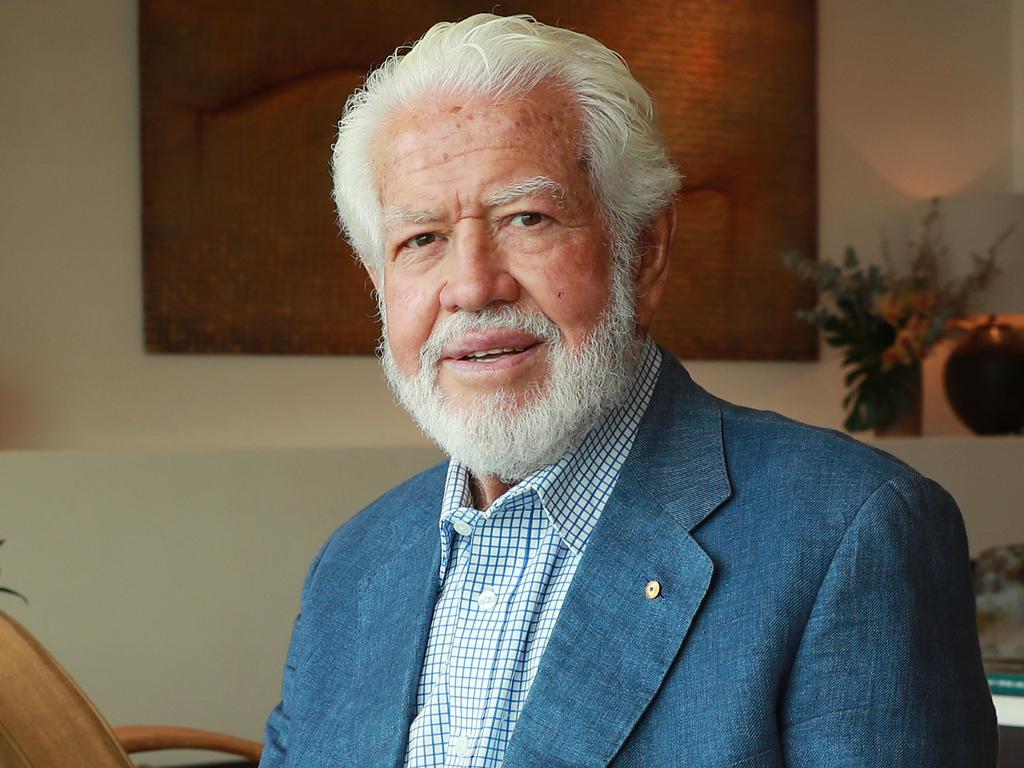

Bitter pill: Marcus Blackmore ‘was disrespectful to director’

It took Blackmores chairman Anne Templeman-Jones 12 months to reveal an accusation that Marcus Blackmore had been disrespectful during his time on the board.

It took Blackmores chairman Anne Templeman-Jones 12 months and an extraordinary falling out with its biggest (and namesake) investor to reveal an accusation that Marcus Blackmore had been disrespectful during his time on the board.

The accusation, made in an explosive letter to shareholders, is understood to concern a brief but heated exchange between Mr Blackmore and another director.

It comes as Blackmores – which rode the China boom, with its shares peaking at $217 in late 2015, before falling to as low as $62.16 in October last year – seeks to reposition itself and diversify its customer base.

The robust boardroom discussion came around the time the company’s share price reached its nadir, with Ms Templeman-Jones saying the relationship between Mr Blackmore and fellow directors had become “strained” by the time he departed.

“While the current board is constrained in what can be disclosed about these matters, there was a difference of views between Mr Blackmore and the rest of the board about his adherence to the principles of respect in the workplace set out in our code of conduct,” Ms Templeman-Jones said.

She made the revelation after Mr Blackmore threatened to vote against her election to her first public company chairmanship ahead of Blackmore’s annual meeting on October 27, after she rebuffed his suggestion to nominate former Pharmacy Guild president George Tambassis as a director.

As Ms Templeman-Jones made her claim about Mr Blackmore’s behaviour, another revelation surfaced from the time of Blackmores’s board “renewal” last October: the board’s executive assistant of six years was made redundant after Ms Templeman-Jones became chairman.

While such moves are common with changes of leadership, it came as the EA was undergoing cancer treatment.

Despite the EA telling colleagues she was having chemotherapy, a Blackmores spokeswoman said Ms Templeman-Jones wasn’t aware of the EA’s health status.

“We will not comment on the private matters of any individual past employee. A role was made redundant and the company paid out full entitlements. Any suggestion or inference that the chair at the time was aware of the individual’s health status would be incorrect,” the spokeswoman said.

Mr Blackmore hired the EA after her redundancy. He declined to comment on the matter amid his escalating war with the people running the company, in which he has about $440m of his wealth invested.

Ms Templeman-Jones’s letter sparked a wave of support for Mr Blackmore, with former long-serving chief executive Christine Holgate saying she was disappointed that the board had made such an accusation against the company’s founder – who might have “strong views” but “always comes from a place of care”.

Ms Templeman-Jones has been actively encouraging shareholders to vote against Mr Tambassis’s self-nomination, engaging proxy solicitation firm Georgeson to contact investors.

The stakes are high. Support is growing for Mr Tambassis, who is also a director of Priceline owner Australian Pharmaceutical Industries. Already, it is understood that he has about 45 per cent of the shareholder vote.

Ms Templeman-Jones said the disclosure of the accusation against Mr Blackmore came as a “direct result” of his campaign to elect Mr Tambassis.

“The board has received questions from shareholders and other key stakeholders in relation to its relationship with Mr Blackmore.

“Having carefully considered our duties after being informed that these matters were being discussed by others with shareholders, proxy advisers and the media, we have reached a view that further disclosure to shareholders with regard to Mr Blackmore’s departure from the board is necessary.”

Brent Wallace, who was Blackmores chairman when Mr Blackmore stepped down as a director last October, declined to comment. But a statement issued at the time of Mr Blackmore’s departure from the board made no mention of the company’s code of conduct.

Instead, Mr Wallace in the statement thanked “Marcus for his many years of passionate commitment to building the company’s leading global reputation in complementary medicines and naturopathic principles”.

Ms Templeman-Jones said Mr Blackmore had not breached the company’s code of conduct, phrasing it instead as “difference of views between Mr Blackmore and the rest of the board about his adherence to the principles of respect in the workplace”.

But Mr Blackmore said he had been “vilified”.

“I am very disappointed in the shareholder letter released by the Blackmores board. It appears to me that I am being vilified for simply expressing my view that George Tambassis would make an excellent addition to the Blackmores board,” Mr Blackmore said.

“As a shareholder and founder of the company that bears my family name, I have respectfully expressed both my support for George Tambassis and my disappointment with the chair and I have done so in my genuine belief that this is in the best interests of the company.

“I have not personalised my comments or vilified anyone. I have simply expressed a view and been transparent on my support and voting intentions. George Tambassis’ broad and deep range of skills and experience are worthy of support and as many other industry leading figures have said recently, we would be extremely privileged as shareholders to have him on our board.”

Those who know Mr Blackmore well say he has strong views but is loyal to employees. Christine Holgate, who had an office beside Mr Blackmore’s during her eight years as Blackmores chief executive, said: “I don’t know Anne and I definitely do not want to in any way criticise the board. I just find today’s statement extremely disappointing.

“I know Marcus. He has robust, strong opinions but he always comes from a place of care.

“And he wants the organisation to be stronger. He would never attack somebody publicly like that. He’s 76 years of age. He’s got photographs of him as a baby on the floor of Blackmores when his father was building the company. His whole life has been there. He owns (almost) 25 per cent of the company. It just feels so wrong.”

Ms Holgate said before Covid-19 struck, Mr Blackmore went to Harvard Business School every year to learn the latest management techniques.

Mr Blackmore said he suggested Mr Tambassis – a pharmacist for 35 years – in an effort to bring more health experience to the Blackmores board. Blackmores’s biggest customer, Chemist Warehouse, has also backed Mr Tambassis’s nomination.

Mr Blackmore owns 23 per cent of the company, more than 3.7 million shares.

That compares to Blackmore’s five directors, who collectively own 26,014 shares.

Ms Templeman-Jones owns 652, according to Blackmore’s latest annual report.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout