A scheme of arrangement is what you do when you have a plan; a voluntary administration (VA) is when you don’t and it is Virgin’s least preferred option.

CBS acquired the Ten network out of VA back in 2017, so it is not a death sentence, but is considered more problematic, which is why Virgin would rather a scheme.

This would come with an extension of John Howard’s fair entitlement guarantee package to any laid-off staff, an extension of the plan employed to help Howard’s late brother Stan over the National Textiles bankruptcy in 2000.

The Wall Street Journal reports Qantas partner American Airlines has agreed to a plan which will give it access to a US government $US4.8bn ($7.6bn) loan in return for an equity stake of up to 12 per cent and an agreement not to lay off staff.

The International Air Transport Association said on Thursday global aviation industry revenue would fall 55 per cent this year, or $US314bn.

The entire US airline industry has at various stages in history gone into Chapter 11 bankruptcy in the rollercoaster world that is global aviation.

Prime Minister Scott Morrison and Treasurer Josh Frydneberg have handled the economic impact of the virus to perfection by avoiding company-specific deals.

The Virgin narrative doesn’t look good because it smacks of the airline knocking on Canberra’s door as a first option, and Morrison worries it will open the door to a conga line of others looking for a handout.

Then again, it was Canberra which shut the local aviation industry. Virgin’s Paul Scurrah tried and failed to get any of his airline industry shareholders to come to the table, so in his mind Canberra wasn’t in fact the first option.

Some 27 years ago when the then government floated Qantas it was in part with a cheque for $1.4bn to help it gain a credit rating before the float, and of course the sale of 25 per cent of the airline to BA.

That is exactly the sum Scurrah is looking for today.

The issue is that Virgin last year flew 25 million people around the country, employed 9000 staff and 6000 contractors who now await any outcome of the talks, and Frydenberg and Morrison both agree two airlines is the preferred option.

Scurrah had a video conference call with staff telling them just that on Thursday.

Talks between Virgin and the government are aimed at exploring ways to avoid the airline filing for voluntary administration in a way which shows the airline, not the government, is backing down.

Virgin’s preferred option is a scheme of arrangement, which would be a packaged deal between the creditors and shareholders with the government issuing a $1.4bn convertible note which would convert into equity at $1 for the entire airline.

All going to plan, the government would sell its stake in a couple of years for a profit.

The scheme would shut Tiger airlines, the international division, and draw up new secured debt deals with unsecured creditors and equity holders getting zero.

Right now there are backroom talks to determine if Virgin exists next week.

Retail rebellion

The good news for online retailers is that the coronavirus has seen a switch to online shopping, and right now the shoppers are not so price-conscious, according to Power Retail’s Grant Arnott. In a member briefing on Thursday Arnott said the virus had caused a shift to e-commerce, and while price would become more of an issue, right now it was more about convenience and safety.

This is shown by the products showing most growth over the last month in the lockdown, which include fitness and sporting goods as people gear up for other forms of exercise, electronics, home office supplies, food and drink and house and garden items.

Paypal remains the biggest payments mechanism.

Power Retail is an e-commerce data source for retailers and suppliers.

While the switch is on so is the stand-off between retailers and shopping centre owners over long-term rent arrangements.

The overwhelming number of mall owners charge rent on a CPI plus X per cent basis but the retailers would prefer to pay as a percentage of turnover.

Last month Solly Lew employed the “never waste a crisis” strategy and shut down his retail empire, standing down 9000 staff and telling the mall owners he wouldn’t be paying rent.

He said the shutdown would last until April 22, which is next Wednesday, and while he is widely expected to extend the shutdown he is yet to say so.

He is waiting for a clear view from the respective governments on how long the shutdown will last and Prime Minister Scott Morrison says the restrictions will stay in place for another four weeks.

Then there are the rent talks or lack of them with Scentre’s Peter Allen. Outside the supermarkets and pharmacies the malls are not exactly thriving but Allen is trying to boost sales through his Westfield Direct click and collect program.

Discretionary retail consumers are cautious, which is not helping the shopping centres.

Talks with Solly and his retail guru Mark McInnes are yet to reach any conclusion, which is another reason why we are yet to hear when the stores will reopen, because they are a point of leverage against Allen.

He would prefer the stores were open to help drive-through traffic.

Crown jewels

If James Packer is focused on Crown’s balance sheet, why is he proceeding with the $203m dividend which delivers him $73m and former partner Melco $18.3m.

The company says it’s a sign of confidence in the balance sheet which must be good news.

Given the uncertainty over the shutdown many companies including local rival Star have deferred dividend payments.

Google sidestep

Federal government plans to use a Singapore government-built mobile phone app to trace coronavirus movement neatly sidesteps the push by Apple and Google to market their own joint venture product.

Google’s business plan is based on new ways to collect personal data to market to advertisers, so its entry into the game raised plenty of eyebrows and privacy concerns.

The government’s own venture does little to allay those because given Google controls 55 per cent of the Australian mobile handsets through Android it hoovers data from all the apps on the phones.

That is the beauty of being a conglomerate: you have a finger in every pie which is why the ACCC wants to control Google better, starting with its proposed code of conduct.

If the Singapore app was a way to sidestep Google, the behemoth has that angle covered.

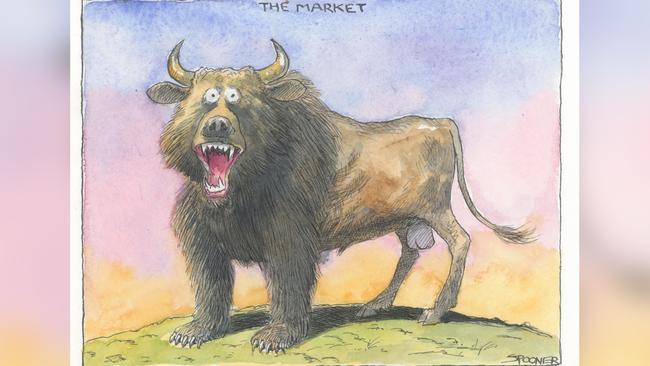

The extraordinary game of brinkmanship between the government, Virgin and its creditors continues as the US and other governments embark on massive programs to bail out their airlines, with Virgin treating voluntary administration as its final resort.