of “saddling future generations” with massive debt.

“There is no pathway to surplus, no plan to pay down debt, and no plan to improve our essential services,” Mr Willie said.

“After 10 years in office, the Liberals have mortgaged Tasmania’s future - and in doing so they’ve destroyed their financial and economic credibility.”

Mr Eslake questioned when the government - in power since 2014, when the state was net debt free - would reveal how it would eventually pay for its spending.

“Or is it leaving the answer to that question … to another government?” he said.

Mr Ferguson said the debt – projected to double again by the mid-2030s without corrective action - was a response to external “challenges” and the need to continue to improve public services and infrastructure.

“Unlike Victoria, we are choosing to not just rack up taxes,” he told ABC Radio’s Leon Compton program. “We’re implementing some budget efficiencies…We are charting back to a much smaller deficit position in 2027-28.”

The government would not sell major state businesses but would consider privatising lesser assets if there was “a compelling case that it would be in the state’s best interests”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout