Coronavirus: $200bn savings warchest to boost recovery

Households, businesses save more than $200bn during pandemic, which Treasury says will be used to bolster economy.

Households and businesses have saved more than $200bn in cash during the pandemic, which Treasury says will be used to bolster the economic recovery as the Morrison government’s emergency support measures are withdrawn.

While the recovery has proved faster than anticipated, it remains incomplete, and there are fears it will falter when programs such as JobKeeper and the JobSeeker coronavirus supplement expire. They are due to end in March.

Direct fiscal support is forecast to fall from 6.9 per cent of nominal GDP in 2020-21, or about $138.4bn, to 2.4 per cent in 2021-22, or $48bn.

Treasury modelling suggests the contribution to economic activity from emergency support measures will extend beyond the end of the spending programs.

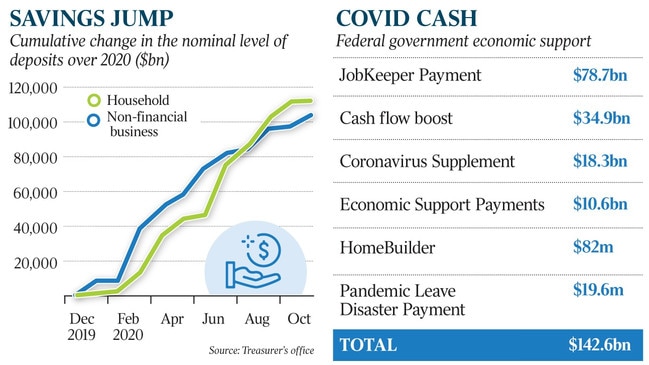

The Morrison government has spent $142.6bn in major relief measures aimed at cushioning the blow from the country’s sharpest downturn in close to a century. In addition to providing relief to struggling workers and firms through mandated shutdowns, a large portion of payments were saved.

Treasury said as government assistance dropped away, households would draw on a $113bn warchest of extra savings accumulated over 11 months to December, and businesses an extra $104bn in deposits, to cushion the transition.

The analysis estimated that direct fiscal support would add 5 per cent to real GDP in 2020-21, and another 4.5 per cent in 2021-22, despite the nearly $90bn drop in government support between the two financial years.

In its mid-year budget forecast, Treasury predicted the economy would grow by 0.75 per cent in 2020-21 and by 3.5 per cent in 2021-22, underlining the role fiscal spending will play in keeping a post-COVID comeback on track.

Josh Frydenberg said there was “a huge sum of money available to be spent across the economy helping to create jobs and maintain the momentum of our economic recovery”.

“The unprecedented economic support provided by the Morrison government during the crisis means that even as JobKeeper and other temporary emergency support measures taper off, a fiscal cliff is avoided,” the Treasurer said.

The new estimates came as Australian Bureau of Statistics data showed employers embarked on a hiring spree over the three months to November, with job vacancies surging to a record 254,000 as businesses in sectors hardest hit in the recession scrambled to replace workers they let go through the pandemic.

The figures suggested the solid post-recession labour market recovery would extend into 2021.

ABS figures showed the number of vacancies jumped by 48,000 in the November quarter, an increase of 23 per cent versus the previous three-month period, when vacancies rose by an even sharper 77,000 as the nation emerged from lockdown.

Job vacancies surpassed pre-pandemic levels in February, the seasonally adjusted figures showed, and were 12 per cent higher than a year earlier.

There were close to double the number of vacancies than in the May quarter.

NAB economist Tapas Strickland said the figures were “very encouraging”, suggesting November’s unemployment rate of 6.8 per cent would fall more sharply than forecast, even with government support tapering.

Morgan Stanley head of Australian economics Chris Nicol said job security would be a key factor in whether consumers were prepared to draw down on their savings in 2021.

National accounts figures showed the household savings ratio at 18.9 per cent in the September quarter, against 5.3 per cent leading into the pandemic. Mr Nicol said Australians needed to reduce their rate of savings by only 3-5 per cent to provide a meaningful level of support to consumption as government help waned: “It’s actually more important that businesses take the stimulus and invest and hire — that will give consumers the confidence to spend, when normally it’s the other way around.”

The three industries with the largest percentage increases in job vacancies in the November quarter all saw large falls in May, during the peak of the COVID-related restrictions, the ABS said.

The number of vacancies for arts and recreation services jobs more than tripled to 4000, while the accommodation and food services sector recorded growth of 66 per cent, bringing vacancies to 22,400, and retail trade close to 40 per cent to 25,700.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout