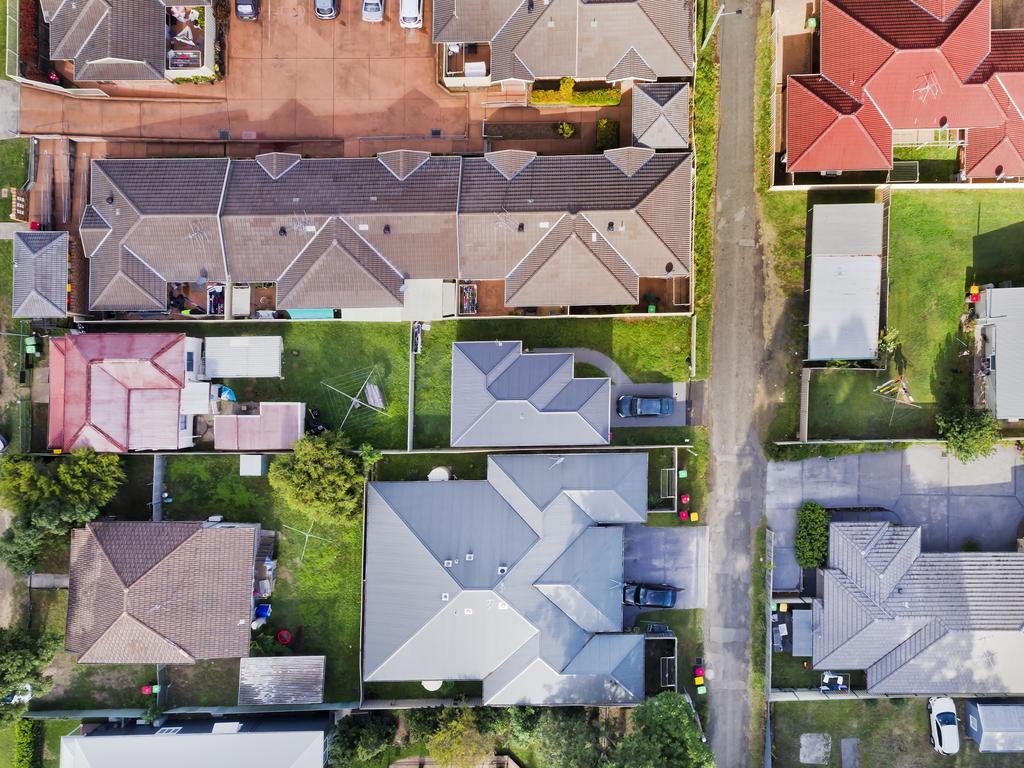

Hot property triggers $26bn mortgage surge

Low rates, government incentives and the post-COVID economic recovery have put a rocket under new lending.

New home lending accelerated in December to hit fresh highs as investors piled back into a hot property market, lifting finance commitments to $26bn in the month — an increase of 30 per cent on the previous year.

A surge in new lending is supporting accelerating property values, as historically cheap money and strong post-COVID recession recovery drive households’ appetite to take on new debt.

CoreLogic data released on Monday showed house prices enjoyed a strong start to 2021, climbing 0.9 per cent nationally in January to regain pre-pandemic record levels.

After grave warnings of a collapse in home values during the height of the COVID crisis last year, analysts are optimistic. CBA senior economist Belinda Allen said house prices would likely lift by 9 per cent this year, supported by the latest borrowing boom.

“Lending growth is a good predictor of dwelling price growth,” Ms Allen said.

Renewed enthusiasm by households to take on debt came as Scott Morrison on Monday said his government — after extending $251bn in fiscal support through the pandemic — was aware of the need to exercise “fiscal discipline necessary to ensure we do not overburden future generations”.

With mortgage rates below 3 per cent on offer, the Reserve Bank of Australia at its first meeting for the year on Tuesday is expected to maintain the extraordinary level of monetary policy support extended through the health crisis, including a commitment to hold its cash rate target at 0.1 per cent for the foreseeable future.

Seasonally adjusted Australian Bureau of Statistics figures showed the total value of new home lending commitments surged by 8.6 per cent in December, after climbing by 5.6 per cent in November. That lifted year-on-year growth to 31 per cent, from 24 per cent.

EY chief economist Jo Masters said the strength of the property market would help drive spending over coming months. “Rising household wealth is likely to be seen as increasing the prospect that households start to spend some of the war chest of savings built over 2020, and this is needed to underpin economic recovery as policy support tapers,” she said.

Borrowing by owner-occupiers accounted for most new commitments, at $19.9bn, 39 per cent more than in December 2019.

ABS data also showed residential property investors have grown increasingly confident, with lending to landlords jumping by 8.2 per cent to $6.1bn in the month, 10.9 per cent higher than a year earlier and the fastest annual pace since mid-2017.

The HomeBuilder program, which offers grants of $25,000 to help construct or renovate a property, is also contributing to an increasingly febrile market.

ABS data showed a 17 per cent jump in the value of construction loan commitments — more than double the level in June when the scheme was first announced.

The hand of government was also evident in the highest number of first-home borrowers since June 2009, when a tripling of first-home owner grants drove a similar surge in activity among first timers.

The ABS reported new finance commitments for owner-occupiers lifted in all states and territories aside from the Northern Territory and South Australia.

Victoria was again a standout, as the value of new loans to owner-occupiers jumped by more than 20 per cent in December

The RBA governor will speak at the National Press Club in Canberra on Wednesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout