Landlords hit back at Premier Investments in retail showdown

The country’s largest shopping malls are taking a hard line against chains calling for rent relief amid a wave of store closures.

The country’s largest shopping malls are taking a hard line against national chains calling for rent relief amid a wave of store closures, but landlords have conceded some ground to smaller retailers by pledging not to evict tenants that cannot pay.

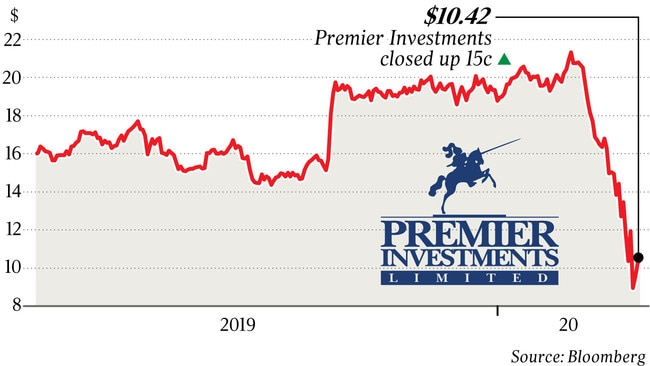

Tensions simmering since the coronavirus outbreak hit the retail sector earlier this month boiled over on Thursday as billionaire Solomon Lew’s Premier Investments took the dramatic decision to close all its stores.

More national retailers are on the brink, threatening to lay off thousands of staff unless they win substantial rental concessions, while small businesses in malls and retail strips around the country struggle to stay afloat as tough health restrictions come into force.

The sector is negotiating with the federal government on a relief package for stressed retail property owners and tenants, with key players saying this will be decisive in keeping the industry afloat.

The nation’s embattled $320bn retail sector had already been savaged by a string of store closures and tens of thousands of job losses this week, ahead of Mr Lew announcing the closure of all Premier Investments stores. These include popular fashion chains Just Jeans, Portmans, Dotti, Peter Alexander and Smiggle, with the loss of 9000 jobs.

Premier called it the “hardest decision ever made”. Premier is one of the largest retailers to close its doors in Australia since the coronavirus pandemic swept through the country, following Michael Hill, Lovisa, Athlete’s Foot, Noni B, Katies and Millers.

The acceleration of retailers shutting has made shopping centres and malls look like ghost towns. However, supermarkets are thriving as other tenants sit out the pandemic.

The Premier closure drew a rare rebuke from mall owners, who have been preparing for more formal shutdowns. The landlords criticised the unilateral action by the large operator while the government response is yet to be finalised, and called on owners to play fair with small tenants.

The chairman of the powerful Shopping Centre Council of Australia, local Westfield boss Peter Allen, told members in an update that they had a role to play in helping retailers, especially small to medium-sized businesses, and it was working with the federal government on measures that are expected to be unveiled shortly.

He called on mall owners to ensure there were no lease terminations for non-payment of rent for small to medium-sized businesses in the current tough period, after noting governments had received direct feedback that some landlords were not acting sympathetically.

But he took a hard line against public negotiating tactics, saying Scentre, which owns the Westfield malls, did not negotiate through the media.

Property owners are also seeking land tax concessions that they can pass directly through to tenants.

Mr Allen backed the Morrison government’s decision to keep shopping centres open, citing their role in providing essential services, as well as supporting jobs across the economy.

Mr Allen called out the unilateral nature of Premier’s move to close stores and stand down staff at a time when the government wanted to ensure economic continuity.

“That seems to go against that from the perspective of Team Australia in terms of what the government has said,” Mr Allen said.

While some areas such as food courts had closed to meet distancing rules, he noted the government was taking proportional measures and that closing other stores might be premature.

“I think people making unilateral decisions jeopardises the co-ordinated efforts governments and financial institutions are trying (to make) ... in ensuring the economy delivers and jobs are maintained,” he said.

Retail landlords have been heavily sold down on expectations that they will have to provide rental abatement and support even during the recovery.

The Just Group has 219 stores across Scentre’s portfolio and rival landlord Vicinity Centres houses 117 stores, with both accounting for less than 1 per cent of their overall space.

Vicinity said it was maintaining an “open dialogue” with retailers, from smaller sole traders and family-run businesses through to the major chains and brands.

“We are continuing to work directly with all of our retailers on a case-by-case basis, including both our retailers who continue to trade and those that aren’t operational, and those that have been significantly impacted by COVID-19,” Vicinity chief executive Grant Kelley said.

Other major mall landlords AMP Capital and GPT said they were working to help tenants.

Rapidly changing social distancing rules have prompted some businesses to restrict their operations. Bunnings is open only to trade customers and essential workers at certain times.

Meanwhile Westfield said it would give rental relief to small tenants in its shopping centres.

In a nod to the tougher economic conditions Mr Allen acknowledged there would be pain for both landlords and tenants. “We are going to have to share the pain as we go through this,” Mr Allen said. “We are already at the table ... we have to come to a commercial arrangement for both of us to get to the other side.”

Mr Lew has led the charge in recent years against shopping centre landlords, calling them out regularly at Premier’s financial results presentations and annual general meetings, blaming them for the ills of the retail sector and in particular for charging excessive rents that were out of step with volatile economic conditions well before the coronavirus pandemic swamped the sector. In November the chief executive of his Premier group, Mark McInnes, launched a blistering attack on the nation’s shopping centre landlords, accusing them of “killing companies and killing jobs” by encouraging overseas chains to come to Australia and ruin the sector.

Mr McInnes accused them of offering better deals to foreign chains than Australian retailers and “killing Australian jobs”.

At Premier’s half-year results last week, Mr McInnes again threatened to close its stores unless landlords lowered their rents to reflect the downturn in foot traffic and consumer sales.

About 70 per cent of Premier’s Australian and New Zealand stores are in ‘‘hold over’’ or out of lease.

“We are prepared to close stores and we are prepared to close them within the period of the hold over,” Mr McInnes said last week.

“It is not what we want to do but if landlords forced us to we will do … we think landlords should just accept this is a global pandemic and that they have a role to play ensuring that retail can survive it.’’

In a shock announcement this morning Premier, which is chaired and 43 per cent-owned by Mr Lew, said it had no choice but to temporarily close all retail stores in Australia from Thursday night until Wednesday morning on April 22. This follows similar decisions Premier has been forced to take in New Zealand, Britain and Ireland.

“Regrettably, this means all employees in Australia are to be stood down, except for a small number of employees required to perform limited essential work. This means our team members will not attend work and will not be paid. We have put in place special arrangements for employees to access accrued annual and long service leave entitlements to reduce the impact over this time,’’ Premier told the ASX.

Globally these closures will affect 9000 employees in the Premier stable of fashion stores and head office.

Mr McInnes has chosen to work from home without pay or other entitlements for the shutdown until re-opening in late April. The Just Group executive team have been stood down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout