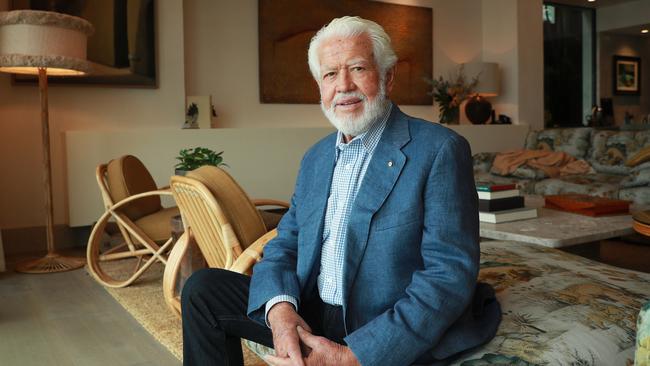

Marcus Blackmore says he’s being ‘vilified’ following accusation of ‘dispresect’ by chair Anne Templeman-Jones

Marcus Blackmore has hit back, saying he has been “vilified” for expressing his views about director nominations at the vitamin giant after chair Anne Templeman-Jones accused him of being disrespectful.

Marcus Blackmore says “it appears to me that I am being vilified” for expressing his opinion about who would be a good director at the vitamin giant founded by his father after chair Anne Templeman-Jones accused him of being disrespectful in an extraordinary letter to shareholders.

The company’s biggest shareholder has hit back at Ms Templeman-Jones’s claim, saying he finds it difficult to “reconcile the recent statement from the board that they hold me in the highest respect with their actions”.

Mr Blackmore has threatened to vote against Ms Templeman-Jones’ election to her first public company chairmanship after she rebuffed his suggestion to nominate the powerful Pharmacy Guild’s former president George Tambassis to the board.

Ms Templeman-Jones has been actively encouraging shareholders to vote against Mr Tambassis, who has self-nominated, engaging proxy solicitation firm Georgeson to request and record investor voting intentions ahead of the company’s AGM on October 27.

“I am very disappointed in the shareholder letter released by the Blackmores board this morning. It appears to me that I am being vilified for simply expressing my view that George Tambassis would make an excellent addition to the Blackmores board,” Mr Blackmore said.

“As a shareholder and founder of the company that bears my family name, I have respectfully expressed both my support for George Tambassis and my disappointment with the chair and I have done so in my genuine belief that this is in the best interests of the company.

“I have not personalised my comments or vilified anyone, I have simply expressed a view and been transparent on my support and voting intentions. George Tambassis’ broad and deep range of skills and experience are worthy of support and as many other industry leading figures have said recently, we would be extremely privileged as shareholders to have him on our board.”

Mr Blackmore owns 23 per cent of the company, more than 3.7m shares. That compares to Blackmore’s five directors, who collectively own 26,014 shares, of which Ms Templeman-Jones owns 652, according to Blackmore’s latest annual report.

Ms Templeman-Jones said the relationship between Mr Blackmore and the board was “strained” when he stepped down as a director last October.

“Having carefully considered our duties ... we have reached a view that further disclosure to shareholders with regard to Mr Blackmore’s departure from the Board is necessary,” Ms Templeman-Jones wrote in a letter to shareholders on Thursday morning.

“While the current board is constrained in what can be disclosed about these matters, there was a difference of views between Mr Blackmore and the rest of the Board about his adherence to the principles of respect in the workplace set out in our code of conduct.”

She did not elaborate further. Mr Blackmores’s father Maurice founded the company 90 years ago. Marcus Blackmore has built on the late Mr Blackmore’s work, making the group a vitamins juggernaut with his name intertwined with the company’s brand.

Ms Templeman-Jones’s letter shows how far the relationship between her and Mr Blackmore has deteriorated.

Despite making accusations against the company’s biggest shareholder, Ms Templeman-Jones — who is also a Commonwealth Bank director — wrote: “The current board, which includes five new independent directors appointed since Mr Blackmore’s departure, have continued to engage with Mr Blackmore and his representatives in an appropriate and constructive manner”.

Those five new directors, which include Ms Templeman-Jones are set to be elected at the AGM. Ms Templeman-Jones used recruitment firm Egon Zehnder to find the nominees.

Mr Blackmore said he suggested Mr Tambassis — a pharmacist of 35 years — in an effort to bring more health experience to the Blackmores board. Blackmores’s biggest customer, Chemist Warehouse, has also backed Mr Tambassis’s nomination.

Mr Tambassis has since self nominated, with the support of Mr Blackmore, have begun their own campaign, contacting shareholders directly. But Blackmores have only given the pair shareholder street addresses. This is despite the company engaging Georgeson, a proxy solicitation firm owned by Computershare, which has contacted shareholders via phone and email.

Blackmores says it has no register of shareholder email addresses and phone numbers, with Computershare coming up with the list itself.

Georgeson has been contacting shareholders, requesting and recording their voting intentions are ahead of the AGM, escalating its feud with Mr Blackmore whose campaign to elect Mr Tambassis has been constrained to postal votes, made worse with Australia Post experiencing significant delays from the Covid-19 pandemic.

Mr Blackmore has never requested a board nominee since stepping down from the board, saying he has no desire to run the company with his name on the door, instead he asked to be heard from time to time.

Of concern among Mr Blackmore’s camp and other investors is their ability to ask questions verbally at the AGM, in line with the Treasury Laws Amendment passed in August.

Blackmores updated its online AGM guide last week to clarify it supported verbal questions. But on its website it states how investors can submit questions in writing, with shareholders having to scroll to the bottom of the page, download the guide, which contains one sentence on asking a question verbally under section 6 on the guide’s second last page.

But Ms Templeman-Jones has continued to rebuff the company’s biggest shareholder, instead appealing to other investors to vote against his recommendation to elect Mr Tambassis, who is on a first-name basis with Prime Minister Scott Morrison and Health Minister Greg Hunt.

Despite this, and Mr Tambassis, who is also a director of Priceline owner Australian Pharmaceutical Industries, Ms Templeman Jones believed his experience was “not enough” to earn his spot on Blackmores’s board.

“We believed – and continue to believe – that to be a director of Blackmores deep skills in narrow areas are not enough. While we recognise Mr Tambassis’ specific expertise as a healthcare professional in the pharmacy sector in Australia, it was concluded that Blackmores already has within its business and on its board,” she said.

“We have been working in the best interests of all shareholders and in a way that also benefits and respects Blackmores’ many stakeholders, including our people. As noted above, since 27 October 2020, Blackmores has delivered a strong turnaround in financial performance and the share price has increased by 51.6 per cent.

“The decision on who sits on the Blackmores Board is yours. And so we encourage you to have your say by voting at our AGM on October 27, 2021.”

The feud comes as Blackmores launches its first brand advertising campaign in six years, in what chief executive Alastair Symington described as connecting to Blackmores’s 90-year heritage in a more contemporary way.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout