Coronavirus: Nightmare in the sky as airlines face big losses, bankruptcy

The ban on air travel between the US and Europe, the busiest route in the world, has made a bad year for airlines even worse.

Running an airline has never been easy. Former American Airlines chief executive CR Smith once said no one could make money in the “goddamn airline business, the economics are sheer hell”.

If that is true in normal conditions, than it’s difficult to imagine the challenges currently being experienced by the world’s carriers.

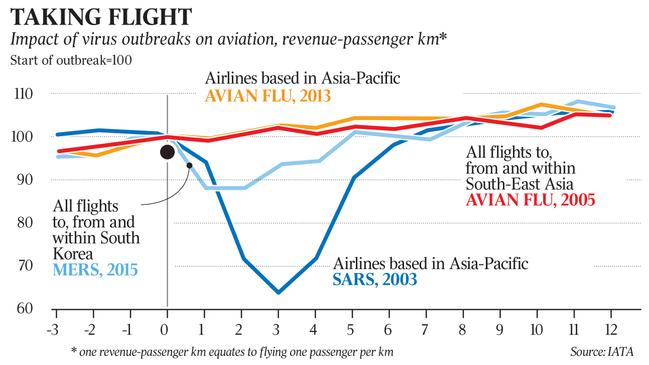

In a matter of weeks, the coronavirus outbreak has devastated demand for travel like nothing before – not the 9/11 terrorist attacks, the 2007-09 global financial crisis, and certainly not the 2002-2003 SARS epidemic to which COVID-19 was originally compared.

Since China confirmed the outbreak, reputable airlines such as Cathay Pacific, China Eastern and Qantas have seen demand and bookings simply evaporate.

A Qantas flight from Hong Kong to Sydney this week in an A330, an aircraft capable of carrying 297 people, had just 39 passengers on board. “Hope you enjoyed your private flight to Australia,” the pilot wrote in a passenger’s travel diary.

Qantas Airways chief executive Alan Joyce will take no salary for the remainder of the financial year, and also scrapped management bonuses, while outlining plans to cut capacity on its main airline and low-cost subsidiary Jetstar by as much as 23 per cent up to mid-September. Other airlines have been forced to fly empty in order to maintain prized airport slots, a situation that regulators are now under pressure to resolve.

And just when it seemed like it could not get any worse, US President Donald Trump announced a 30-day ban on all travel between Europe and the US — a move Prime Minister Scott Morrison may yet adopt for Australia, where travel bans have already been slapped on China and Italy, among other nations.

Hours after Mr Trump’s address, the US State Department advised American citizens against all travel abroad, even to countries not yet experiencing an outbreak. It warned of mandatory quarantines, travel restrictions and other measures that could complicate international travel.

A turning away from travel will certainly do economic damage yet, the history of pandemics suggests closing the borders usually comes too late in the progress of the virus to make much difference.

Typically it postpones the pandemic peak by no more than a month, and its true value lies in buying more time for crucial measures such as promotion of “social distancing”, the pre-emptive closure of schools and provisioning of hospitals.

British exceptionalism

The US ban applies to the countries in the Schengen Area, a zone without border controls where foreigners from outside Europe can travel freely. The UK isn’t inside the Schengen Area — and wasn’t even before it exited the European Union — though the country hasn’t escaped coronavirus.

Europe is the largest regional destination for US travellers, with 72.4 million passengers in the year ended June 2019. American Airlines said the Trump directive would affect 14 flights a day from Paris, Frankfurt, Munich, Barcelona, Madrid and Zurich.

Against a background of narrow profit margins, deregulation and cutthroat competition, major US airlines were reporting bumper profits only last year, thanks to good economic times. But by its nature, aviation is brutally exposed to economic downturns and shocks. And the fear spreading in advance of the virus has already slashed bookings.

Most carriers in the US have withdrawn their financial guidance for the year and suspended share buyback programs, among other measures. Airlines are now preparing for the prospect that recovery could take months, rather than the quick bounceback many had initially anticipated. While a sharp drop in fuel prices is likely to relieve some pressure, carriers are facing a global-demand shock.

If airlines were difficult businesses to manage before, they just became near impossible, and conditions in the Asia-Pacific region are dire.

“What I’m hearing is that the best-positioned airline in Asia has 30 days of cash left,” says Centre for Asia-Pacific Aviation chairman Peter Harbison.

“You can’t emasculate a business by 70 or 80 per cent for a period of weeks, in a cashflow business, and expect them to stay solvent. It’s as simple as that.”

In an effort to minimise the damage, airlines have slashed flights, pulled out capacity, trimmed executive salaries, grounded aircraft and laid off staff.

Qantas spread its capacity reductions to almost a quarter of its international network this week, in response to the plunge in forward bookings on just about every route. Air New Zealand did the same, and European and US carriers are now also following suit; in the case of Norwegian Air, carving 3000 seats from its schedule.

Debt manager with Narrow Road Capital, Jonathan Rochford, says it’s impossible to know at this stage what level of cuts will be enough for airlines to weather the coronavirus storm.

“It’s as bad as you can get because you simply don’t know what’s going to happen tomorrow,” he says.

“The travel that doesn’t happen now, they’ll never get back. It’s three, maybe six months of shutdown, and earnings that they would’ve had are now likely to turn into losses. People may go back to normal but they’re not going to fly extra to make up for what’s been missed.”

Harbison agrees the uncertainty is perhaps the worst part of the COVID-19 crisis, which already is far worse than SARS.

“SARS came out of China and was about a fifth, or even a tenth of the size in aviation terms,” he says.

“Secondly, it was geographically relatively confined. And thirdly it was over pretty quickly. This (COVID-19) doesn’t fit any of those criteria.”

The spread into Europe is particularly significant, given the impact on the world’s most lucrative travel route — the trans-Atlantic corridor. “This is the most valuable route in the world by a country mile,” Harbison says.

“There’s a lot of business and corporate travel, even diluted as it has been, and you’re effectively cutting out half of the market.

“Leave aside the UK because (Trump’s Europe travel ban) is going to be a bonanza for British Airways, but for the rest of them you’re cutting out all but US passengers from the route.

“That means a lot more aircraft are going to be grounded and all the flow-on impact of that.”

Qantas’s Alan Joyce has already predicted the crisis will be too much for a number of airlines, suggesting it will be a case of “survival of the fittest”.

While Qantas itself seems safe thanks to its strong financial position going into the crisis, smaller rival Virgin Australia looks less robust. Rochford says Virgin’s lack of exposure to international markets could save it but only time will tell.

“We simply don’t know how bad the losses are going to be. We have to wait for some sort of update from the airline,” he says.

“But an airline that was typically losing a little bit of money probably now moves into a phase of losing more money for a period of time, and we don’t know whether their shareholders, in terms of debt investors, are willing to put good money after bad.”

Aviation consultant Neil Hansford is more blunt, tipping Virgin Australia will struggle to ride out the coronavirus crisis if domestic demand continues to fall alongside the international declines.

“I can’t see how they can survive with their international being cut, with all the equipment in a declining domestic market, I just can’t see how they can handle the losses,” Hansford says.

“They can’t put their begging bowl out to shareholders because HNA Group, Nanshan, Etihad and Singapore Airlines don’t have anything to offer.”

Other carriers he fears could succumb to the overriding force of the coronavirus include Hong Kong-based Cathay Pacific and Norwegian Air.

“Cathay are in diabolical trouble, and I think Singapore Airlines, which has something like 400,000 Chinese passengers a week, will be in all sorts of trouble,” says Hansford. “The government (of Singapore) will have to prop them up. I’m not hearing anything on Malaysia Airlines but this won’t help their cause in trying to get their financial situation turned around.”

Qantas, he says, has been “very innovative” in the way it’s gone about downsizing and should emerge from the period bruised but not bloodied.

“They’ve been very smart in keeping on the market with equipment that will fit the market,” Hansford says.

“Doing double daily from Perth (to London, in the place of Sydney-Singapore-London) strengthens up domestic Perth, and keeps them away from Singapore.”

Profits recede

Any airline’s prospects of turning a profit in 2020 appear greatly diminished, however, with the industry’s umbrella body — the International Air Transport Association — expecting the worst.

Last week, the association forecast that after 10 consecutive years of profitability, airlines around the world would collectively suffer losses of about $175bn.

IATA is yet to update its estimates in the wake of Trump’s European travel ban.

The grim outlook for the aviation sector is shared by Harbison, who believes the financial pain will not be short-lived for airlines, and the recovery will not be as fast as was first hoped.

He says when routes are restored and travel restrictions lifted, it will still take a while for confidence to return.

“It’s hard to see a full global airlines system operating before next year, really. Then you would expect a decent rate of recovery and getting back to long-term trends some time in 2021,” he says.

“Until then, that will mean some pretty substantial financial ructions for every part of the travel industry that’s involved.”

Additional reporting: The Wall Street Journal

NO-FLY ZONE

Do travel restrictions work?

Domestic

• Limited effectiveness

• Delay pandemic spread by about one week

• Delay pandemic peak by about 1½ weeks

• Little impact on magnitude of pandemics

• Especially weak against highly transmissible strains

International

• Limited effectiveness, a 90 per cent air travel restriction in all affected nations may delay spread by three to four weeks

• Minimal impact on the magnitude of pandemics, reducing attack rates by less than 0.02 per cent

• May prolong the flu season

• May result in higher epidemic peak if resultant delay causes pandemic wave to coincide with seasonal influenza wave

• Especially weak against highly transmissible strains

• Extensive restriction of air travel might delay introduction of a pandemic into a country by up to two months

• May give time for work on hospital preparation, vaccines and antiviral drugs.

— WHO

USE DELAY WELL

While travel restrictions alone do little to directly ameliorate the pandemic, they can buy time to develop and deliver a vaccine and institute powerful non-pharmaceutical interventions such as social distancing, public education and staging of medical equipment, all of which could sharply reduce cases.

The grounding of planes in the US after the September 11, 2001, terrorist attacks in New York and Washington delayed influenza during the 2001–02 season by about two weeks.

The main purpose of travel restrictions is to delay dissemination of the disease until targeted medical and other interventions can be developed and deployed. Even a couple of weeks of additional delay is important for the deployment of national and local containment strategies, which might not necessarily be related to vaccination per se.

— The Brookings Institution

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout