It’s payback time: home, business loans stress fades

New figures reveal the national economic recovery is on track, with more than 80 per cent of the almost $250bn in loans deferred at the height of the pandemic now being repaid.

Households and small businesses are now paying back more than 80 per cent of the almost $250bn in loans deferred at the height of the coronavirus pandemic, with new figures revealing the national economic recovery is on track.

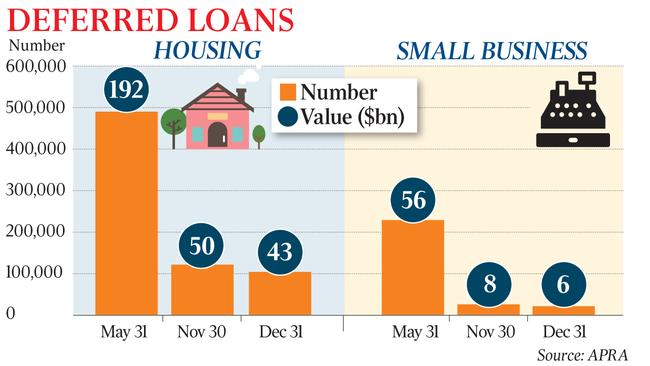

Australian Prudential Regulation Authority data to be released on Friday shows the value of deferred home loans fell $7bn in December to $43bn, a large reduction from the peak total in May of $192bn.

Josh Frydenberg said the figures showed “the substantial and continuing reduction in deferred loans” was a positive sign that Australia’s economic recovery was under way.

“The value of deferred housing loans has now fallen by almost 80 per cent since their peak in May while the value of deferred small business loans is around 90 per cent lower than at their May peak,” the Treasurer said.

“As more households and businesses resume loan repayments, banks are in an even stronger position to continue lending in support of the economic recovery by helping those wanting to buy a home, invest or grow their business.”

Mr Frydenberg said the loans data was yet another indicator of the nation’s economic rebound, with 785,000 jobs created in the past seven months.

The APRA update reveals that, by December 31, the value of loan deferrals for small and medium enterprises had dropped from a peak of $56bn to $6bn, and were down by $2bn from the previous month.

The loan figures correspond with the expiry of the majority of the six-month deferrals offered by the banks and show deferral applications continued to fall during Victoria’s COVID-19 lockdowns.

The turnaround in loan stress will reduce exposure for the banks, which had agreed to the deferrals as part of the government’s emergency pandemic response last April when the economy was put in hibernation.

Labor’s Treasury spokesman Jim Chalmers, writing in The Australian today, says the government is failing to “listen to communities crying out for targeted support after JobKeeper ends”.

“We can’t pretend there aren’t many families, workers, small businesses and communities still struggling,” Mr Chalmers writes.

While the government will argue the lower loan deferral figures — and a strong take-up in its HomeBuilder program — show the economic recovery is on track and JobKeeper payments can be phased out on schedule, some business groups are pushing for more support past March.

The Australian Chamber of Commerce and Industry this week sent a proposal to Mr Frydenberg and Treasury suggesting a new support program commence from April 1.

“The wage subsidy support would operate via payroll but in addition to a reduction in turnover, the business confirms they operate within a business that is still highly impacted by restrictions imposed by government to manage COVID-19,” the ACCI submission to Treasury said.

APRA’s analysis shows that, at the peak of the pandemic, more than 10 per cent of all residential mortgages were deferred. That has fallen to 2 per cent, while the number of small business loans on hold, which peaked at almost one in five, has also dropped to 2 per cent.

The update reveals the number of housing loans deferred due to financial stress caused by the economic shutdown last year reached 490,000 in May, falling to about 100,000 by the end of December. More than 230,000 small and medium enterprise loans were deferred at the peak of the pandemic but this has fallen to about 20,000.

This amounted to an 80 per cent fall in loans deferred for housing and a 90 per cent reduction in those applying to small and medium businesses.

Australian Banking Association chief executive Anna Bligh said the loan deferral data illustrated encouraging signs for the nation’s recovery. “More small businesses are starting to resume their loan repayments, reflecting Australia’s successful efforts in fighting the virus,” Ms Bligh said.

“The road ahead is uncertain, but it’s good to see the vast majority of homeowners and small businesses getting through the worst and getting their finances back on track.”

The ACCI proposal suggests two thresholds for a new payment program at one-third reduction in turnover and two-thirds reduction compared with either the same quarter in 2019 or 2020. “The subsidy would be $450 per week per Tier 1 eligible employee for business one-third down and $700 per week for businesses two-thirds down,” the industry group said.

Eligible staff were those employed on or before January 1 this year.

The National Australia Bank said businesses were becoming less reliant on JobKeeper, but warned that sporadic border closures would hinder recovery for some industries. Data released by the bank shows the hospitality and accommodation sectors are lagging and softening the country’s recovery.

For the week ending January 25, accommodation and food services spending was down 3 per cent compared with the same period a year ago — bucking the trend of positive growth that had been felt in the broader economy. NAB chief economist Alan Oster said the retail sector remained “relatively robust” and increases in mining activity had supported economic growth in states such as Western Australia. “The economy is still good … but it’s been softer through the course of January, and part of that of that softness is due to hospitality,” he said.

Mr Oster noted data the banks collected from business customers showed JobKeeper payments were making up less of revenue intake, highlighting firms were becoming less reliant on the wage subsidy scheme.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout