New home lending hits new highs in November

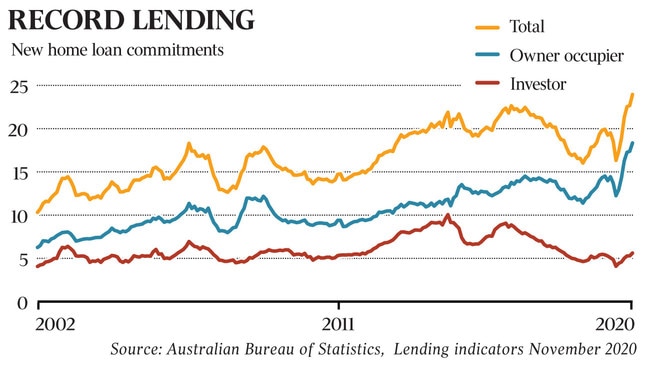

Australians are taking on new loan commitments in record numbers, ABS figures reveal.

The cocktail of generous government incentives, the lowest borrowing rates in history and a resilient housing market has driven new home lending to another record-breaking month.

Loan commitments jumped 5.6 per cent in November to just shy of $24bn, or 24 per cent higher than a year earlier, seasonally adjusted figures from the Australian Bureau of Statistics showed. From the lows in May, monthly new lending has surged 47 per cent.

Another strong month for banks was underpinned by a 20 per cent surge in home lending commitments in Victoria, as the state enjoyed its first full month free of restrictions.

The data also revealed the powerful impact of the Morrison government’s HomeBuilder program, which was implemented in June and provides grants of $25,000 to construct a new home. Construction loan commitments jumped 5.6 per cent in November to $3bn to be up 75 per cent since July and at twice the level of a year earlier.

Economists believe the spike in new lending should provide further support for the residential construction sector.

NAB economist Tapas Strickland said the “surprisingly strong lift in housing market activity should also flow through to stamp duty revenue for state governments”.

ABS head of finance and wealth Amanda Seneviratne said “other federal and state government incentives and ongoing low interest rates also contributed to the continuing growth in new housing loan commitments”.

Encouraged by cheap and easy money and a suite of state inducements, the number of first home buyers lifted by 3 per cent to 13,90, the highest since October 2009 when the federal government temporarily tripled the grant as part of its post-global financial crisis stimulus package.

There was evidence that investors were returning to the market in greater numbers as fears of a property-price collapse during the pandemic disappear. New house lending to would-be landlords climbed 6 per cent in November to $5.6bn and was 4 per cent higher than a year before.

The share of investor lending climbed to its highest since March, at 16.4 per cent of housing commitments.

Despite the spike in new lending in Victoria, commitments were a more modest 2 per cent above a year earlier. In contrast, new home borrowing in Western Australia in November was 73 per cent higher than the same month in 2019, and 41 per cent higher in Queensland.

The fast-paced recovery from the COVID-19 recession has contributed to the willingness of Australians to take on debt. The Reserve Bank has committed to keeping rates pinned to the floor for years yet.

Treasury modelling released this week showed that households have accumulated more than $100bn through the crisis, money which will be used to support the economic recovery even as major support measures such as JobKeeper expire in March.

The data comes as ABS job vacancies showed businesses looked to fill a record 254,000 jobs over the three months to November. The December labour force figures will be released next Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout