Blackmores calls in proxy solicitation firm to shore up AGM support

Two weeks from Blackmores AGM, its board’s war with its biggest and namesake shareholder is showing no sign of abating.

Blackmores has engaged proxy solicitation firm Georgeson ahead of its annual meeting later this month, escalating its war with its biggest and namesake shareholder Marcus Blackmore.

Georgeson, a division of Computershare, has been contacting Blackmores shareholders requesting their voting intentions ahead of the AGM on October 27, as a feud between Mr Blackmore and the vitamin maker’s chair Anne Templeman-Jones shows no signs of abating.

Mr Blackmore is threatening to vote against the election of Ms Templeman-Jones to her first public company chair after she rebuffed his suggestion to nominate the powerful Pharmacy Guild’s former president, George Tambassis, to the board.

Mr Tambassis has since self- nominated with Mr Blackmore’s support, but the company has only given them shareholder street addresses – not emails and phone numbers – handicapping Mr Tambassis’s campaign to postal communication only.

This is despite Blackmores shareholders – some who hold as little as a few hundred shares – receiving phone calls and emails from Georgeson and Blackmores asking for their voting intentions. Ms Templeman-Jones is urging shareholders to vote against Mr Tambassis’s nomination, putting her on collision course with Mr Blackmore.

Mr Blackmore and Mr Tambassis requested in writing last month full shareholder contact details, requesting access under the Corporations Act, to ensure a fair fight. But Blackmores maintains that it doesn’t record shareholder email addresses and phone numbers, with a spokesman stating that “shareholders provide this information to Computershare, often in relation to their shareholdings in multiple companies”.

In a letter to shareholders, seen by The Australian, Blackmores general counsel and company secretary Richard Conway said Georgeson had been engaged until November 12.

“We hereby confirm that we have appointed Georgeson Shareholder Communications and its associates to request and receive information from Blackmores shareholders on beneficial ownership, relevant interest, stock on loan, voting intentions and other holding related information,” Mr Conway said in the email to shareholders.

Georgeson, which Computershare acquired in 2003, markets itself to companies as a way to “understand what your shareholders are thinking” and to “make sure you are the source of truth”.

“We‘re a global provider of strategic shareholder engagement, proxy solicitation and governance consulting services. We’ve helped many of the world’s leading organisations maximise the value of relationships with their investors and stakeholders,” Georgeson’s website reads.

Still, Georgeson’s engagement has done little to soothe Blackmores‘ relationship with Mr Blackmore, who owns almost a fifth of the company.

Of concern among Mr Blackmore’s camp and other investors is their ability to ask questions verbally at the AGM, in line with the Treasury Laws Amendment passed in August.

Blackmores updated its online AGM guide last week to clarify it supported verbal questions.

But on its website it states how investors can submit questions in writing, with shareholders having to scroll to the bottom of the page, download the guide, which contains one sentence on asking a question verbally under section 6 on the guide’s second last page.

While some have questioned why Mr Blackmore does not request Mr Tambassis as a formal nominee, avoiding the fight, he has dismissed such a move, saying he is no longer interested in running the company – he just wants to be heard from time to time.

And here is the root of the problem. As the Australian Shareholders Association’s monitor for Blackmores, Julienne Mills, said, Blackmores had “good governance in an old-fashioned way” while the board was seeking to modernise the company, fuelling a clash with its biggest shareholder.

“The cultural fit between the modern board and what was the old board may be very different,” Ms Mills said. She said the relationship with Mr Blackmore could be managed better.

Mr Blackmore has since engaged Rothschild, ahead of the AGM and is baffled why the board can’t see how Mr Tambassis’s pharmacy, retail and political acumen could help Blackmores’s turnaround and strategy.

Ms Templeman-Jones has a different view. She engaged a recruitment company, understood to be Egon Zehnder, to find five director nominees, including herself, to rebuild Blackmore’s board.

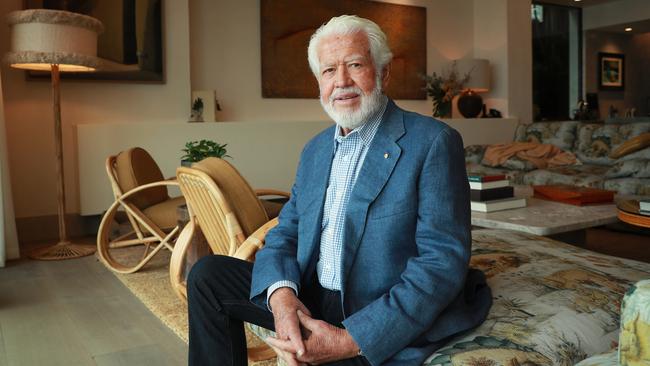

But Mr Blackmore, while known for being old-school, is also known for maintaining good relationships with his fellow shareholders, particularly those who bought its stock when it was trading at $5 in the late 1990s. After all, Mr Blackmore steered the company to stratospheric heights, culminating in its shares soaring above $217 in December 2015.

Its share price has more than halved since then but it has still risen more than 1800 per cent in the past 20 years – and more than 47 per cent in the past year to $96.54.

While it is rare for companies to engage a proxy solicitation firm for an AGM, a Blackmores spokesman said its work with Georgeson was nothing new.

“Blackmores has engaged Georgeson in the past which is common practice to assist in relation to an AGM. They have been engaged to provide shareholders with an update about the company, the upcoming AGM and to hear their feedback. Shareholders voting intention is only a part of this,” the spokesman said.

“Georgeson obtain shareholder phone numbers and email addresses from a number of sources including from public sources, privacy-compliant databases and from Computershare.

“George Tambassis has not requested phone numbers or email addresses of shareholders. We fulfilled his request for the shareholder register and have heard nothing further on the matter.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout